The European Commission has given its clearest signal yet that it’s prepared to intervene over weak enforcement of the EU’s data protection rules against big tech.

Today the bloc’s executive also had a warning for adtech giants Google and Facebook — accusing them of choosing “legal tricks” over true compliance with the EU’s standard of “privacy by design” — and emphasizing the imperative for them to take data protection “seriously”.

Speaking at a privacy conference this morning, Vera Jourová, the EU’s commissioner for values and transparency, said enforcement of the General Data Protection Regulation (GDPR) at a national level must buck up — and become “effective” — or else it “will have to change”, warning specifying that any “potential changes” will move toward centralized enforcement.

“When I was looking at existing enforcement decisions and pending cases, I also came to another conclusion,” she also said. “So, we have penalties or decisions against Google, Facebook, WhatsApp.

“To me this means that clearly there is a problem with compliance culture among those companies that live off our personal data. Despite the fact that they have the best legal teams, presence in Brussels and spent countless hours discussing with us the GDPR. Sadly, I fear this is not privacy by design.

“I think it is high time for those companies to take protection of personal data seriously. I want to see full compliance, not legal tricks. It’s time not to hide behind small print, but tackle the challenges head on.”

In parallel, an influential advisor to the bloc’s top court has today published an opinion which states that EU law does not preclude consumer protection agencies from bringing representative actions at a national level — following a referral by a German court in a case against Facebook Ireland — which, if the CJEU’s judges agree, could open up a fresh wave of challenges to tech giants’ misuse of people’s data without the need to funnel complaints through the single point of failure of gatekeeper regulators like Ireland’s Data Protection Commission (DPC).

Towards centralized privacy oversight?

On paper, EU law provides people in the region with a suite of rights and protections attached to their data. And while the regulation has attracted huge international attention, as other regions grapple with how to protect people in an age of data-mining giants, the problem for many GDPR critics, as it stands, is that the law decentralizes oversight of these rules and rights to a patchwork of supervisory agencies at the EU Member State level.

While this can work well for cases involving locally bounded services, major problems arise where complaints span borders within the EU — as is always the case with tech giants’ (global) services. This is because a one-stop-shop (OSS) mechanism kicks in, ostensibly to reduce the administrative burden for businesses.

But it also enables a huge get-out clause for tech giants, allowing them to forum shop for a ‘friendly’ regulator through their choice of where to locate their regional HQ. And working from a local EU base, corporate giants can use investment and job creation in that Member State as a lever to work against and erode national political will to press for vigorous oversight of their European business at the local authority level.

“In my view, it does take too long to address the key questions around processing of personal data for big tech,” said Jourová giving a keynote speech to the Forum Europe data protection & privacy conference. “Yes, I understand the lack of resources. I understand there is no pan-European procedural law to help the cross-border cases. I understand that the first cases need to be rock-solid because they will be challenged in court.

“But I want to be honest — we are in the crunch time now. Either we will all collectively show that GDPR enforcement is effective or it will have to change. And there is no way back to decentralised model that was there before the GDPR. Any potential changes will go towards more centralisation, bigger role of the EDPB [European Data Protection Board] or Commission.”

Jourová added that the “pressure” to make enforcement effective “is already here” — pointing to debate around incoming legislation that will update the EU’s rules around ecommerce, and emphasizing that, on the Digital Services Act, Member States have been advocating for enforcement change — and “want to see more central role of the European Commission”.

Point being that if there’s political will for structural changes to centralize EU enforcement among Member States, the Commission has the powers to propose the necessary amendments — and will hardly turn its nose up at being asked to take on more responsibility itself.

Jourová’s remarks are a notable step up on her approach to the thorny issue of GDPR enforcement back in summer 2020 — when, at the two year review mark of the regulation entering into application, she was still talking about the need to properly resource DPAs — in order that they could “step up their work” and deliver “vigorous but uniform enforcement”, as she put it then.

