Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. App Annie says global spending across iOS and Google Play is up to $135 billion in 2021, and that figure will likely be higher when its annual report, including third-party app stores in China, is released next year. Consumers also downloaded 10 billion more apps this year than in 2020, reaching nearly 140 billion in new installs, it found.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that was up 27% year-over-year.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

This Week in Apps is taking a vacation over the holidays, so this week’s update is briefer than usual!

Top Story

900+ app publishers will see their first $1 million in 2021

Image Credits: Sensor Tower

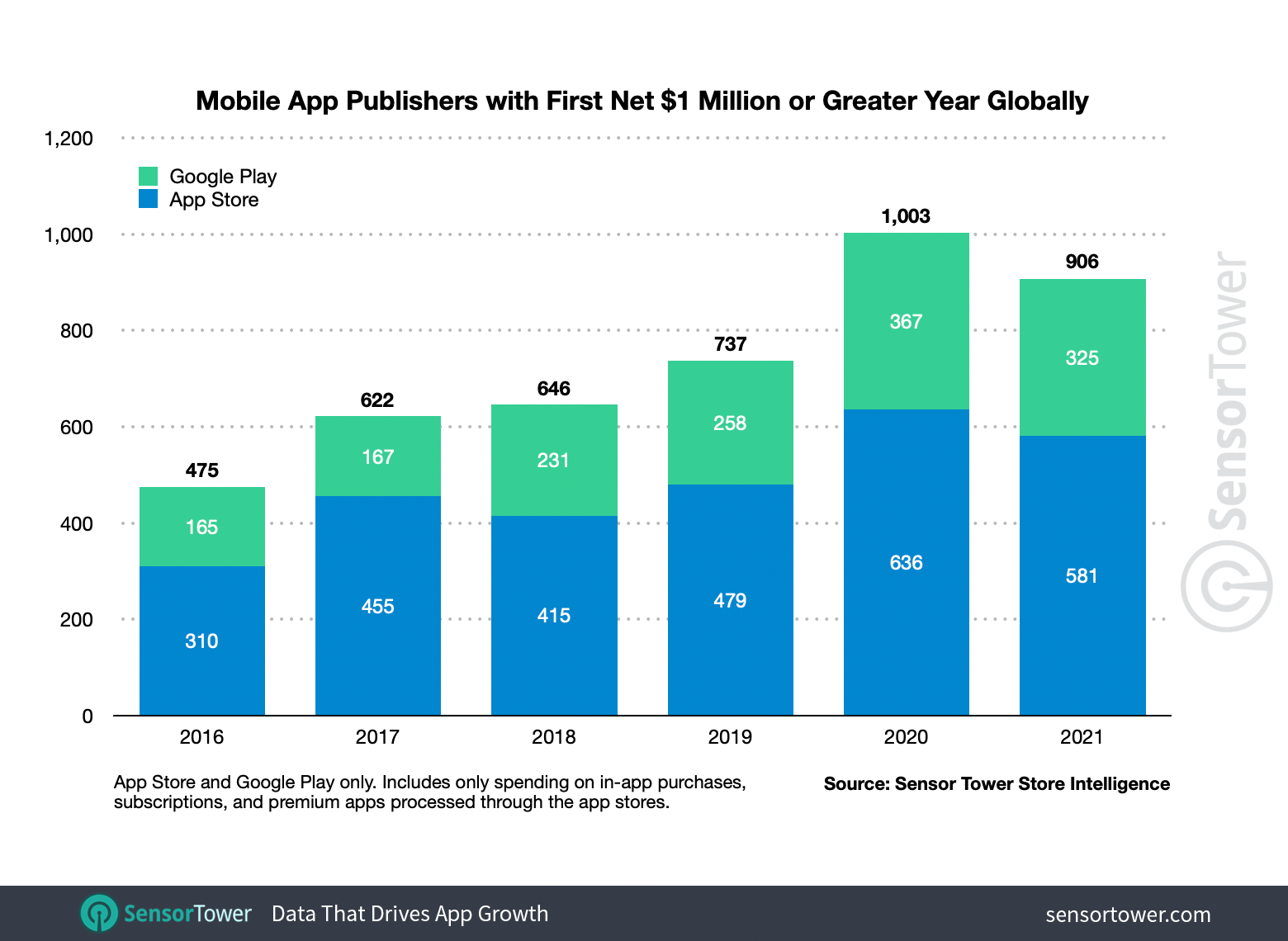

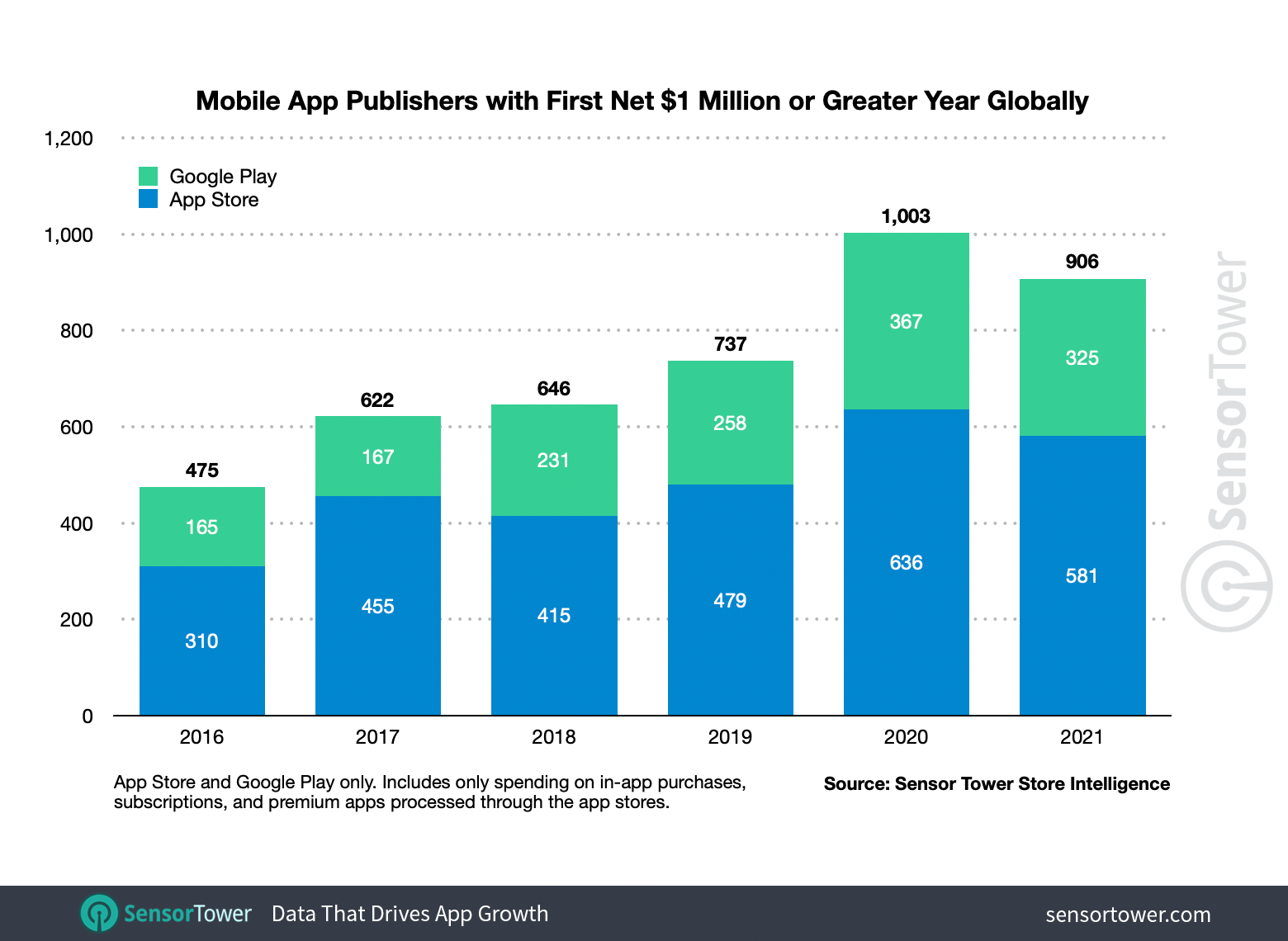

Sensor Tower is forecasting that the number of publishers set to see their first $1 million (or more) in annual net income in 2021 has nearly doubled since 2016. This year, more than 900 publishers will reach this milestone, up nearly 91% from the 475 who hit the milestone in 2016. This 900+ breaks down to 581 on iOS and 325 on Google Play, it notes.

