Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. Global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year over year to reach $295 billion.

Today’s consumers now spend more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they’re not even the world’s heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021.

Apps aren’t just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated over $100 million in consumer spend and 13 topped $1 billion in revenue. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend and just eight apps topped $1 billion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place, with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions and suggestions about new apps to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Stories

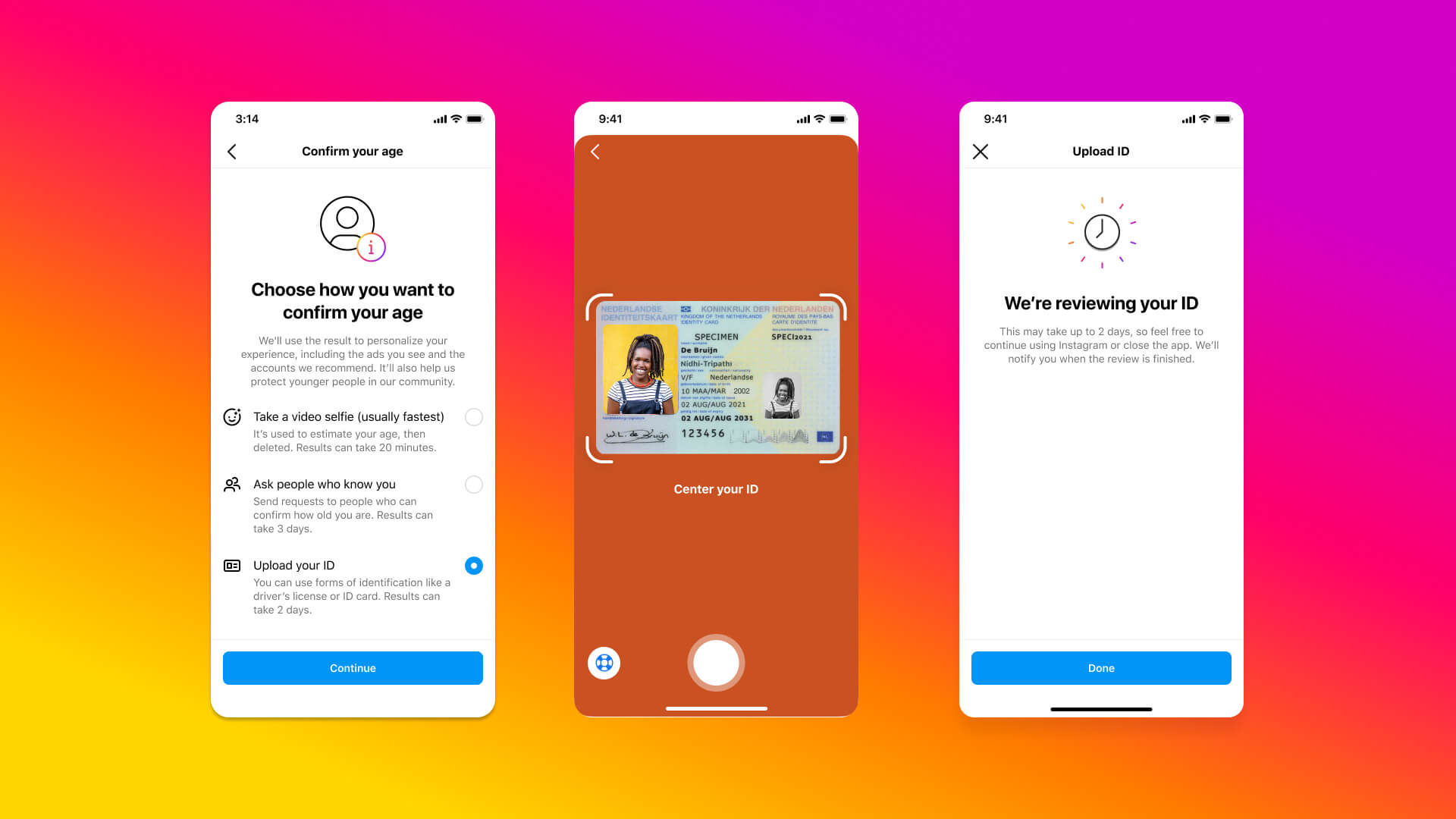

Instagram to verify users’ ages in new test

Image Credits: Instagram

Instagram announced this week it’s testing a new set of features for verifying users’ ages in the app, including things like video selfies, vouching from adult friends and providing an ID. The tests, which will begin in the U.S., will apply to users who try to change their age to 18 or over after being previously set to under 18. These users may be trying to correct an earlier mistake or they could be teens trying to circumvent the app’s newer age-appropriate restrictions.

If users are prompted to provide an ID card, like a passport or driver’s license, Meta will store it on its servers for 30 days before deletion. If users choose the social vouching option, they’ll need at least three other adult friends to vouch for their age — and Instagram will choose a list of six people randomly who meet the criteria. Those users can’t have a new account or be vouching for others at the same time.

The company also said it’s using AI that can estimate users’ ages in video selfies. The company is working with the London-based digital identify firm Yoti which will examine the file, make an estimate, then delete the file.

Age verification is an increasingly common feature in social apps used by younger users as a result of tighter regulations. Another company catering to Gen Z users, Yubo, recently rolled out its own age estimating tech as well.

Twitter goes long form

TechCrunch broke the news that Twitter was testing a long-form writing feature called Twitter Notes. The next day after our report went live, Twitter announced it officially.

The news is one of Twitter’s more significant changes since doubling the character count from 140 to 280 characters, as it will allow users to write on Twitter directly, as if it’s a blogging platform. With Twitter Notes, users are able to create articles using rich formatting and uploaded media, which can then be tweeted and shared with followers upon publishing. The company also said it would merge its newsletter service, Revue, into Twitter Notes.

Users with access can create Twitter Notes from the “Write” link in Twitter’s navigation. For the time being, Twitter is testing Notes with a small group of writers in the United States, Canada, Ghana and the United Kingdom. The Notes can be up to 2,500 words in length.

The feature could encourage users to rely on Twitter Thread (tweetstorms) less in order to share their longer thoughts, ideas or stories with their Twitter followers, Community or Circle. It could also put an end to using a screenshot from the Notes app to tweet something longer than 280 characters. Meanwhile, Twitter Notes can tap into the potential for viral distribution that comes with posting to the platform. Like tweets, the Notes would have their own link and could be tweeted, retweeted, sent in DMs, liked and bookmarked. They can also be reported and must comply with Twitter’s rules.

It’s worth noting (ha!) that Twitter Notes also gives the company a new business and potential revenue stream as it further develops the product. The feature may allow the social platform to compete with established services, like Medium for blogging, or Substack’s newsletters.

Weekly News

Platforms: Apple

- Apple released the second developer beta for iOS 16 and iPadOS 16, along with other betas for Mac, Apple Watch and Apple TV. Among the changes is support for cellular iCloud backups over LTE; a new feature that shows a brand or company’s logo beside their email in the Mail app to cut down on phishing; tech that lets you skip CAPTCHAs; plus new SMS filters and the ability to tap to report a junk SMS sender in the U.S. But another thing to note if you’re testing iOS 16 — the current beta’s editable iMessage feature doesn’t work with older iPhones, meaning your edits are texted to the person after the original message.

- Apple also rolled out Xcode 14 beta 2 which now includes a Stage Manager simulator.

- The iPad will no longer work as a home hub in iOS 16 according to information discovered in the Home app.

E-commerce

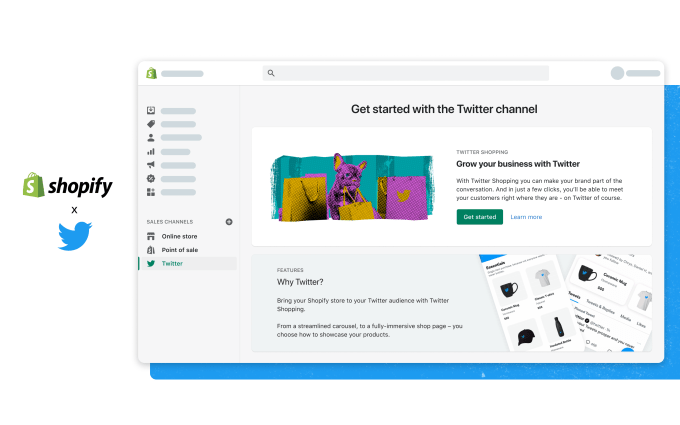

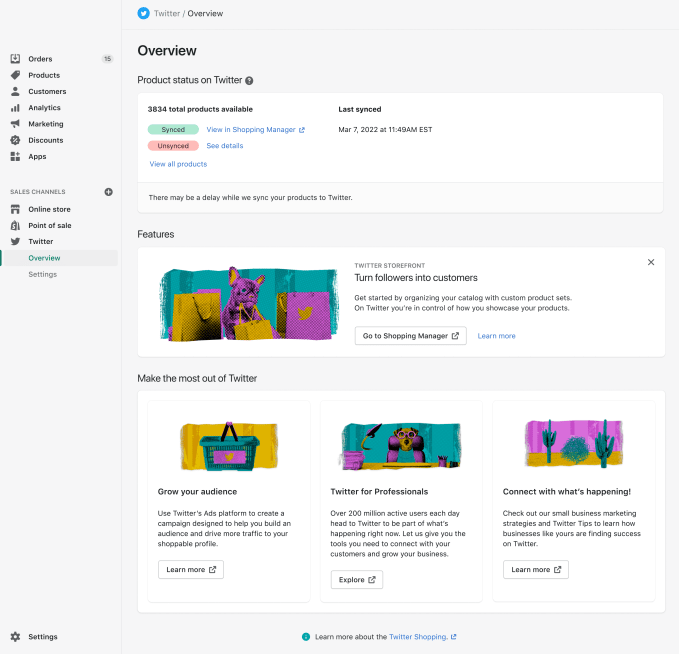

Image Credits: Twitter/Shopify

- As part of its ongoing efforts to expand into e-commerce, Twitter announced a new partnership with Shopify. The deal will see Twitter launching a sales channel app that will be made available to all of Shopify’s U.S. merchants through its app store. The app allows merchants to onboard themselves to Twitter’s Shopping Manager, the dashboard offered by the social media company where sellers can access product catalog tools and enable other shopping features for their profiles. Merchants will be able to use the new sales channel app to connect their Twitter account to their Shopify admin then get set up with Twitter’s Shopping Manager and other free tools Twitter built for “Professionals.” This includes Twitter’s launch of a new feature called Location Spotlight, which allows local businesses in the U.S., Canada, U.K. and Australia to display information like their street address, contact info and operating hours directly on their profile.

Augmented Reality

- Walmart gave its app an AR upgrade with the launch of View in Your Space, which allows customers to see home décor and furniture in their own homes. The feature will be rolled out to over 300 items on Walmart’s iOS app by early July.

- Tim Cook may have hinted at Apple’s AR headset plans when he told a Chinese state-run news outlet to “stay tuned” to see what Apple had in store next for AR in an interview. A later investor note by Ming-Chi Kuo also suggested the new hardware could arrive as soon as early 2023.

- IKEA launched a new in-app design experience, called IKEA Kreativ, that lets U.S. shoppers visualize furniture in their own spaces using AR and AI. The feature can also remove the existing furniture from your room so you can better imagine the changes.

- Snap shared some data about AR shopping trends, noting that there was a 32% increased use of shoppable AR during the pandemic and that 69% of consumers believed AR was a part of shopping’s future.

Fintech

- Coinbase is shutting down its standalone Pro service by year’s end and replacing it with Advanced Trade across its website and app. The latter offers comparable features to the Pro service, which had lowered fees to traders who interacted directly with the Coinbase Exchange order book.

- Facebook Pay formally rebranded to Meta Pay. The change had already been announced but is now rolling out in the U.S. before expanding globally.

Social

Image Credits: Twitter

- Snapchat announced its first accelerator program for emerging Black creators, which will see 25 selected participants receive $10,000 per month to launch their careers across a total $3 million investment.

- Instagram has been experimenting with a new feature that would allow users to leave notes for their friends at the top of the DM inbox. The feature could help users share urgent or more important messages that could be overlooked in Stories or in messages.

- Meta announced more ways for creators to make money on Facebook and Instagram and the expansion of other monetization tools to more creators. The company will keep paid online events, fan subscriptions, badges and its upcoming independent news products free for creators until 2024, instead of 2023, as it had said before. Meta is also testing a designated place on Instagram where creators can get discovered by brands for partnerships; will launch a way for users to subscribe to Facebook Groups even for those who have paid for access on another platform; and is expanding the Reels Play Bonus program to more creators and making Facebook Stars available to all.

- Twitter announced the return of its developer conference, Chirp. The event was first held in 2010 but was then canceled the next year. At the time, the event had been a reflection of Twitter’s attitude toward its developer community in general — disorganized and constantly in flux as the company’s business initiatives changed. Times have since changed and Twitter has been trying to woo back developers with its new API, even by promoting some apps on Twitter itself.

Messaging

- Telegram said it now has over 700 monthly active users and announced Telegram Premium, a subscription that gives users access to exclusive features like doubled limits, 4 GB file uploads, faster downloads, exclusive stickers and reactions, improved chat management and more.

Photos

- Camera+, an alternative to Apple’s built-in app, added a new “UltraRes upscaling” feature. With machine learning technology, the app can upscale images to up to four times what the native sensor can capture.

Dating

- Match-owned Hinge added a new feature that allows users to share their “Dating Intentions” — meaning whether they’re looking for long-term, short-term, open relationships and more. The update changes Hinge’s focus as the company has historically been the app designed to connect people looking for more serious relationships, while Match-owned Tinder was aimed at those seeking casual encounters.

Streaming & Entertainment

Image Credits: Spotify

- Spotify revamped its concert discovery feature with the launch of a new Live Events Feed. The personalized feature will allow users to find favorite artists’ events in your area and will now include artist imagery and more tour details. Local events will also be highlighted while streaming and soon, in other places in the Spotify app.

- Clubhouse is testing a new feature called Houses, per Bloomberg, which are private rooms aimed at encouraging social interactions where anyone can unmute themselves and speak.

- Reddit Talk, the company’s live audio Clubhouse-like feature, announced its Host program would launch on July 11th. The program will promote hosts’ audio across the site. Reddit Talk also gained new features like a soundboard and topic selector for discovery purposes.

- Apple Music raised the price of its student plan in the United States, Canada and the United Kingdom. In the United States and Canada, the price for the plan has increased from $4.99 to $5.99. In the United Kingdom, the price has increased from £4.99 to £5.99.

Gaming

- Epic Games has come up with a new system for game ratings. While these changes apply to its own online games store, it’s an example of why alternative app stores could be useful to provide competition with Apple’s own — they can be a ground to test out new ideas. In Epic’s case, random players who have played a game for over two hours will be asked to rate the game on a five-point scale. Over time, these will create the game’s Overall Rating. The system, which relies on random sampling, could cut down on review bombing and reviews left by those who aren’t actual players, the company notes.

- China’s regulation of the mobile gaming market may be leading to declining use of the App Store in the country, according to Morgan Stanley. The firm’s latest analysis estimated that the App Store only saw 1% growth in June so far, compared with 6% growth in May.

Health & Fitness

- Fitbit added a new premium feature, “Sleep Profile,” which will allow users to track their sleep patterns across 10 key metrics, including new data points like bedtime consistency, the time before sound sleep and disrupted sleep. The feature is rolling out to the Fitbit app’s Premium users and supports devices including Sense, Versa 3, Versa 2, Charge 5, Luxe or Inspire 2.

Travel & Transportation

- Apple is planning to expand its CarPlay experience to China, according to a job posting.

- Polestar has now added Apple CarPlay to its all-electric Polestar 2 sedan via an over-the-air software update, after previously only supporting Android Auto.

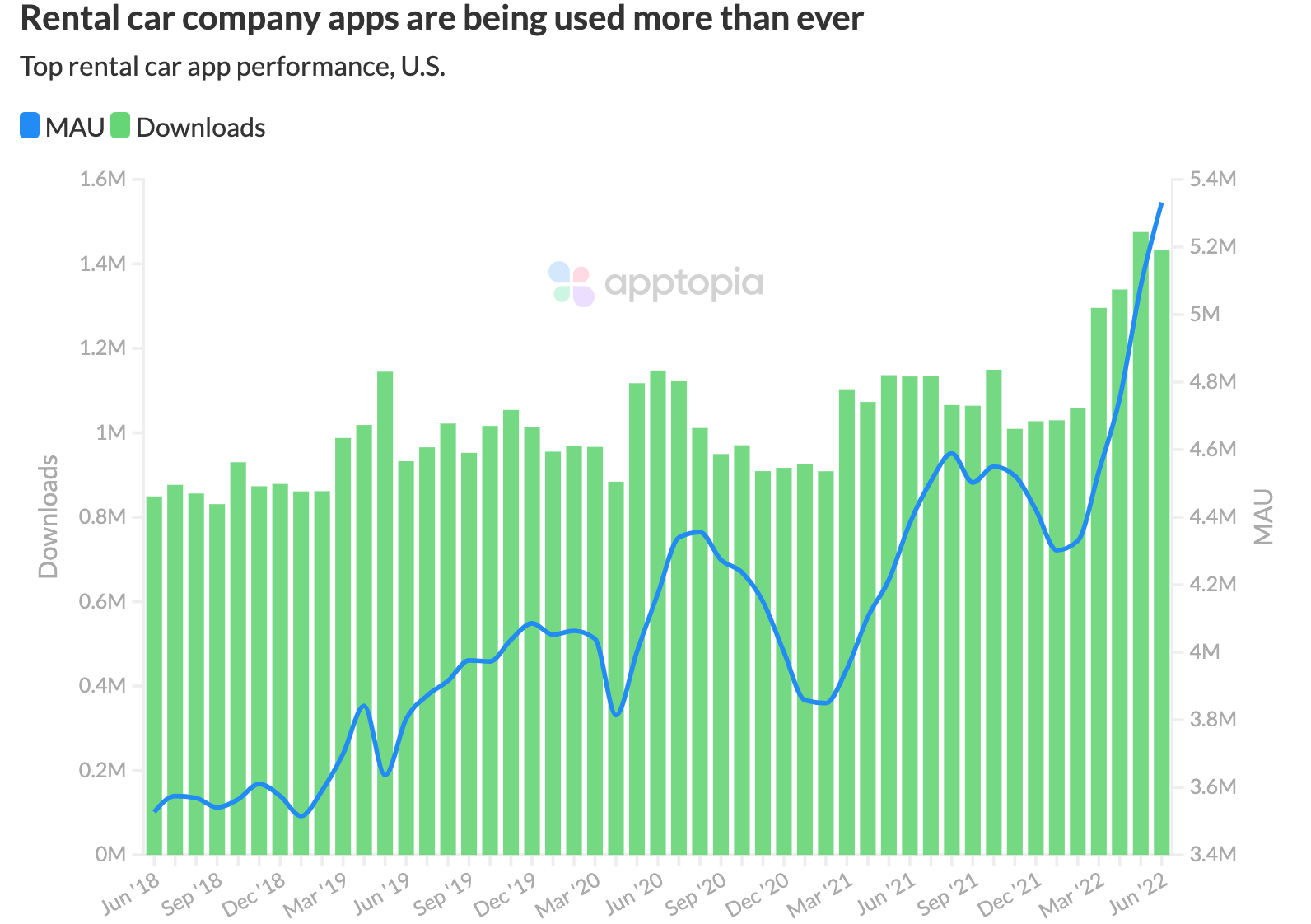

- Car rental apps saw their MAUs grow 19% year-over-year in the U.S. in May, reported Apptopia, despite rising gas prices.

Image Credits: Apptopia

Government & Policy

- TikTok offered a series of commitments in the EU to improve user reporting and disclosure requirements around ads/sponsored content as well as an agreement to boost transparency around its digital coins and virtual gifts. The agreement follows a series of complaints over child safety and consumer protection complaints filed back in February 2021.

- The U.S. Department of Justice today entered into an agreement with Meta to resolve a lawsuit that alleged Meta engaged in discriminatory advertising in violation of the Fair Housing Act (FHA). As a result, Meta has agreed to develop a new system for housing ads and will pay a roughly $115,000 penalty, the maximum under the FHA.

Reading & News

- India-based VerSe Innovation rolled out its news aggregator Dailyhunt in the UAE, Saudi Arabia, Bahrain, Oman, Qatar and Kuwait, with over 5,000 content partners in the region.

Security & Privacy

- Google Chrome for iOS gained a number of new features in a recent update, including access to Enhanced Safe Browsing to protect users from dangerous websites and malware, as well as the ability to make Google Password Manager your Autofill provider. Other additions include Chrome Actions (typed commands in the URL bar) and access to Google’s Discover feed on the main page.

- Daycare apps including those from Brightwheel, HiMama and others were found to lack 2FA and other privacy protections, in an analysis.

- Google threat researchers detailed a commercial spyware system called Hermit, used in Kazakhstan and Italy, which targeted both Android and iOS. The iOS version had six exploits, including two zero-days. Targeted victims are tricked into installing a malicious app — which masquerades as a legitimate branded telco or messaging app — from outside the app store.

Funding and M&A

Courier raised $35 million in a Series B funding round led by GV. The company provides an API for sending notifications across multiple channels, including email, text, web and mobile.

Courier raised $35 million in a Series B funding round led by GV. The company provides an API for sending notifications across multiple channels, including email, text, web and mobile.

Ghana-based fintech Fido raised $30 million in equity investment and some undisclosed debt funding in a Series A round led by Israel-based private equity fund Fortissimo Capital. The round brings the total equity investment raised to date to $38 million. The startup says it’s adding savings and payment products to its portfolio later this year and will enter Uganda.

Ghana-based fintech Fido raised $30 million in equity investment and some undisclosed debt funding in a Series A round led by Israel-based private equity fund Fortissimo Capital. The round brings the total equity investment raised to date to $38 million. The startup says it’s adding savings and payment products to its portfolio later this year and will enter Uganda.

Twitter asked its shareholders to approve the $44 billion Elon Musk acquisition. At the time of its SEC filing, Twitter’s share price was around $38.12 — lower than Musk’s offer price of $54.20 a share. The company’s market cap had also dropped below $30 billion, making a $44 billion deal look very good.

Twitter asked its shareholders to approve the $44 billion Elon Musk acquisition. At the time of its SEC filing, Twitter’s share price was around $38.12 — lower than Musk’s offer price of $54.20 a share. The company’s market cap had also dropped below $30 billion, making a $44 billion deal look very good.

Downloads

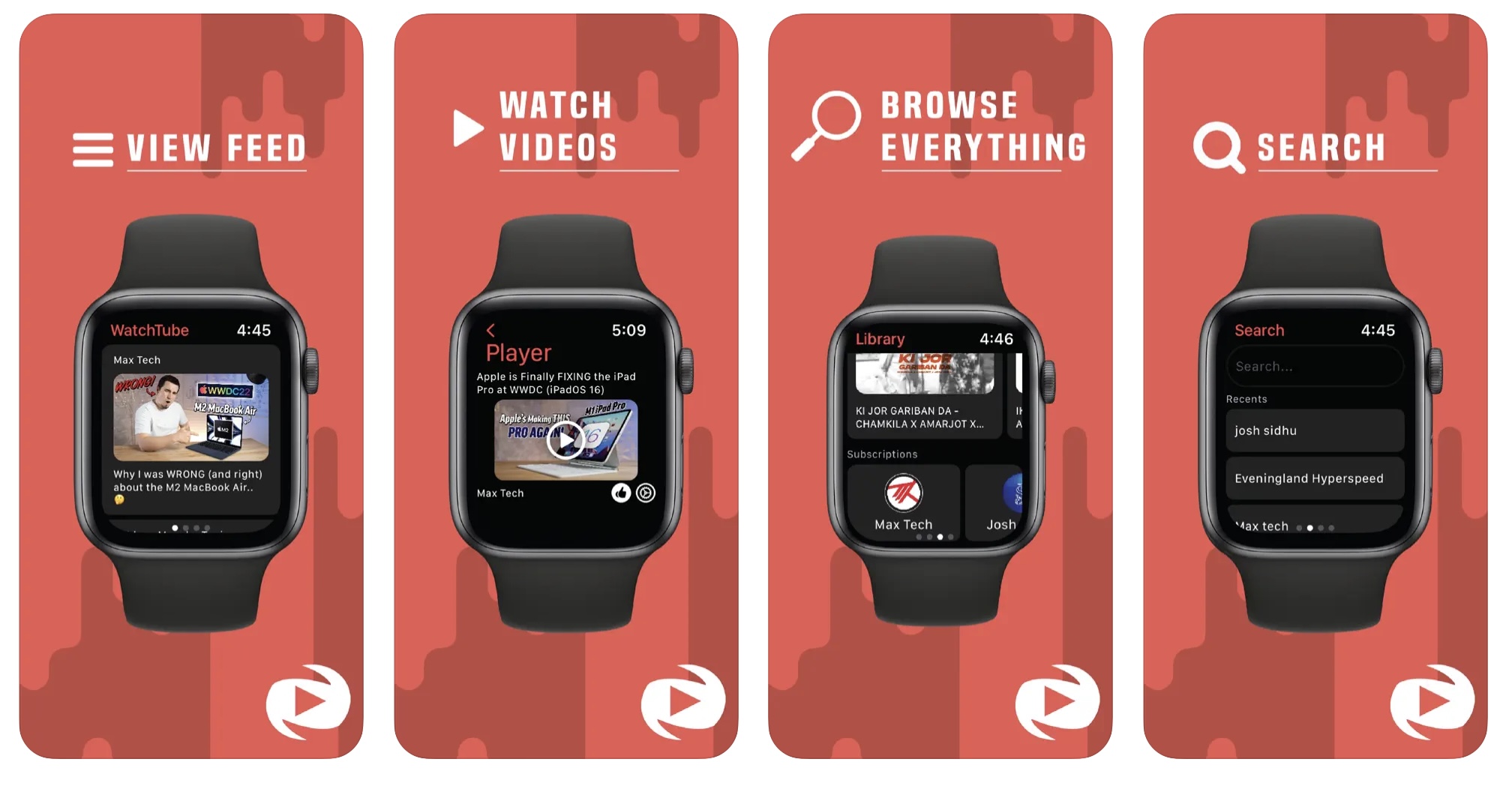

WatchTube

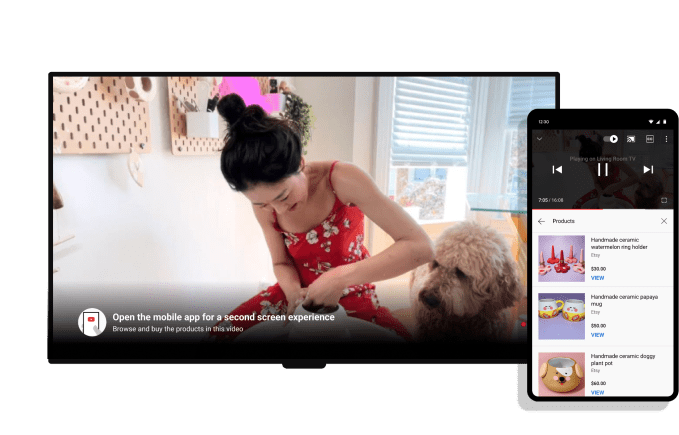

Image Credits: WatchTube

Well, here’s something kind of crazy: 9to5Mac this week highlighted the new app WatchTube, which lets you watch YouTube videos directly on your Apple Watch. Yes, really!

The app is not the best experience for watching videos, as you may have guessed, but it is pretty wild that it actually works. The app by default shows you top trending videos, but you can customize this so the videos that appear are selected from a particular genre, like Music, News, Gaming, Movies and more. While it would be enough to just accomplish bringing YouTube to the Watch, the developer also added other features like the ability to search for videos, save videos to the app’s local Library and subscribe to Channels. When you get back to your other devices, you can also scan a QR code to share the video back to your iPhone or iPad.