The contract between the UK’s National Health Service (NHS) and ecommerce giant Amazon — for a health information licensing partnership involving its Alexa voice AI — has been released following a Freedom of Information request.

The government announced the partnership this summer. But the date on the contract, which was published on the gov.uk contracts finder site months after the FOI was filed, shows the open-ended arrangement to funnel nipped-and-tucked health advice from the NHS’ website to Alexa users in audio form was inked back in December 2018.

The contract is between the UK government and Amazon US (Amazon Digital Services, Delaware) — rather than Amazon UK.

Nor is it a standard NHS Choices content syndication contract. A spokeswoman for the Department of Health and Social Care (DHSC) confirmed the legal agreement uses an Amazon contract template. She told us the department had worked jointly with Amazon to adapt the template to fit the intended use — i.e. access to publicly funded healthcare information from the NHS’ website.

The NHS does make the same information freely available on its website, of course. As well as via API — to some 1,500 organizations. But Amazon is not just any organization; It’s a powerful US platform giant with a massive ecommerce business.

The contract reflects that power imbalance; not being a standard NHS content syndication agreement — but rather DHSC tweaking Amazon’s standard terms.

“It was drawn up between both Amazon UK and the Department for Health and Social Care,” a department spokeswoman told us. “Given that Amazon is in the business of holding standard agreements with content providers they provided the template that was used as the starting point for the discussions but it was drawn up in negotiation with the Department for Health and Social Care, and obviously it was altered to apply to UK law rather than US law.”

In July, when the government officially announced the Alexa-NHS partnership, its PR provided a few sample queries of how Amazon’s voice AI might respond to what it dubbed “NHS-verified” information — such as: “Alexa, how do I treat a migraine?”; “Alexa, what are the symptoms of flu?”; “Alexa, what are the symptoms of chickenpox?”.

But of course as anyone who’s ever googled a health symptom could tell you, the types of stuff people are actually likely to ask Alexa — once they realize they can treat it as an NHS-verified info-dispensing robot, and go down the symptom-querying rabbit hole — is likely to range very far beyond the common cold.

At the official launch of what the government couched as a ‘collaboration’ with Amazon, it explained its decision to allow NHS content to be freely piped through Alexa by suggesting that voice technology has “the potential to reduce the pressure on the NHS and GPs by providing information for common illnesses”.

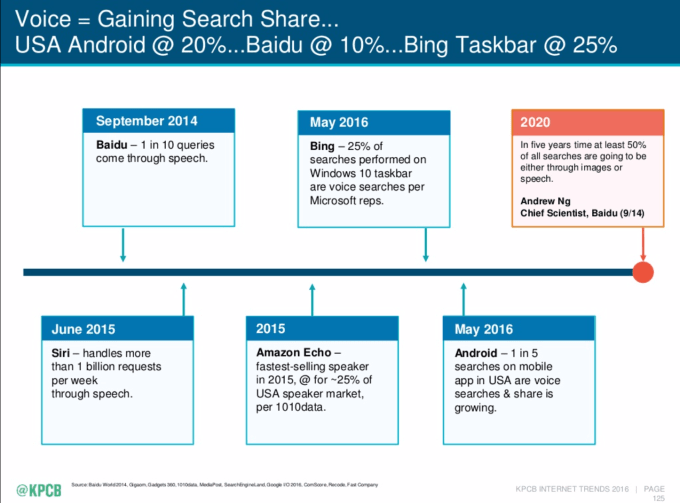

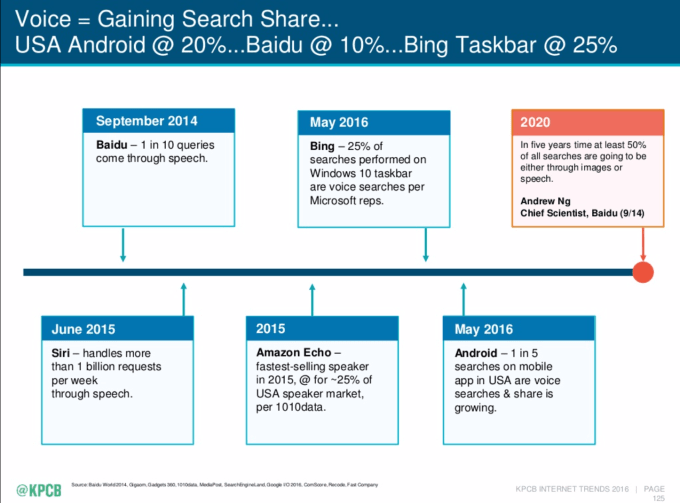

Its PR cited an unattributed claim that “by 2020, half of all searches are expected to be made through voice-assisted technology”.

This prediction is frequently attributed to ComScore, a media measurement firm that was last month charged with fraud by the SEC. However it actually appears to originate with computer scientist Andrew Ng, from when he was chief scientist at Chinese tech giant Baidu.

