Ride Vision, an Israeli startup that is building an AI-driven safety system to prevent motorcycle collisions, today announced that it has raised a $7 million Series A round led by crowdsourcing platform OurCrowd. YL Ventures, which typically specializes in cybersecurity startups but also led the company’s $2.5 million seed round in 2018, Mobilion VC and motorcycle mirror manufacturer Metagal also participated in this round. The company has now raised a total of $10 million.

In addition to this new funding round, Ride Vision also today announced a new partnership with automotive parts manufacturer Continental .

“As motorcycle enthusiasts, we at Ride Vision are excited at the prospect of our international launch and our partnership with Continental,” Uri Lavi, CEO and Co-Founder of Ride Vision, said in today’s announcement. “This moment is a major milestone, as we stride toward our dream of empowering bikers to feel truly safe while they enjoy the ride.”

The general idea here is pretty straightforward and comparable with the blind-spot monitoring system in your car. Using computer vision, Ride Vision’s system, the Ride Vision 1, analyzes the traffic around a rider in real time. It provides forward collision alerts and monitors your blind spot, but it can also tell you when you’re following another rider or car too closely. It can also simply record your ride and, coming soon, it’ll be able to make emergency calls on your behalf when things go awry.

The general idea here is pretty straightforward and comparable with the blind-spot monitoring system in your car. Using computer vision, Ride Vision’s system, the Ride Vision 1, analyzes the traffic around a rider in real time. It provides forward collision alerts and monitors your blind spot, but it can also tell you when you’re following another rider or car too closely. It can also simply record your ride and, coming soon, it’ll be able to make emergency calls on your behalf when things go awry.

As the company argues, the number of motorcycles (and other motorized two-wheeled vehicles) has only increased during the pandemic, as people started avoiding public transport and looked for relatively affordable alternatives. In Europe, sales of two-wheeled vehicles increased by 30 percent during the pandemic.

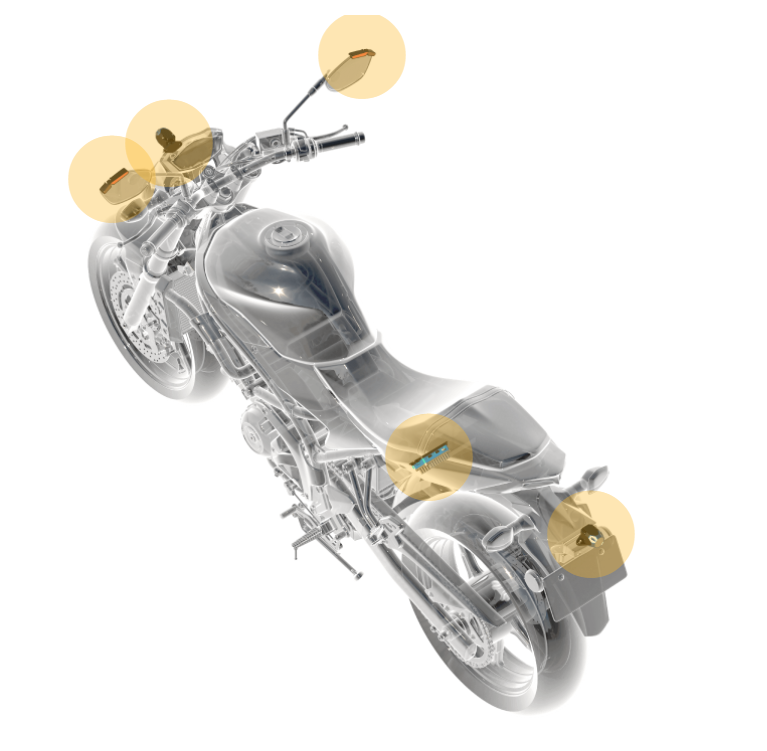

The hardware on the motorcycle itself is pretty straightforward. It includes two wide-angle cameras at the front and rear, as well as alert indicators on the mirrors, as well as the main computing unit. Ride Vision has patents on its human-machine warning interface and vision algorithms.

It’s worth noting that there are some blind-spot monitoring solutions for motorcycles on the market already, including those from Innovv and Senzar. Honda also has patents on similar technologies. These do not provide the kind of 360-degree view that Ride Vision is aiming for.