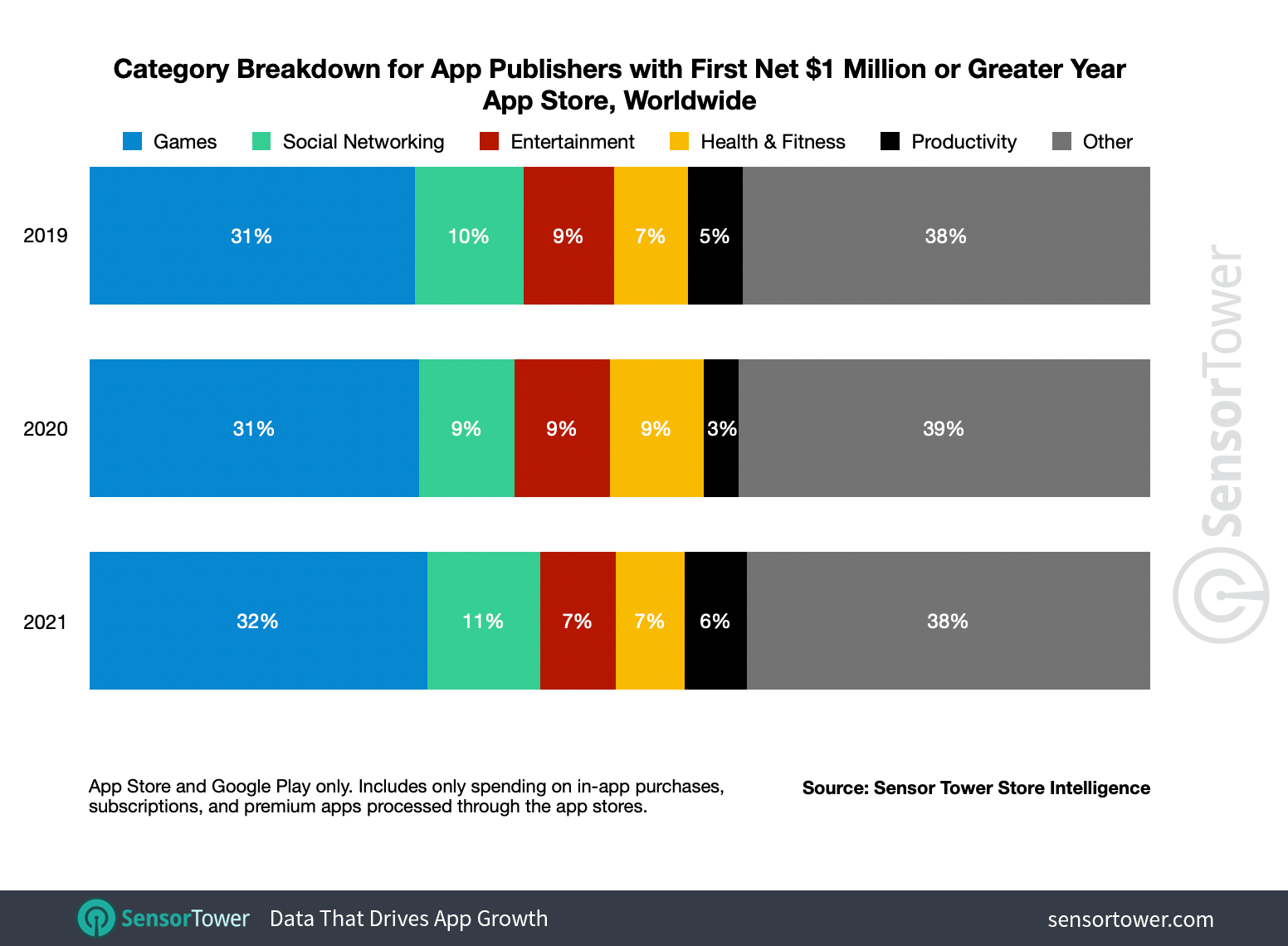

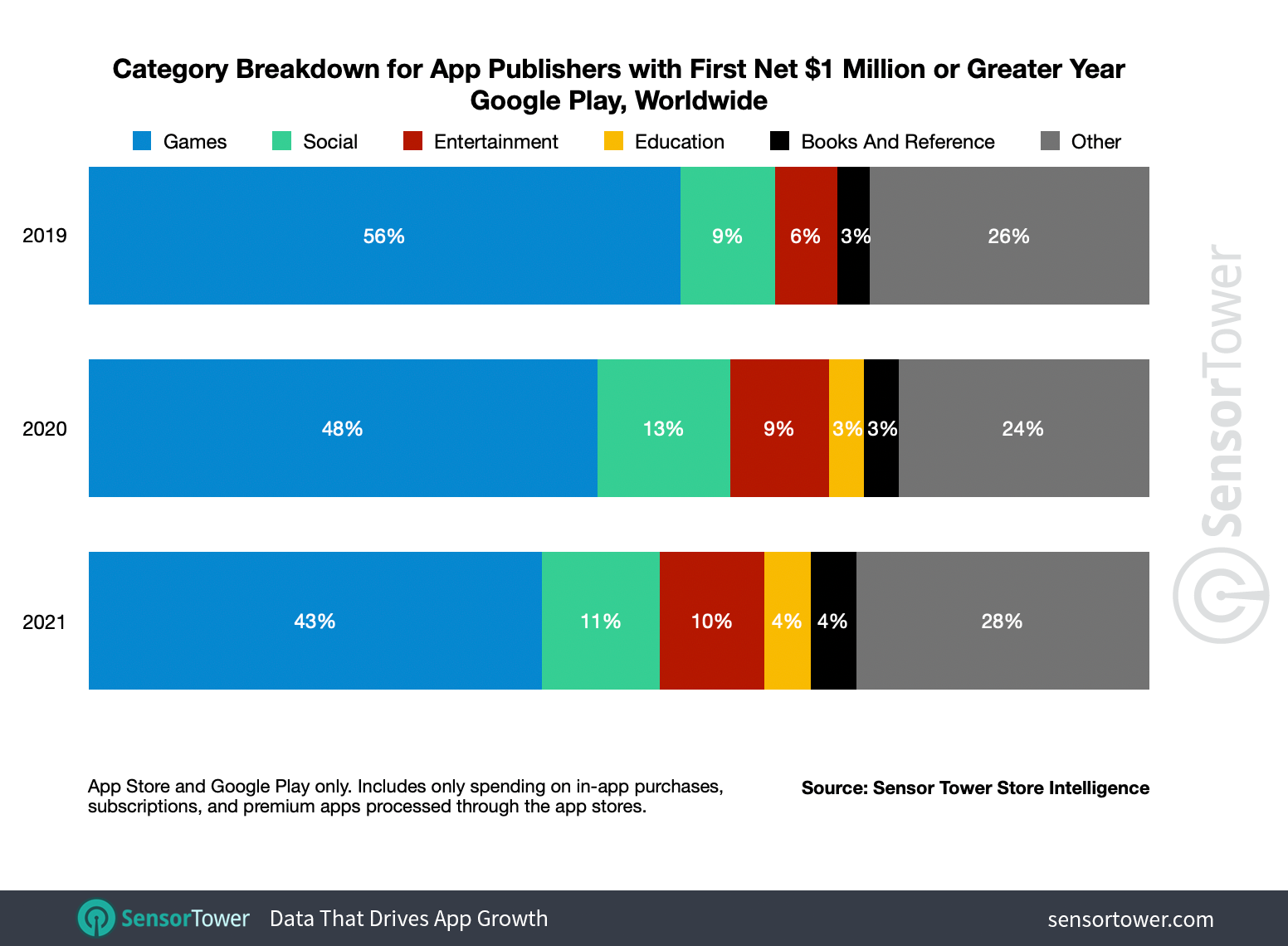

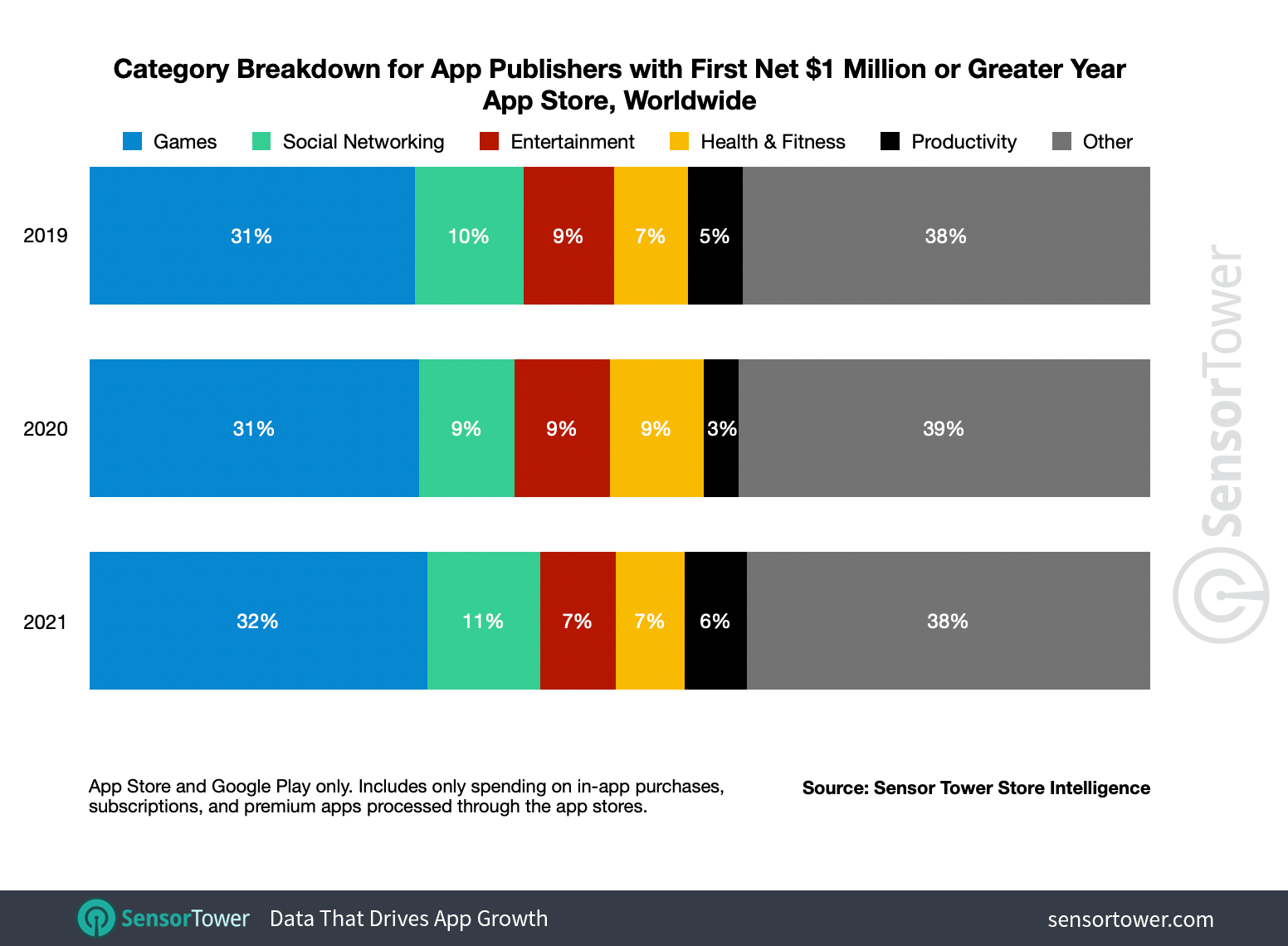

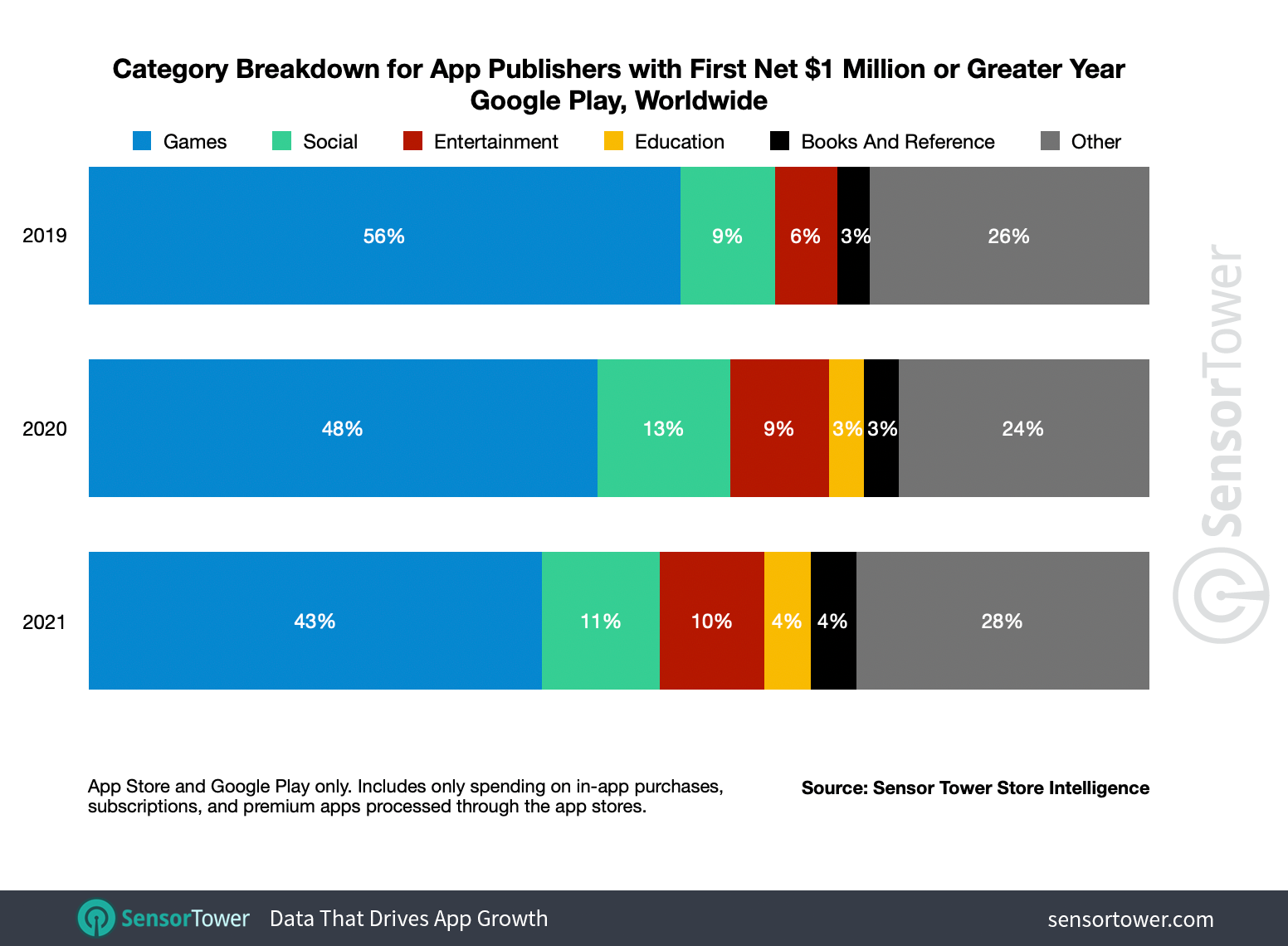

Image Credits: Sensor TowerBroken down by category, mobile game publishers continued to account for the largest percentage of iOS apps that hit the $1 million milestone in 2021, with a 32% share of the overall total. Social networking apps followed with an 11% share, then Entertainment, Health & Fitness and Productivity apps, at 7%, 7% and 6%, respectively. On Google Play, games also led but accounted for even more of the milestone-achieving apps, with a 43% share.