Econsultancy noted last year that Mary Meeker included Ng’s claim on a slide in her 2016 Internet Trends report — which is likely how the prediction got so widely amplified.

But on Meeker’s slide you can see that the prediction is in fact “images or speech”, not voice alone…

So it turns out the UK government incorrectly cited a tech giant prediction to push a claim that “voice search has been increasing rapidly” — in turn its justification for funnelling NHS users towards Amazon.

“We want to empower every patient to take better control of their healthcare and technology like this is a great example of how people can access reliable, world-leading NHS advice from the comfort of their home, reducing the pressure on our hardworking GPs and pharmacists,” said health secretary Matt Hancock in a July statement.

Since landing at the health department, the app-loving former digital minister has been pushing a tech-first agenda for transforming the NHS — promising to plug in “healthtech” apps and services, and touting “preventative, predictive and personalised care”. He’s also announced an AI lab housed within a new unit that’s intended to oversee the digitization of the NHS.

Compared with all that, plugging the NHS’ website into Alexa probably seems like an easy ‘on-message’ win. But immediately the collaboration was announced concerns were raised that the government is recklessly mixing the streams of critical (and sensitive) national healthcare infrastructure with the rapacious data-appetite of a foreign tech giant with both an advertising and ecommerce business, plus major ambitions of its own in the healthcare space.

On the latter front, just yesterday news broke of Amazon’s second health-related acquisition: Health Navigator, a startup with an API platform for integrating with health services, such as telemedicine and medical call centers, which offers natural language processing tools for documenting health complaints and care recommendations.

Last year Amazon also picked up online pharmacy PillPack — for just under $1BN. While last month it launched a pilot of a healthcare service offering to its own employees in and around Seattle, called Amazon Care. That looks intended to be a road-test for addressing the broader U.S. market down the line. So the company’s commercial designs on healthcare are becoming increasingly clear.

Returning to the UK, in response to early critical feedback on the Alexa-NHS arrangement, the IT delivery arm of the service, NHS Digital, published a blog post going into more detail about the arrangement — following what it couched as “interesting discussion about the challenges for the NHS of working with large commercial organisations like Amazon”.

A core critical “discussion” point is the question of what Amazon will do with people’s medical voice query data, given the partnership is clearly encouraging people to get used to asking Alexa for health advice.

“We have stuck to the fundamental principle of not agreeing a way of working with Amazon that we would not be willing to consider with any single partner – large or small. We have been careful about data, commercialisation, privacy and liability, and we have spent months working with knowledgeable colleagues to get it right,” NHS Digital claimed in July.

In another section of the blog post, responding to questions about what Amazon will do with the data and “what about privacy”, it further asserted there would be no health profiling of customers — writing:

We have worked with the Amazon team to ensure that we can be totally confident that Amazon is not sharing any of this information with third parties. Amazon has been very clear that it is not selling products or making product recommendations based on this health information, nor is it building a health profile on customers. All information is treated with high confidentiality. Amazon restrict access through multi-factor authentication, services are all encrypted, and regular audits run on their control environment to protect it.

Yet it turns out the contract DHSC signed with Amazon is just a content licensing agreement. There are no terms contained in it concerning what can or can’t be done with the medical voice query data Alexa is collecting with the help of “NHS-verified” information.

Per the contract terms, Amazon is required to attribute content to the NHS when Alexa responds to a query with information from the service’s website. (Though the company says Alexa also makes use of medical content from the Mayo Clinic and Wikipedia.) So, from the user’s point of view, they will at times feel like they’re talking to an NHS-branded service.

But without any legally binding confidentiality clauses around what can be done with their medical voice queries it’s not clear how NHS Digital can confidently assert that Amazon isn’t creating health profiles.

The situation seems to sum to, er, trust Amazon. (NHS Digital wouldn’t comment; saying it’s only responsible for delivery not policy setting, and referring us to the DHSC.)

Asked what it does with medical voice query data generated as a result of the NHS collaboration an Amazon spokesperson told us: “We do not build customer health profiles based on interactions with nhs.uk content or use such requests for marketing purposes.”

But the spokesperson could not point to any legally binding contract clauses in the licensing agreement that restrict what Amazon can do with people’s medical queries.

We’ve also asked the company to confirm whether medical voice queries that return NHS content are being processed in the US.

“This collaboration only provides content already available on the NHS.UK website, and absolutely no personal data is being shared by NHS to Amazon or vice versa,” Amazon also told us, eliding the key point that it’s not NHS data being shared with Amazon but NHS users, reassured by the presence of a trusted public brand, being encouraged to feed Alexa sensitive personal data by asking about their ailments and health concerns.

Bizarrely, the Department of Health and Social Care went further. Its spokeswoman claimed in an email that “there will be no data shared, collected or processed by Amazon and this is just an alternative way of providing readily available information from NHS.UK.”

When we spoke to DHSC on the phone prior to this, to raise the issue of medical voice query data generated via the partnership and fed to Amazon — also asking where in the contract are clauses to protect people’s data — the spokeswoman said she would have to get back to us.