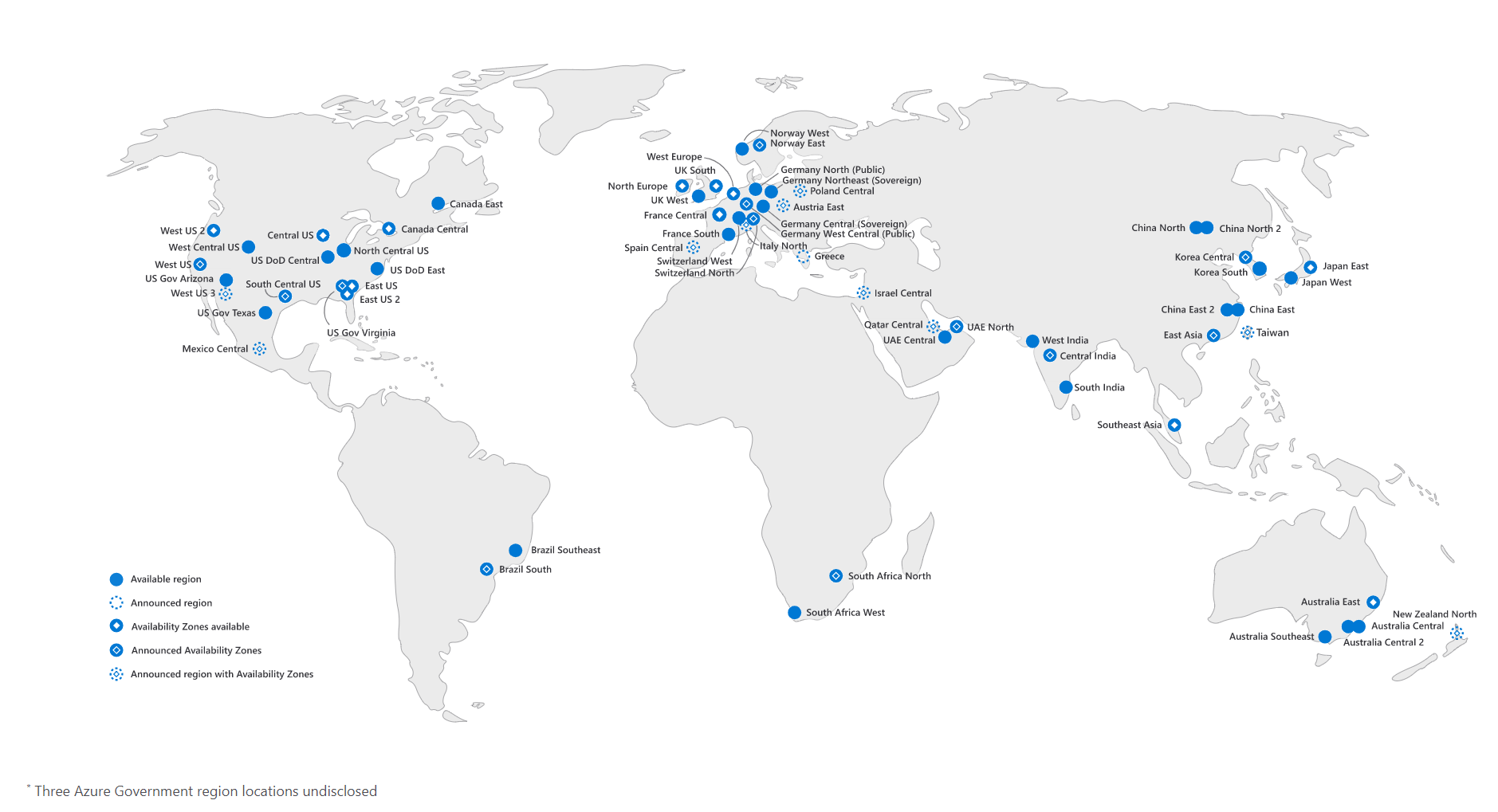

Ride Vision says its products will be available in Italy, Germany, Austria, Spain, France, Greece, Israel and the UK in early 2021, with the U.S., Brazil, Canada, Australia, Japan, India, China and others following later.