Alex Hofmann once served as Musical.ly’s president, overseeing the North and South American markets for the TikTok precursor, then leaving shortly after the app exited to Chinese tech giant ByteDance in 2017. For his next act, the startup exec returned to the consumer social space with the launch of 9count — the maker of the popular friend-finder Wink, mobile dating app Summer (previously Spark), and others.

Though it’s typically difficult for new consumer social apps to gain widespread adoption, 9count’s apps have already seen some early traction — and investors have taken notice.

As a result, the company is today announcing an additional $27.5 million in new funding from GGV Capital Redpoint, Signia, Greycroft, Progression, Crosscut Grishin Robotics, I2BF, and Waverley Capital, among others. The round is an extension of 9count’s earlier Series A and includes only its existing investors.

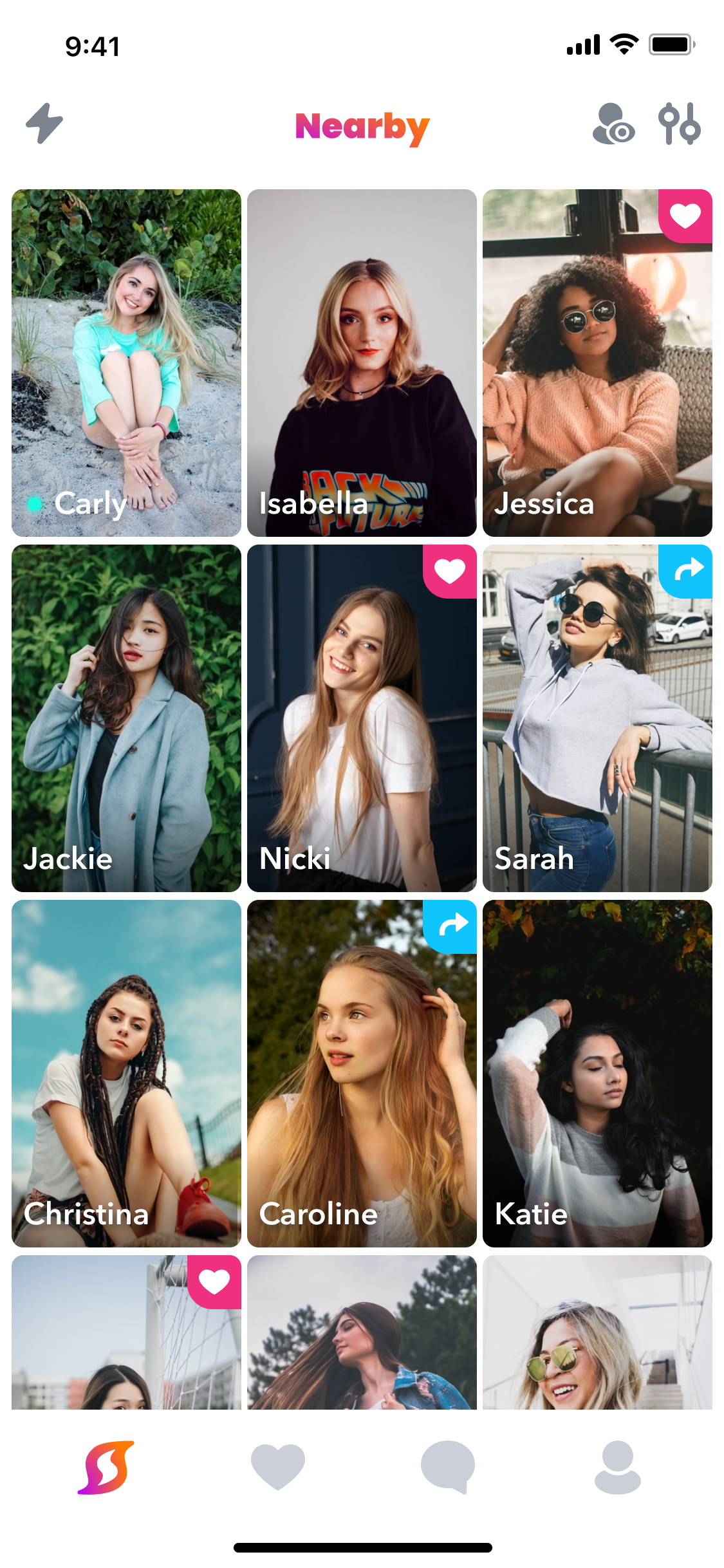

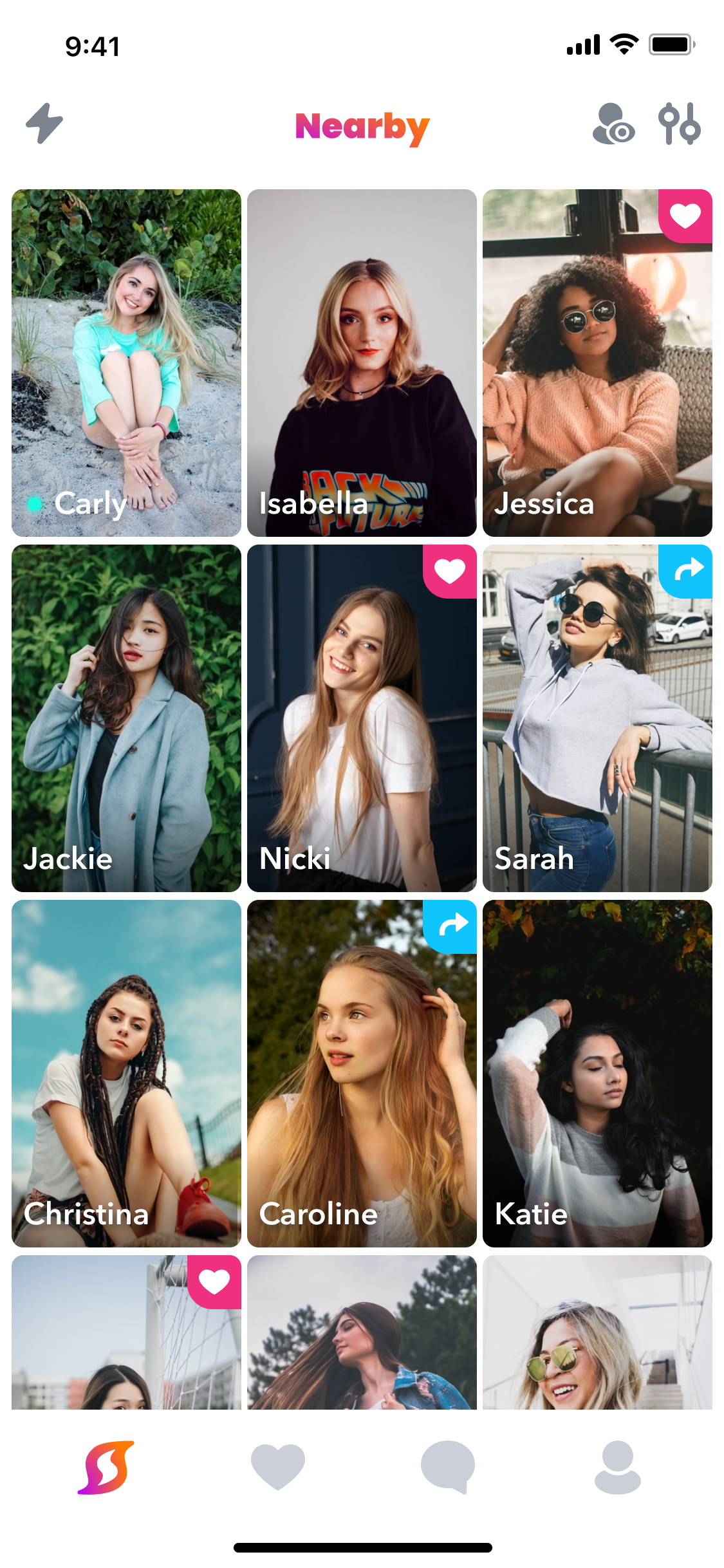

In particular, 9count’s backers were impressed with the metrics coming out of Summer, which launched as Spark back in May but later rebranded. The dating app targets a younger demographic, ages 18 and up. But unlike traditional swipe-based dating apps, Summer’s differentiator is its grid that displays many users at once — an experience meant to more closely mimic the way it feels to walk into a crowded space in real life, like a bar or a party, for example.

“[Summer is retaining users] better than the top apps, especially in our strongest markets,” Hofmann says. “That just tells us that we’re on the right path with this product.

The 9count co-founder says Summer hit the No. 1 position in the App Store in two markets immediately following its launch and now has over 300,000 monthly active users, only a few months later. If looking at growth metrics alone, Hofmann claims it’s the fastest-growing dating app to hit the market since Bumble arrived in 2014. When he showed these figures to current investors, they wanted to double down on the app’s growth.

