Fast growth pushes an unprofitable no-code startup into the public markets: Inside Monday.com’s IPO filing

At long last, the Monday.com crew dropped an F-1 filing to go public in the United States. TechCrunch has long known that the company, which sells corporate productivity and communications software, has scaled north of $100 million in annual recurring revenue (ARR).

The countdown to its IPO filing — an F-1, because the company is based in Israel, rather than the S-1s filed by domestic companies — has been ticking for several quarters, so seeing Monday.com drop the document on this Monday morning was just good fun.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange has been riffling through the document since it came out, and we’ve picked up on a few things to explore. We’ll start by looking at the company’s revenue growth on a historical basis to see if it has accelerated in recent quarters thanks to the pandemic. Then, we’ll turn to profitability, cash burn, share-based compensation expenses and product vision.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

It’s a lot to chew through, so no more dilly-dallying. Into the numbers!

As always, we’re starting with revenue growth because it’s still the single most important thing about any venture-backed company.

Revenue adds are accelerating

This is great news for the startup, its employees and its investors. From 2019 to 2020, Monday.com grew its revenues from $78.1 million to $161.1 million, or 106%.

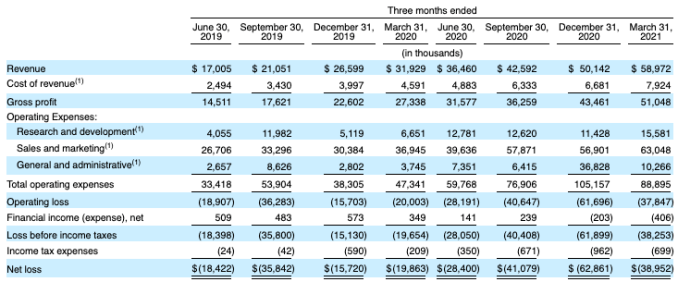

From Q1 2020 to Q1 2021, the company’s revenues grew from $31.9 million to $59.0 million. That’s about 85% growth. So, by what measure do we mean that the company’s revenue growth is accelerating? Its sequential-quarter revenue growth is picking up. Observe the following:

Image Credits: Monday.com F-1 filing

From Q2 2019 to Q3 2019, the company added around $4 million in revenue. From Q2 2020 to Q3 2020, that number was $6.1 million. More recently, the company’s revenue added $7.6 million from Q3 2020 to Q4 2020, which accelerated to $8.8 million from the final quarter of 2020 to the first quarter of 2021. Of course, from an ever-larger base, the company’s growth rate may decline. But the super-clean and obvious expanding sequential revenue gains at the company are solid.

The fact that it added so much top line in recent quarters also helps explain why Monday.com is going public now. Sure, the markets are still near record highs and the pandemic is fading, but just look at that consistent growth! It’s investor catnip.