Luko raises $60 million for its home insurance products

French startup Luko has raised a $60 million Series B funding round (€50 million). The round is led by EQT Ventures, with existing investors Accel, Founders Fund and Speedinvest also participating.

Some angel investors with a background in insurance and technology are also investing in the startup, such as Assaf Wand, the co-founder of Hippo Insurance.

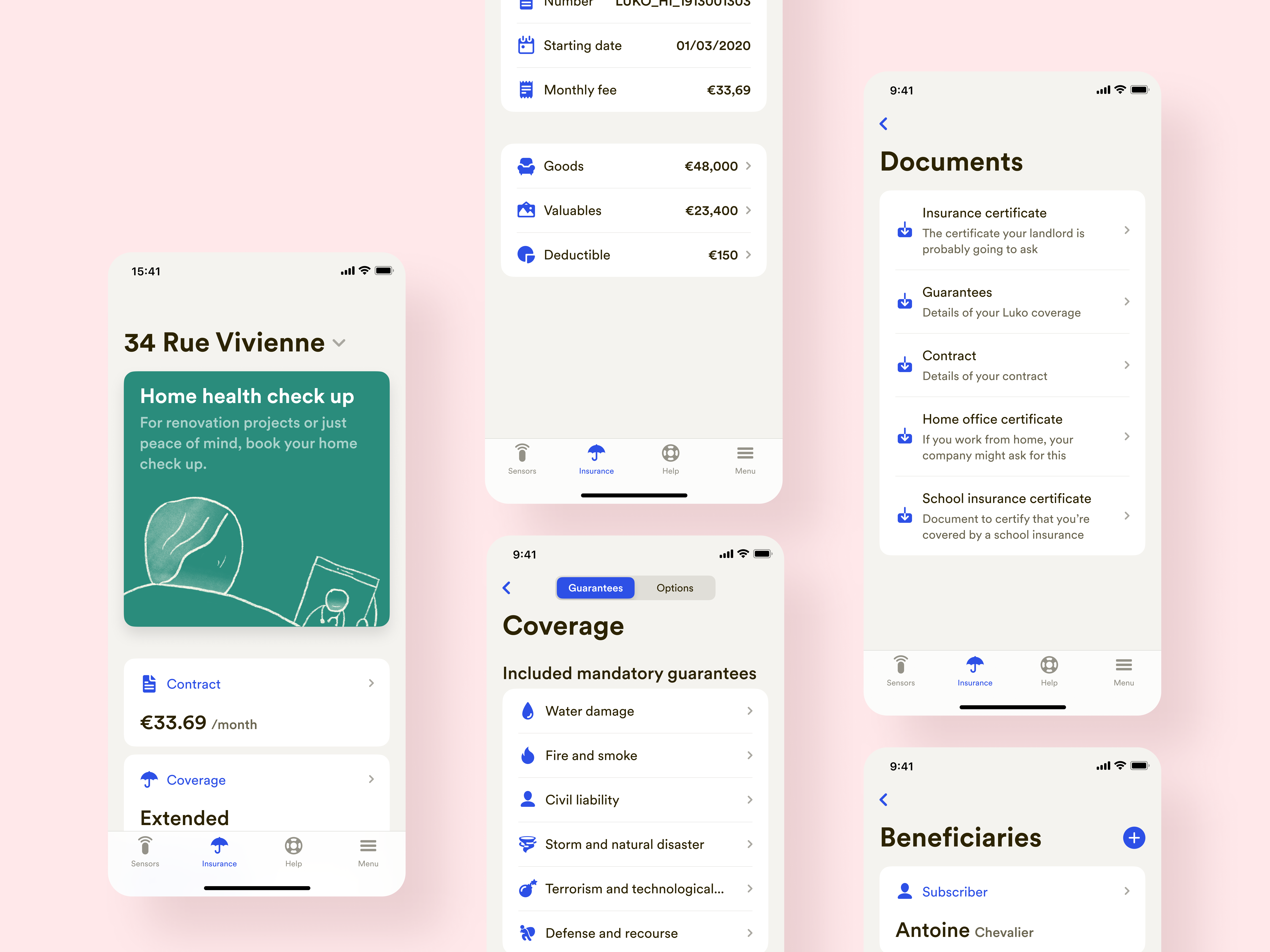

Luko is selling home insurance products for both homeowners and renters. And the company has managed to attract 100,000 clients so far. Over the past year or so, the company has grown quite rapidly, jumping from 15,000 customers to 100,000.

In addition to a speedy on-boarding process, Luko has been refining its insurance product to make the experience better for the client. For instance, Luko doesn’t want to benefit from unused premiums.

Luko has a straightforward revenue model. It takes a 30% cut on monthly payments. Everything else is pooled together to pay compensation. This way, the startup isn’t always trying to generate bigger margins from premiums.

At the end of the year, you can choose to donate your portion of what’s left of the 70% share. Luko is also B-Corp certified.

This model is reminiscent of Lemonade, another insurtech company that recently went public and that should launch in France soon. Let’s see whether Luko can keep growing at the same pace with Lemonade entering the market.

In order to speed up repayments, Luko can send you money through Lydia, the leading peer-to-peer payment app in France. This way, you get your money back in just a few seconds.

With 85 employees, Luko plans to expand beyond its home country. It also wants to proactively protect homes by providing water meters to detect leaks, door sensors to detect when somebody is trying to get in, etc.

Image Credits: Luko