The company plans to use a large portion of the new investment to fuel marketing efforts for Summer after it launches on Android next month. This will include some in-person events in the startup’s hometown of L.A. 9count will also use the funds to expand its 35-person team, though Hofmann says they haven’t yet determined the exact headcount they plan to add.

Image Credits: 9count, Alex Hofmann and Joe Viola

But more than betting on Summer’s success alone, investors seem interested in the model 9count espouses.

Founded in January 2019 by both Hofmann and an experienced product manager, Joe Viola, 9count isn’t focused only on developing a single app and perfecting it. Instead, it’s co-developing multiple consumer products at once, iterating using data and customer feedback, then cross-promoting the apps within its portfolio. In addition to Wink and Summer, the startup has also developed social arcade app Juju, motivational app Everland, creator-fan connection app Popstream, and more.

This multi-product approach is something Hofmann is familiar with, thanks to his time spent at Musical.ly.

There, the team ran four different products: Musical.ly, its live-streaming counterpart known as Live.ly, and two others that weren’t as well known to the public. This model, Hofmann notes, is popular in Asia, where tech companies often operate multiple products — including TikTok’s parent company ByteDance, as well as Tencent, Alibaba, and others.

To benefit from this method, 9count tests and iterates on its products using a combination of A/B testing, data analysis, and user feedback. It additionally hosts employee hackathons and runs a “labs” division where it can try out new ideas to see if anything sticks.

“The learnings we have by rolling out new products are just tremendous,” Hofmann notes. “We can either make them into a standalone product or feed them into existing products.”

Image Credits: 9count

In fact, this model is what led the company to develop Summer in the first place, the co-founder explains.

He says some Wink users were asking for a way to use the social app for dating purposes. But Wink also caters to minors aged 13 to 17 (who aren’t allowed to interact with adult users, we should note). This focus skews the app toward a younger crowd, which wouldn’t be appropriate for online dating, even if it’s what some of the older users wanted. That prompted the team to break out the feature request into its own, new product — the app that has since become Summer.

Today, 9count claims its new dating app has already attracted over 500,000 downloads, over a million registered users, and more than 300,000 monthly actives. This makes it the sixth most popular dating app in the U.S. and the fourth in Canada, Hofmann said. (App intelligence firm Sensor Tower confirmed this with TechCrunch, saying Hofmann’s statement is correct based on App Store and Google Play downloads for July 2022.)

In addition, the video chat app Wink reportedly has over 2 million monthly active users, remaining 9count’s largest app to date.

In total, 9count’s app portfolio now reaches over 10 million users, the company says. Sensor Tower data indicated an even higher figure of 16 million-plus downloads across all their products launched to date. Wink was the largest chunk of this with over 15 million lifetime downloads.

Image Credits: 9count team photo

“Alex and Joe are building a next-generation social application company at 9count, consolidating disparate products under one banner, with one team to find what works for the next generation,” said Hans Tung, managing partner at GGV Capital, a 9count board member and early investor in Musical.ly. “The team at 9count is poised to experience rapid growth among their user base and we’re excited to partner with them to bring their vision to reality,” he added.

The new investment is also another signal that there’s an increased willingness from VCs to again back the often difficult consumer social app market.

Historically, it’s been near impossible to unseat Facebook and Meta’s other products from the top of the App Store. But TikTok has proven Facebook’s hold on the market could be winding down. The Meta-owned social network is no longer popular with Gen Z users, who are also growing frustrated with Instagram’s clutter and its continual attempt to force video on them through Reels.

Hungry for new experiences, today’s younger users are sampling a range of social apps, like the chart-topper BeReal, the home screen widget provider Locket, and the video chat app Yubo — a Wink rival. Not surprisingly, these apps have also pulled in VC backing. BeReal was valued at $600 million following its Series B this past spring, for instance. Locket announced this month it has closed on $12.5 million across two seed stage rounds. And Yubo banked $47.5 million in its 2020 Series C. Even Pinterest’s brand-new experimental app Shuffles has rocketed to the top of the App Store’s “Lifestyle” charts, despite being in invite-only status.

According to Hofmann, fueling this trend is younger users’ demand for apps offering them “niche” experiences.

“[9count’s team] looked at the market and realized that in the last ten years, there were really just — in our opinion — two major consumer social products. One is Musical.ly/TikTok, the other one is Discord. We realized that to build products that connect people, it might not be a one-product approach, but a multi-product approach,” the co-founder explains. “We see this trend towards…niche desires and niche preferences. We realized that very few products can serve a larger audience and bring them joy and happiness,” Hofmann says.