Now, in the dying days of 2021 — with a still massive backlog of decisions yet to be issued around cross-border cases, some of which are highly strategic, targeting adtech platforms’ core surveillance business model (Jourová’s speech, for example, noted that 809 procedures related to the OSS have been triggered but only 290 Final Decisions have been issued) — the Commission appears to be signalling that it’s finally running out of patience on enforcement.

And that it is already eyeing a Plan B to make the GDPR truly effective.

Criticism of weak enforcement against tech giants has been a rising chorus in Europe for years. Most recently frustration with regulatory inaction led privacy campaigner Max Schrems’ not-for-profit, noyb, to file a complaint of criminal corruption against the GDPR’s most infamous bottleneck: Ireland’s DPC, accusing the regulator of engaging in “procedural blackmail” which it suggested would help Facebook by keeping key developments out of the public eye, among other eye-raising charges.

The Irish regulator has faced the strongest criticism of all the EU DPAs over its role in hampering effective GDPR enforcement.

Although it’s not the only authority to be accused of creating a bottleneck by letting major complaints pile up on its desk and taking a painstaking ice-age to investigate complaints and issue decisions (assuming it opens an investigation at all).

The UK’s ICO — when the country was still in the EU — did nothing about complaints against real-time-bidding’s abuse of people’s data, for example, despite sounding a public warning over behavioral ads’ unlawfulness as early as 2019. While Belgium’s DPA has been taking a painstaking amount of time to issue a final decision on the IAB Europe’s TCF’s failure to comply with the GDPR. But Ireland’s central role in regulating most of big tech means it attracts the most flak.

The sheer number of tech giants that have converged on Ireland — wooed by low corporate tax rates (likely with the added cherry of business-friendly data oversight) — gives it an outsized role in overseeing what’s done with European’s data.

Hence Ireland has open investigations into Apple, Google, Facebook and many others — yet has only issued two final decisions on cross-border cases so far (Twitter last year; and WhatsApp this year).

Both of those decisions went through a dispute mechanism that’s also baked into the GDPR — which kicks in when other EU DPAs don’t agree with a draft decision by the lead authority.

That mechanism further slowed down the DPC’s enforcement in those cases — but substantially cranked up the intervention the two companies ultimately faced. Ireland had wanted to be a lot more lenient vs the collective verdict once all of the bloc’s oversight bodies had had their say.

That too, critics say, demonstrates the DPC’s regulatory capture by platform power.

An opinion piece in yesterday’s Washington Post skewered the DPC as “the wrong privacy watchdog for Europe” — citing a study by the Irish Council for Civil Liberties that found it had only published decisions on about 2% of the 164 cross border cases it has taken on.

The number of complaints the DPC has chosen to entirely ignore — i.e. by not opening a formal investigation — or else to quietly shutter (“resolve”) without issuing a decision or taking any enforcement action is likely considerably higher.

The agency is shielded by a very narrow application of Freedom of Information law, which applies only in relation to DPC records pertaining to the “general administration” of its office. So when TechCrunch asked the DPC, last December, how many times it had used GDPR powers such as the ability to order a ban on processing it declined to respond to our FOIs — arguing the information did not fall under Ireland’s implementation of the law.

Silence and stonewalling only go so far, though.

Calls for root and branch reform of the DPC specifically, and enforcement of the GDPR more generally, can now be heard from Ireland’s own parliament all the way up to the European Commission. And big tech’s game of tying EU regulators in knots looks as if it’s — gradually, gradually — getting toward the end of its rope.

What comes next is an interesting question. Last month the European Data Protection Superviso (EDPS) announced a conference on the future of “effective” digital enforcement — which will take place in June 2022 — and which he said would discuss best practice and also “explore alternative models of enforcement for the digital future”.

“We are ambitious,” said Wojciech Wiewiorowski as he announced the conference. “There is much scope for discussion and much potential improvement on the way current governance models are implemented in practice. We envisage a dialogue across different fields of regulation — from data protection to competition, digital markets and services, and artificial intelligence as well — both in the EU, and Europe as a continent, but also on the global level.”

Discussion of “different” and “alternative” models of enforcement will be a focus of the event, per Wiewiorowski — who further specified that this will include discussion of “a more centralized approach”. So the EDPS and the Commission appear to be singing a similar tune on reforming GDPR enforcement.

As well as the Commission itself (potentially) taking on an enforcement role in the future — perhaps specifically on major, cross border cases related to big tech, in order to beef up GDPR’s application against the most powerful offenders (as is already proposed in the case of the DSA and enforcing those rules against ‘very large online platforms’; aka vLOPs) — the GDPR steering and advisory body, the EDPB, also looks set to play an increasingly strategic and important role.

Indeed, it already has a ‘last resort’ decision making power to resolve disputes over cross border GDPR enforcement — and Ireland’s intransigence has led to it exercising this power for the first time.

In the future, the Board’s role could expand further if EU lawmakers decide that more centralization is the only way to deliver effective enforcement against tech giants that have become experts in exhausting regulators with bad faith arguments and whack-a-mole procedures, in order to delay, defer and deny compliance with European law.

The EDPB’s chair, Andrea Jelinek, was also speaking at the Forum Europe conference today. Asked for her thoughts on how GDPR enforcement could improve, including problematic elements like the OSS, she cautioned that change will be a “long term project”, while simultaneously agreeing there are notable “challenges” at the point where national oversight intersects with the needs of cross border enforcement.

“Enforcing at a national level and at the same time resolving cross border cases is time and resource intensive,” she said. “Supervisory authorities need to carry out investigations, observe procedural rules, coordinate and share information with other supervisory authorities. For the current system to work properly it is of vital important that supervisory authorities have enough resources and staff.

“The differences in national administrative procedures and the fact that in some Member States no deadlines are foreseen for handling a case also creates an obstacle to the efficient functioning of the OSS.”

Jelinek made a point of emphasizing that EDPB has been taking action to try to remedy some of issues identified — implementing what she described as “a series of practical solutions” to tackle problems around enforcement.

She said this has included developing (last year) a co-ordinated enforcement framework to facilitate joint actions (“in a flexible and coordinated manner”) — such as launching enforcement sweeps and joint investigations.

The EPBD is also establishing a pilot project to provide a pool of experts to support investigations and enforcement activities “of significant common interest”, she noted, predicting: “This will enhance the cooperation and solidarity between all the supervisory authorities by addressing their operational needs.”

“Finally we should not forget that the GDPR is a long term project and so is strengthening cooperation between supervisory authorities,” she added. “Any transformation of the GDPR will take years. I think the best solution is therefore to deploy the GDPR fully — it is likely that most of the issues identified by Member States and stakeholders will benefit from more experience in the application of the regulation in the coming years.”

However it is already well over three years since GDPR came into application. So many EU citizens may query the logic of waiting years more for regulators to figure out how to jointly work together to get the job of upholding people’s rights done. Not least because this enforcement impasse leaves data-mining tech giants free to direct their vast data-enabled wealth and engineering resource at developing new ‘innovations’ — to better evade legal restrictions on what they can do with people’s data.

One thing is clear: The next wave of big tech regulatory evasion will come dressed up in claims of privacy “innovation” from the get-go.

Indeed, that is already how adtech giants like Google are trying to re-channel regulators’ attention from enforcing against their core attention-manipulation, surveillance-based business model.

Google SVP Kent Walker also took to the (virtual) conference stage this morning for a keynote slot in which he argued that the novel ad targeting technologies Google is developing under its “Privacy Sandbox” badge (such as FloCs; aka federated learning of cohorts) will provide the answer to what big (ad)tech likes to claim is an inherent tension between European fundamental rights like privacy and economic growth.

The truth, as ever, is a lot more nuanced than that. For one thing, there are plenty of ways to target ads that don’t require processing people’s data. But as most of Europe’s regulators remain bogged down in a mire of corporate capture, under-resourcing, culture cowardice/risk aversion, internecine squabbles and, at times, a sheer lack of national political will to enforce the law against the world’s wealthiest companies, the adtech duopoly is sounding cockily confident that it will be allowed to carry on and reset the terms of the game in its own interests once again.

(The added irony here is that Google is currently working under the oversight of the UK’s Competition and Markets Authority and ICO on shaping behavioral remedies attached to its Sandbox proposals — and has said that these commitments will be applied globally if the UK is minded to accept them; which does risk tarnishing the GDPR’s geopolitical shine, given the UK is no longer a member of the EU… )

For EU citizens, it could well mean that — once again — it’s up to the CJEU to come to the rescue of their fundamental rights — assuming the court ends up concurring with advocate general Richard de la Tour’s opinion today that the GDPR:

” … does not preclude national legislation which allows consumer protection associations to bring legal proceedings against the person alleged to be responsible for an infringement of the protection of personal data, on the basis of the prohibition of unfair commercial practices, the infringement of a law relating to consumer protection or the prohibition of the use of invalid general terms and conditions, provided that the objective of the representative action in question is to ensure observance of the rights which the persons affected by the contested processing derive directly from that regulation.”

Consumer protection agencies being able to pursue representative legal actions to defend fundamental rights against tech giants’ self interest — at the Member State level, and therefore, all across the EU — could actually unblock GDPR enforcement via a genuinely decentralized wave of enforcement that’s able to route around the damage of captured gatekeepers and call out big adtech’s manipulative tricks in court.

Introducing Birdwatch aliases!

Introducing Birdwatch aliases! We want everyone to feel comfortable contributing to Birdwatch, and aliases let you write and rate notes without sharing your Twitter username.

We want everyone to feel comfortable contributing to Birdwatch, and aliases let you write and rate notes without sharing your Twitter username.

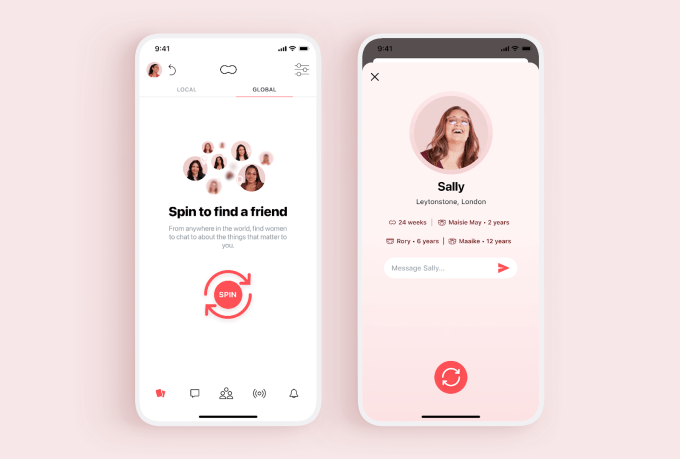

Family locator and communication app Life360

Family locator and communication app Life360  Niantic

Niantic

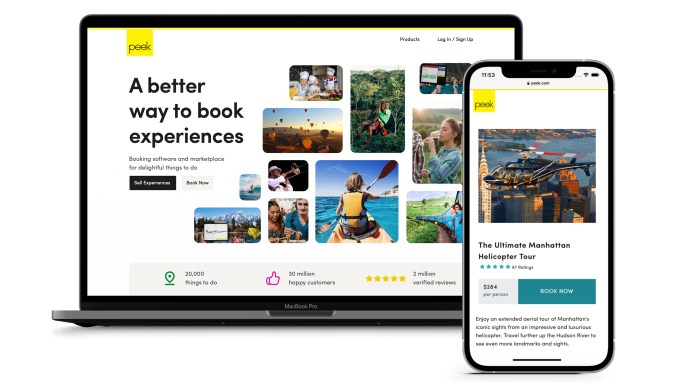

Peek also took to the offensive, thinking of how it could work differently with its customers on both sides of the business. With end users, it doubled down on virtual experiences (for example, online cooking classes); and rethinking and expanding who “customers” could be by building out experiences booking for corporate and internal events.

Peek also took to the offensive, thinking of how it could work differently with its customers on both sides of the business. With end users, it doubled down on virtual experiences (for example, online cooking classes); and rethinking and expanding who “customers” could be by building out experiences booking for corporate and internal events.