However, the figure represents a decline from last year, when 1,003 publishers hit their first net $1 million in global revenue — a change that Sensor Tower chalks up to a normalization of consumer behavior after the pandemic drove installs up during 2020 to outsized levels. Consumers in 2021 experimented with fewer new apps than during the height of the pandemic, the report noted.

Image Credits: Sensor Tower

China’s laws impact the number of available apps

The South China Morning Post this week reported on how China’s big tech crackdown is playing out across the Chinese app stores. According to its findings, the number of available mobile apps has fallen 40% over the past three years as new data laws and other clean-up campaigns went into effect. By the numbers, Chinese app stores had 4.52 million apps in December 2018, but as of October 2021, that had dropped to just 2.78 million. It also noted the biggest declines took place over the course of this year, as Beijing further cracked down on big tech with its new data privacy laws.

The Netherlands orders Apple to allow dating apps to offer alternative payments

The Netherlands is the latest country looking to regulate the app stores with a new ruling, as reported by Reuters, that says Apple has violated the country’s competition laws via its in-app purchase policies. However, the case in this market is unique because it’s only applying to a segment of the app store — specifically, dating apps. (Match, of course, has been a significant Apple critic and has been pushing for new payment policies both in the U.S. and abroad.) The Netherlands’ Authority for Consumers and Markets (ACM) says that Apple has until January 15 to implement App Store changes. If the company fails to comply, it could be fined up to €50 million ($56.6 million), the report notes. Apple has appealed the ruling.

Weekly News

Platforms: Apple

- An unconfirmed leak by a French site claims iOS 16 will not support the iPhone 6s and 6s Plus and the iPhone SE 2016.

- Apple stopped signing iOS 15.1.1, meaning there will be no more downgrading options available now.

Platforms: Google

- Google announced the number of users engaging with Android apps on Chrome OS devices was up 50% year-over-year in 2021, while Chrome OS grew over 92% YoY.

- Amazon finally fixed its broken Amazon Appstore on Android 12 devices, which had been preventing users from using its app — or apps installed via its app — for over a month.

- The Google Play Store added filters that let you narrow down searches by devices, like Android TV or Wear OS.

Social

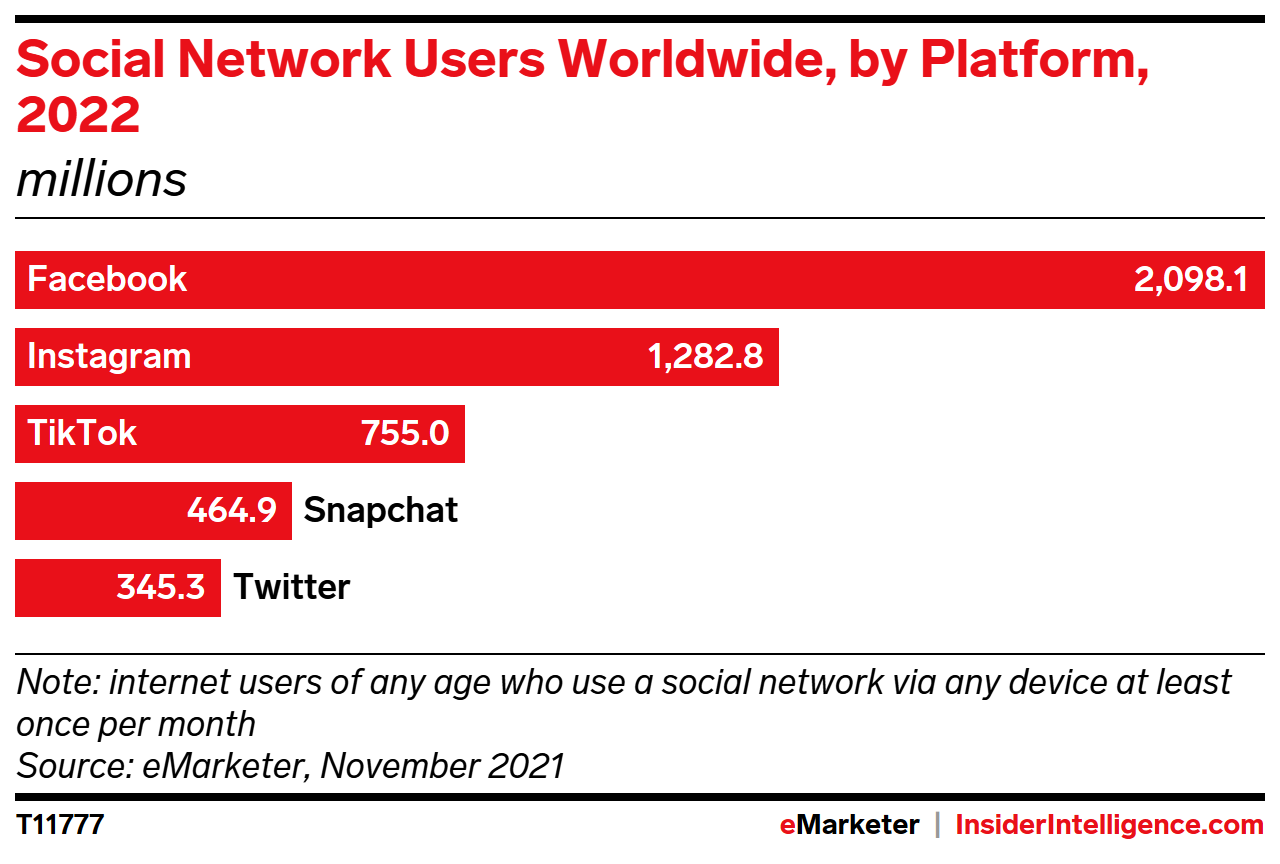

Image Credits: Insider Intelligence

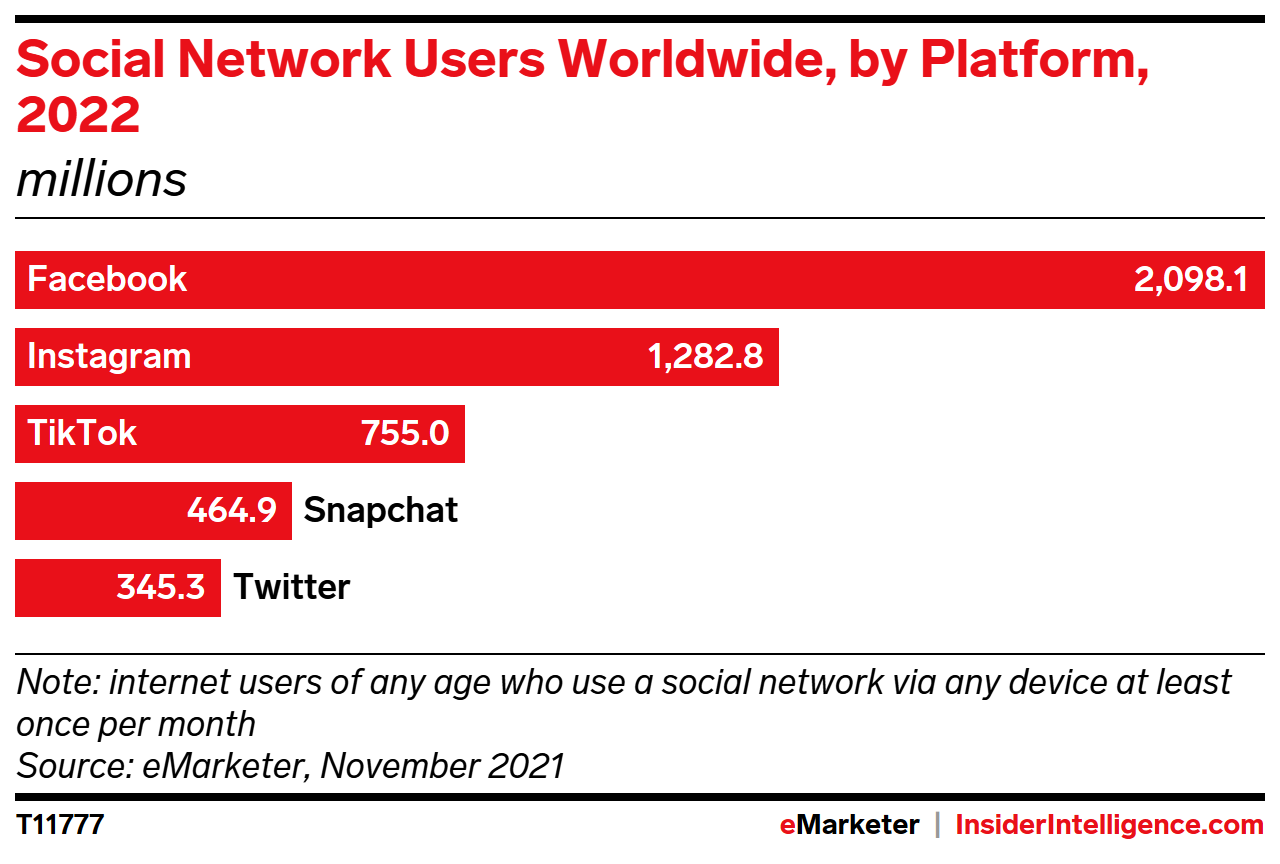

- A 2022 forecast notes TikTok is the world’s third-largest social network, on track for 755 million monthly users next year. This estimate comes from Insider Intelligence (formerly eMarketer), which uses its own system for counting MAUs to be more consistent across companies, while also weeding out fake accounts.

- TikTok will launch a delivery-only restaurant business across the U.S. in March to promote some of the most viral food dishes on its app, posted by TikTok influencers and creators. The company said it’s not going into the food business itself, but is partnering with Virtual Dining Concepts and Grubhub on the TikTok Kitchen promotion.

Messaging

Image Credits: Meta

- Facebook Messenger rolled out holiday features, including new AR effects from beauty influencers like Bretman Rock and Ashley Strong; plus holiday-themed word effects; a New Year’s Eve chat theme; various seasonal soundmojis, backgrounds and “gift wrap” on Messenger using Facebook Pay on Android. Messenger Kids is launching a Santa chat experience and other games and AR effects.

- WhatsApp is testing a new interface for voice calls and other features on iOS and Android. The site WABetaInfo spotted the new interface under development, which offers some UI tweaks and new indicators for end-to-end encryption.

Streaming & Entertainment

- TikTok is being accused of violating open source licenses in its new Live Studio Windows app. The app is allegedly using code from the Open Broadcaster Software project’s OBS Studio app and other open-source projects without following the licensing terms.

- The Verge wants to know what happened to Spotify HiFi? The high-end version of the streaming service was supposed to roll out this year, but never did. What gives?

Government & Policy

Funding and M&A (and IPOs)

Zepto, a 10-minute grocery delivery app operating in India, raised $100 million in Series C funding, led by Y Combinator’s Continuity Fund. With the round, the app has now more than doubled its valuation to $570 million, up from $225 million in less than two months ago.

Zepto, a 10-minute grocery delivery app operating in India, raised $100 million in Series C funding, led by Y Combinator’s Continuity Fund. With the round, the app has now more than doubled its valuation to $570 million, up from $225 million in less than two months ago.

Rocket Companies, maker of Rocket Mortgage, acquired Truebill, a personal finance app that helps consumers manage their bills, subscriptions and budgets. The deal was for $1.275 billion, up from Truebill’s final private valuation of $530 million following its last round.

Rocket Companies, maker of Rocket Mortgage, acquired Truebill, a personal finance app that helps consumers manage their bills, subscriptions and budgets. The deal was for $1.275 billion, up from Truebill’s final private valuation of $530 million following its last round.

