Meet Revyze, a French startup that is developing a mobile app for iOS and Android at the intersection of education and social. In many ways, Revyze looks just like TikTok. But it is focused specifically on educational content for teenagers.

“We talked with kids attending 30 or 35 different high schools,” co-founder Florent Sciberras told me. “We asked them: ‘What do you think about school and what’s the best way to learn?’ And they told us that nobody had ever asked them those questions.”

In hindsight, the answer was quite simple and obvious. They said that they would rather learn from their friends than their teachers. “They said ‘because they talk like us and they are like us,’” Sciberras said.

And that’s probably the reason why educational videos are so popular on YouTube and TikTok — the hashtag #LearnOnTikTok is massively popular for instance.

But there is an issue with mainstream social platforms. They aren’t designed specifically for education. If you watch an interesting video on TikTok, the social app might recommend something completely different when you skip to the next video. You end up jumping from math to dancing cat to physics to magic tricks…

Revyze aims to be the TikTok of education — a commmunity-powered app with a sharp focus on high school education. Essentially, Revyze wants to unbundle education videos from TikTok — a very large social platform — so that they get the attention they deserve.

At first, the Revyze team focused on France’s baccalauréat, the exam that you have to pass at the end of high school. They built a quick version of the app, put together a Discord community to spread the word and shared a few videos on TikTok and Instagram.

In just a few weeks, Revyze managed to attract 35,000 downloads. They reached the #2 spot in the top free apps of the App Store — right behind Doctolib.

Image Credits: Revyze

This summer, Revyze raised a $2 million pre-seed round (€2 million) from more than a hundred business angels, such as Nate Blecharczyk, Jean-Charles Samuelian, Charles Gorintin, Mathilde Collin, Lenny Rachitzky, Thomas France, Julia Bijaoui, Roxanne Varza, Arion (Jacques Attali’s fund), Olivier Dacourt, Varsha Rao and others. firstminute Capital, Kima Ventures, AirAngels, Nomad Capital and Ligature VC also invested.

Now, the company wants to turn this small experiment into a massive social/education app. “Our goal is to reach 500,000 users by the end of the year and to expand to the U.S. within 6 to 12 months,” co-founder Guillaume Perrot told me.

Building the community behind the app

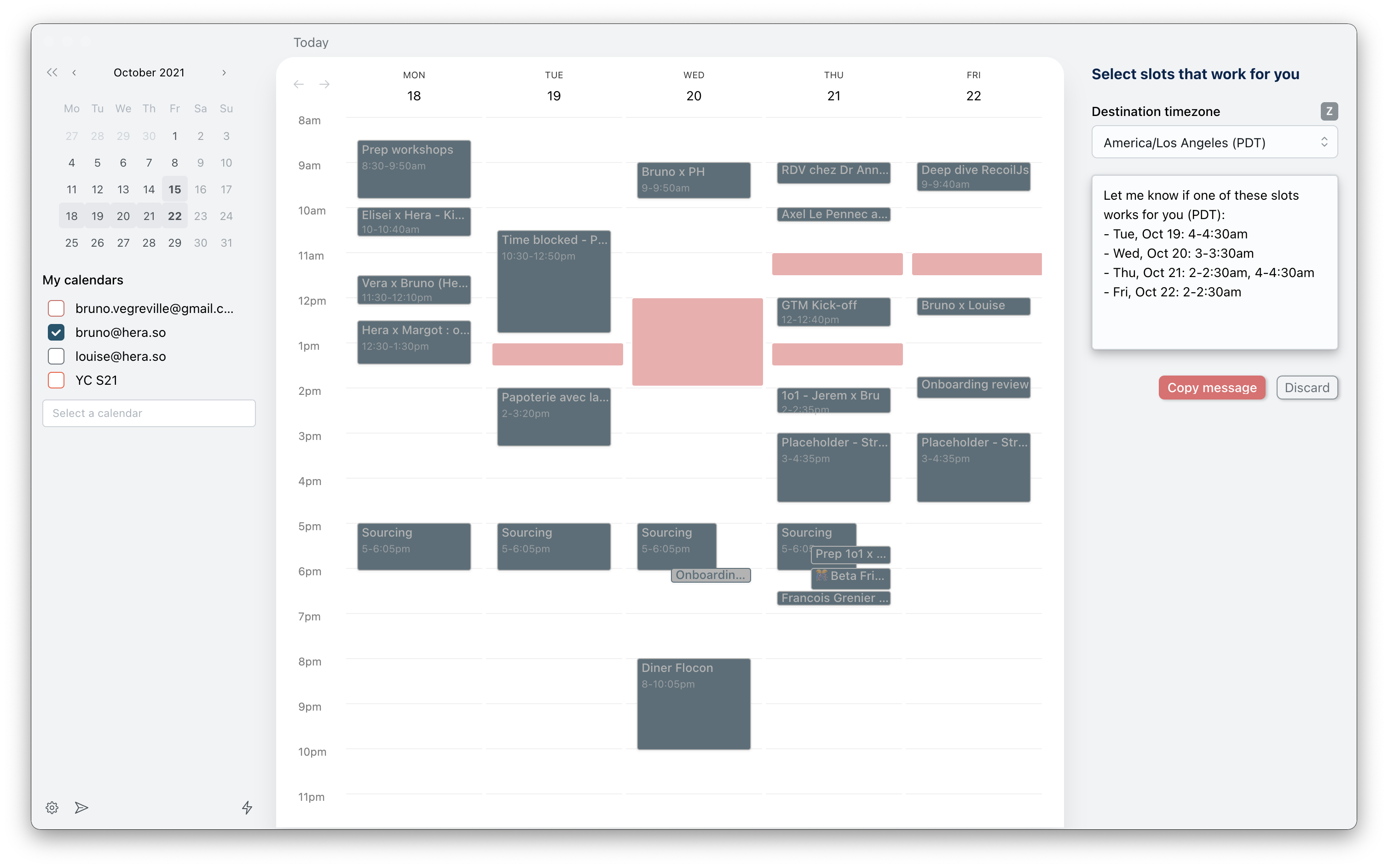