All of which suggests the government has a very vague idea (to put it generously) of how cloud-powered voice AIs function.

Presumably no one at DHSC bothered to read the information on Amazon’s own Alexa privacy page — although the department spokeswomen was at least aware this page existed (because she knew Amazon had pointed us to what she called its “privacy notice”, which she said “sets out how customers are in control of their data and utterances”).

If you do read the page you’ll find Amazon offers some broad-brush explanation there which tells you that after an Alexa device has been woken by its wake word, the AI will “begin recording and sending your request to Amazon’s secure cloud”.

Ergo data is collected and processed. And indeed stored on Amazon’s servers. So, yes, data is ‘shared’.

The more detailed Alexa Internet Privacy Notice, meanwhile, sets out broad-brush parameters to enable Amazon’s reuse of Alexa user data — stating that “the information we learn from users helps us personalize and continually improve your Alexa experience and provide information about Internet trends, website popularity and traffic, and related content”. [emphasis ours]

The DHSC sees the matter very differently, though.

With no contractual binds covering health-related queries UK users of Alexa are being encouraged to whisper into Amazon’s robotic ears — data that’s naturally linked to Alexa and Amazon account IDs (and which the Alexa Internet Privacy Notice also specifies can be accessed by “a limited number of employees”) — the government is accepting the tech giant’s standard data processing terms for a commercial, consumer product which is deeply integrated into its increasingly sprawling business empire.

Terms such as indefinite retention of audio recordings — unless users pro-actively request that they are deleted. And even then Amazon admitted this summer it doesn’t always delete the text transcripts of recordings. So even if you keep deleting all your audio snippets, traces of medical queries may well remain on Amazon’s servers.

Earlier this year it also emerged the company employs contractors around the world to listen in to Alexa recordings as part of internal efforts to improve the performance of the AI.

A number of tech giants recently admitted to the presence of such ‘speech grading’ programs, as they’re sometimes called — though none had been up front and transparent about the fact their shiny AIs needed an army of external human eavesdroppers to pull off a show of faux intelligence.

It’s been journalists highlighting the privacy risks for users of AI assistants; and media exposure leading to public pressure on tech giants to force changes to concealed internal processes that have, by default, treated people’s information as an owned commodity that exists to serve and reserve their own corporate interests.

Data protection? Only if you interpret the term as meaning your personal data is theirs to capture and that they’ll aggressively defend the IP they generate from it.

So, in other words, actual humans — both employed by Amazon directly and not — may be listening to the medical stuff you’re telling Alexa. Unless the user finds and activates a recently added ‘no human review’ option buried in Alexa settings.

Many of these arrangements remain under regulatory scrutiny in Europe. Amazon’s lead data protection regulator in Europe confirmed in August it’s in discussions with it over concerns related to its manual reviews of Alexa recordings. So UK citizens — whose taxes fund the NHS — might be forgiven for expecting more care from their own government around such a ‘collaboration’.

Rather than a wholesale swallowing of tech giant T&Cs in exchange for free access to the NHS brand and “NHS-verified” information which helps Amazon burnish Alexa’s utility and credibility, allowing it to gather valuable insights for its commercial healthcare ambitions.

To date there has been no recognition from DHSC the government has a duty of care towards NHS users as regards potential risks its content partnership might generate as Alexa harvests their voice queries via a commercial conduit that only affords users very partial controls over what happens to their personal data.

Nor is DHSC considering the value being generously gifted by the state to Amazon — in exchange for a vague supposition that a few citizens might go to the doctor a bit less if a robot tells them what flu symptoms look like.

“The NHS logo is supposed to mean something,” says Sam Smith, coordinator at patient data privacy advocacy group, MedConfidential — one of the organizations that makes use of the NHS’ free APIs for health content (but which he points out did not write its own contract for the government to sign).

“When DHSC signed Amazon’s template contract to put the NHS logo on anything Amazon chooses to do, it left patients to fend for themselves against the business model of Amazon in America.”

In a related development this week, Europe’s data protection supervisor has warned of serious data protection concerns related to standard contracts EU institutions have inked with another tech giant, Microsoft, to use its software and services.

The watchdog recently created a strategic forum that’s intended to bring together the region’s public administrations to work on drawing up standard contracts with fairer terms for the public sector — to shrink the risk of institutions feeling outgunned and pressured into accepting T&Cs written by the same few powerful tech providers.

Such an effort is sorely needed — though it comes too late to hand-hold the UK government into striking more patient-sensitive terms with Amazon US.

There’s a lot of good news to be found. Today, Chinese technology giant Baidu revealed an interesting set of datapoints regarding Apollo Go, it’s “autonomous ride-hailing service”:

There’s a lot of good news to be found. Today, Chinese technology giant Baidu revealed an interesting set of datapoints regarding Apollo Go, it’s “autonomous ride-hailing service”: