One of the big leaders in buying up and scaling third-party merchants selling on Amazon and other marketplace platforms is announcing a major round of funding today as it continues to expand its ambitions. Thrasio, the Boston-based startup, has closed an all-equity Series D of over $1 billion — a huge infusion in cash that it will be using to continue buying up more companies as well as to expand internationally. It said that it’s currently on a rate of buying 1.5 businesses per week and now has some 200 brands in its portfolio.

Silver Lake and Advent International led the round, with Advent remaining the company’s largest shareholder. Upper90, funds managed by Oaktree Capital Management, L.P., PEAK6 Investments and Corner Capital — all previous backers — were also in the round.

Thrasio has confirmed to me that the valuation is between $5 billion and $10 billion but declined to get more specific. As a marker of where it was prior to this round, in April of this year, when it raised $100 million, Thrasio was valued at $3.7 billion. Just on a straight added-capital basis that would put its valuation at close to $5 billion but the company also notes that it has been seeing accelerated growth — the number of brands under its wing has doubled since then to 200 — so very likely some ways higher than that. Current brands include Angry Orange pet deodorizers and stain removers, SafeRest mattress protectors and ThisWorx car cleaning and detailing products.

The company, founded in 2018, has now raised $3.4 billion, including a $650 million debt round earlier this year.

Thrasio is one of the pioneers of the modern “roll up” player, and its traction, along with the wider opportunity in the market, have spawned dozens of other startups around the world building businesses replicating its model that have collectively raised hundreds of millions of dollars in equity and debt to build out their businesses. Other recent fundings in the space have included Heroes, which raised $200 million in August; Olsam ($165 million); Suma Brands ($150 million); Elevate Brands ($250 million); Perch ($775 million); factory14 ($200 million); as well as Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.

One of the reasons it has raised so much in this round is to better target that global opportunity. Thrasio already has operations in the UK, Germany China and Japan and the plan is to expand that further, both as a means of finding more companies to gobble up, but also to expand its wider supply chain.

That wider opportunity, meanwhile, remains a large one despite how crowded the market is getting. By various estimates there are between 5 million and 10 million third-party merchants selling on Amazon alone, leveraging the e-commerce giant’s giant audience of shoppers and its Fulfillment by Amazon platform for delivery and other distribution logistics to cut down the operational costs and inefficiencies of building a direct-to-consumer business from the ground up. Thrasio’s co-CEO and co-founder Josh Silberstein told me earlier this year that Thrasio estimates that there are around 50,000 businesses out of those that make more than $1 million in revenues annually, so the tail of what is out there in terms of size is very long.

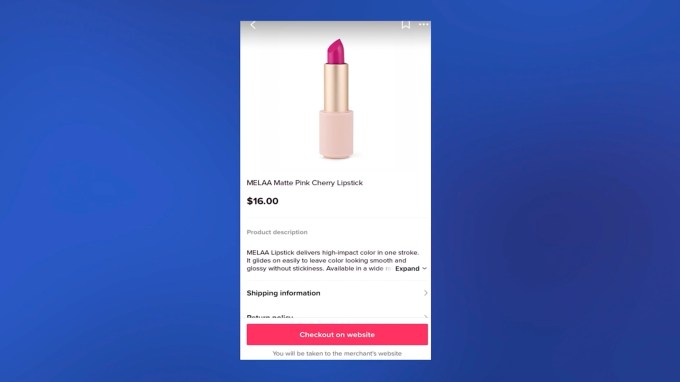

Thrasio is building out a bigger economy of scale play around that basic model, and in some cases replacing some of the Amazon components with scale of its own, which — the theory goes — only improves as it grows. That includes sourcing for products (as well as wider supply chain challenges), analytics both to source the more interesting companies to buy up as well as to market those products once under the Thrasio wing, even its own fulfillment technology. It is also increasingly also looking at opportunities to build sales and customer relationships outside of the Amazon ecosystem, using other marketplaces, other sales channels and in some cases direct-to-consumer plays.

(And that analytics engine for sourcing potential acquisitions is working hard: Thrasio says that it has “evaluated” some 6,000 businesses overall.)

“Our business is getting better as it gets bigger, and these investments will be invaluable as we continue on that path,” said Carlos Cashman, the other co-founder and CEO of Thrasio, in a statement. “Advent and Silver Lake both have phenomenal track records of building successful global businesses, and the additional funds from existing investors including Upper90 and PEAK6 are extremely rewarding votes of confidence in a crowded space.”

“Thrasio created the Amazon aggregator category, and their innovative approach and impressive growth have brought a lot of attention to this space,” said Greg Mondre, co-CEO, and Stephen Evans, managing director, of Silver Lake, in a joint statement. “We believe Carlos Cashman and his team are well positioned to accelerate their growth and build the preeminent next-generation, technology-driven consumer goods company. We’re excited to partner with Carlos, his team and the existing shareholders as the company enters the next phase of growth.”

“Thrasio has quickly established itself as the largest ecommerce aggregator globally, and we are thrilled to strengthen our partnership with Carlos and his team, in addition to welcoming Silver Lake as a new investor,” added David Mussafer, chairman and managing partner and Jeff Case, managing director, of Advent International. “Thrasio is well positioned for further success, and we look forward to working with the company as it continues to scale.”