Amsterdam-based tennis and padel court booking app Playtomic raised €56 million in Series C funding led by GP Bullhound after its monthly bookings surpassed 1 million in November 2021, up nearly 3x from a year ago. The app reaches 1+ million users across 34 countries.

Amsterdam-based tennis and padel court booking app Playtomic raised €56 million in Series C funding led by GP Bullhound after its monthly bookings surpassed 1 million in November 2021, up nearly 3x from a year ago. The app reaches 1+ million users across 34 countries.

Taptap Send raised $65 million in Series B funding led by Spark Capital to further grow its cross-border remittances app, which now covers 20 countries, including those in less developed markets.

Taptap Send raised $65 million in Series B funding led by Spark Capital to further grow its cross-border remittances app, which now covers 20 countries, including those in less developed markets.

Lapse, a Dispo-like app that lets users take photos that “develop” 24 hours later, raised $11 million in seed funding led by Octopus Ventures and GV.

Lapse, a Dispo-like app that lets users take photos that “develop” 24 hours later, raised $11 million in seed funding led by Octopus Ventures and GV.

Gaming company Rec Room raised $145 million in funding led by Coatue Management, for its cross-platform game that runs on mobile, PC, game consoles and VR headsets. The company has grown its user base from 2 million in March to now 37 million, and is valued at $3.5 billion.

Gaming company Rec Room raised $145 million in funding led by Coatue Management, for its cross-platform game that runs on mobile, PC, game consoles and VR headsets. The company has grown its user base from 2 million in March to now 37 million, and is valued at $3.5 billion.

Spotify acquired podcast tech company Whooshkaa, which turns radio programming into on-demand podcasts. The tech will be integrated with Spotify’s Megaphone.

Spotify acquired podcast tech company Whooshkaa, which turns radio programming into on-demand podcasts. The tech will be integrated with Spotify’s Megaphone.

Vietnam-based MoMo, a super app offering money transfers, insurance, investments, donations and more, raised $200 million in Series E funding led by Mizhuo Bank. The round values the business at $2+ billion.

Vietnam-based MoMo, a super app offering money transfers, insurance, investments, donations and more, raised $200 million in Series E funding led by Mizhuo Bank. The round values the business at $2+ billion.

Stockholm-based Voi, an app offering e-scooter and e-bike rentals, raised $115 million in Series D funding led by Raine Group and VNV Global. The company, which has scooters in 80 European cities, will next begin preparing for an IPO.

Stockholm-based Voi, an app offering e-scooter and e-bike rentals, raised $115 million in Series D funding led by Raine Group and VNV Global. The company, which has scooters in 80 European cities, will next begin preparing for an IPO.

Triller, a one-time TikTok rival turned live events app, announced plans to merge with adtech company SeaChange to take the two companies public at a ~$5 billion valuation.

Triller, a one-time TikTok rival turned live events app, announced plans to merge with adtech company SeaChange to take the two companies public at a ~$5 billion valuation.

Indian e-commerce startup Snapdeal filed for an IPO, which seeks to raise $165 million. The 11-year-old company, which offers its services online and via app, competes with Amazon and Flipkart in India, and has shifted its focus in recent years to serve consumers in smaller towns and cities.

Indian e-commerce startup Snapdeal filed for an IPO, which seeks to raise $165 million. The 11-year-old company, which offers its services online and via app, competes with Amazon and Flipkart in India, and has shifted its focus in recent years to serve consumers in smaller towns and cities.

Downloads

Wombo Dream

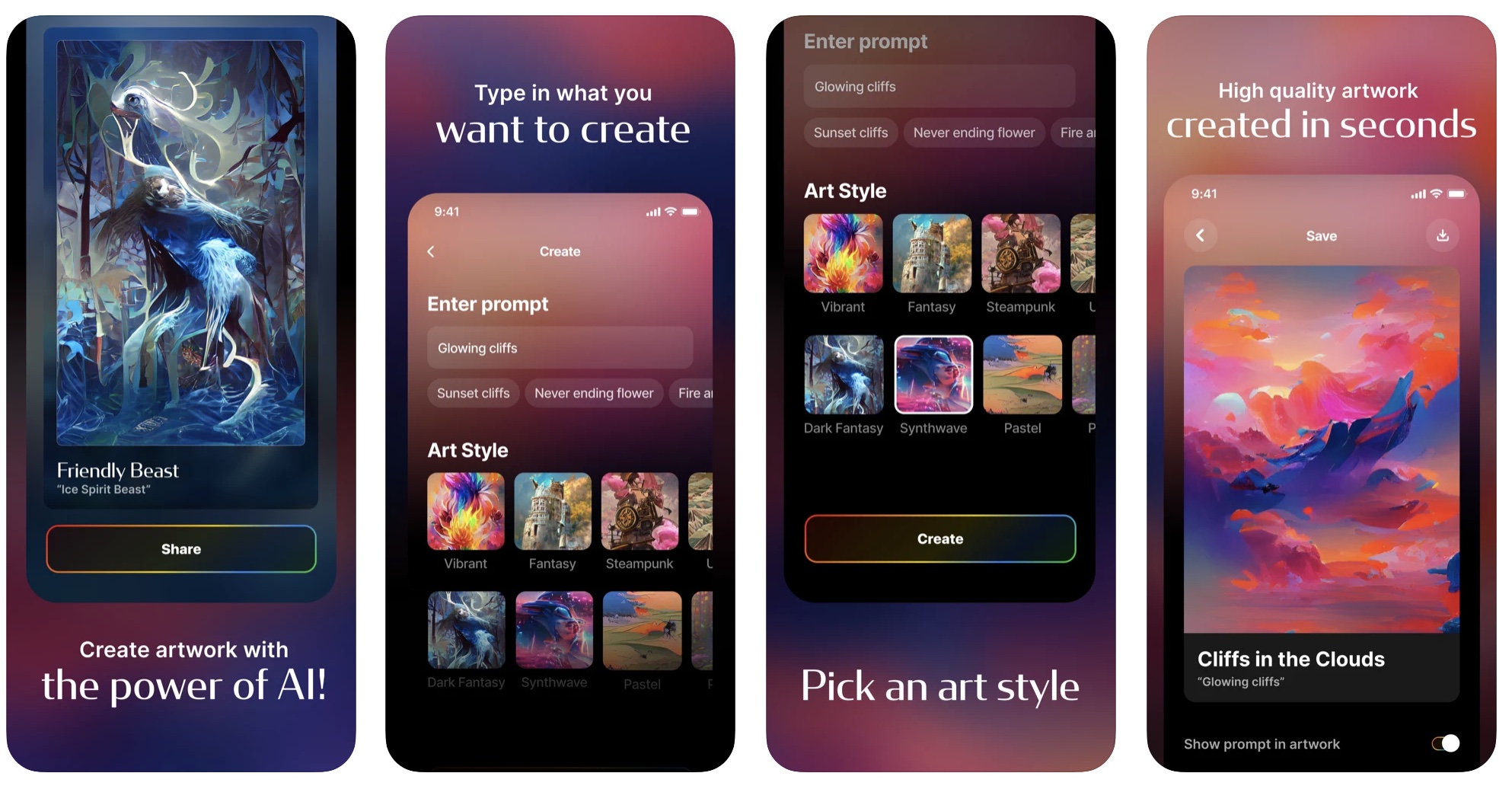

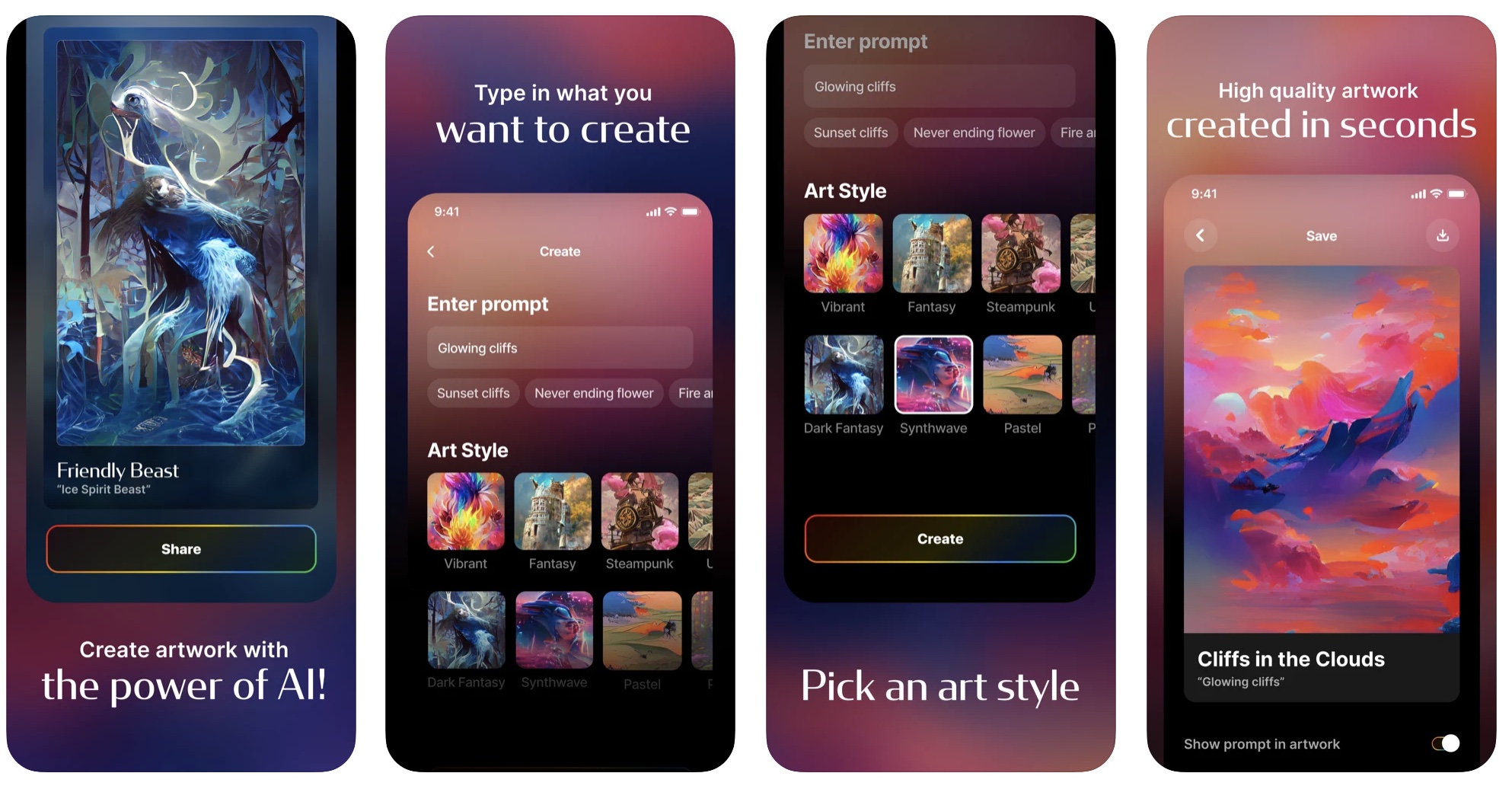

Image Credits: Wombo

Known for an AI-powered lip-syncing app, Wombo’s latest app, Dream, is tapping into AI to create art. (Read TechCrunch’s review by Natasha Lomas here). To use the app, you type in what you want to create a picture of, then choose a style — like vibrant, pastel, dark fantasy, steampunk, etc. Dream will then spend a few seconds making the finished composition — some of which look better than others. You can repeat the process until it delivers a result you like. The app has already seen over 10 million images created by users and has been downloaded over 1 million times across iOS and Android.

Zepto, a 10-minute grocery delivery app operating in India,

Zepto, a 10-minute grocery delivery app operating in India,  Rocket Companies, maker of Rocket Mortgage,

Rocket Companies, maker of Rocket Mortgage,  Triller, a one-time TikTok rival turned live events app,

Triller, a one-time TikTok rival turned live events app,