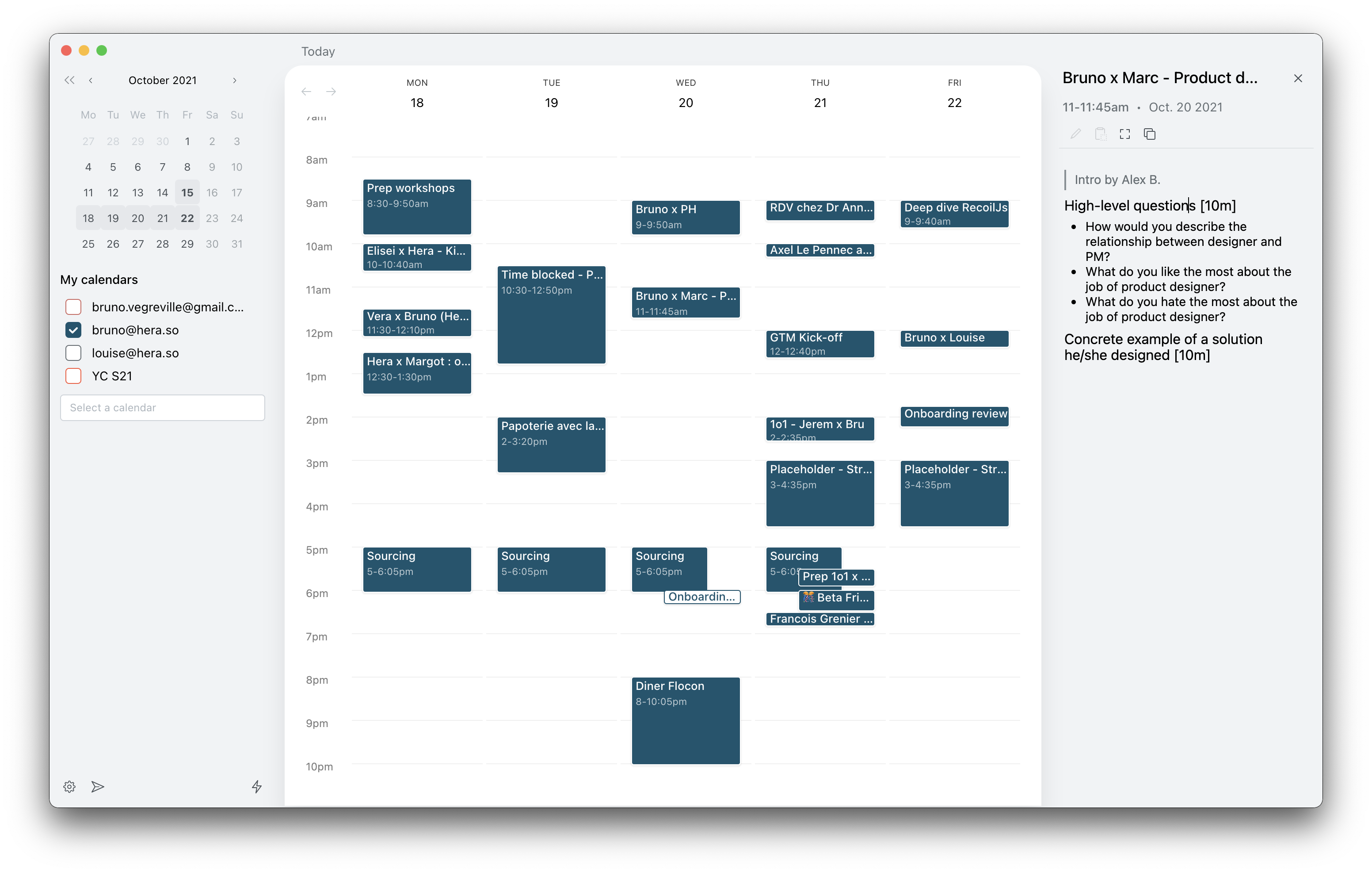

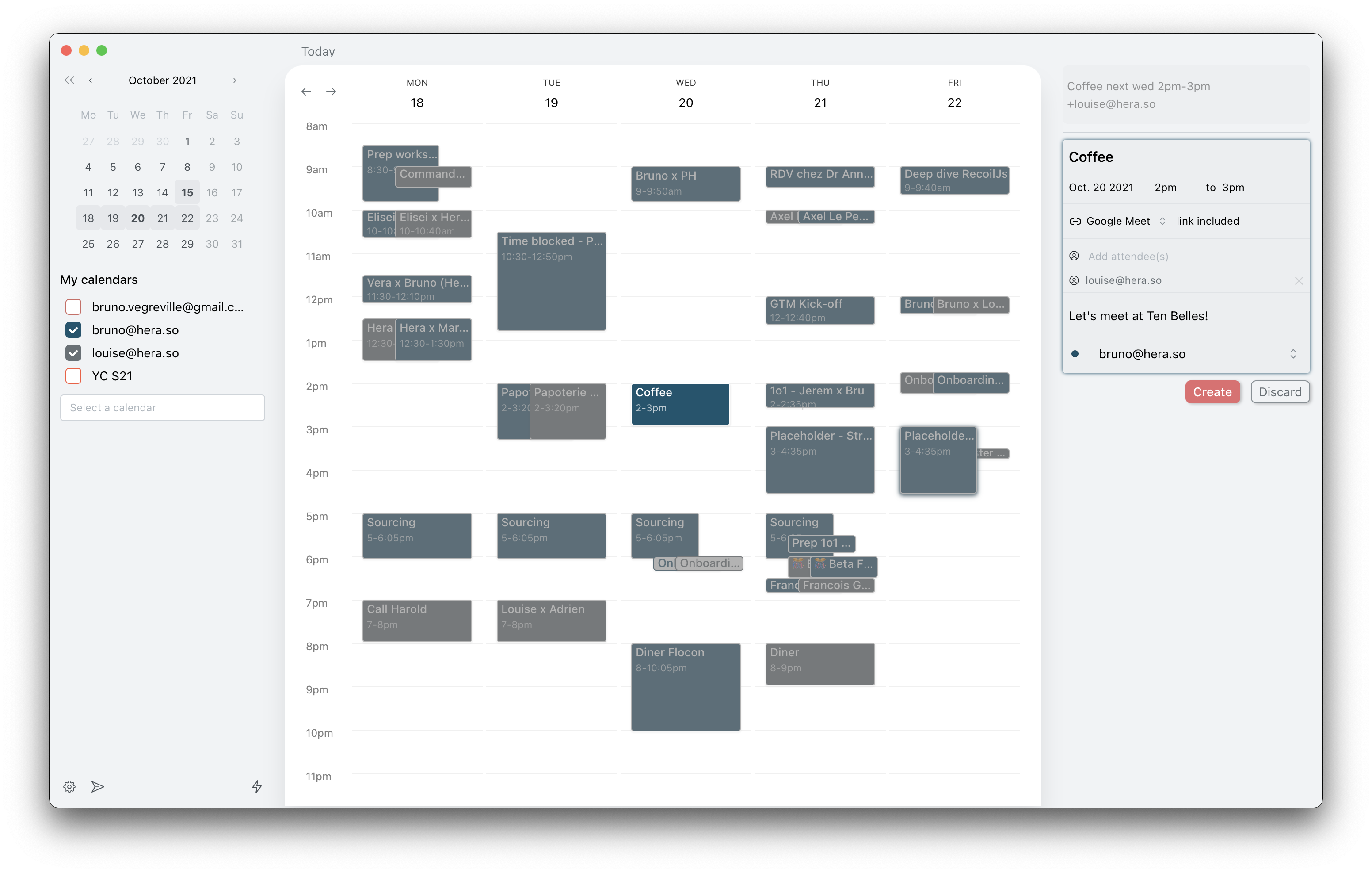

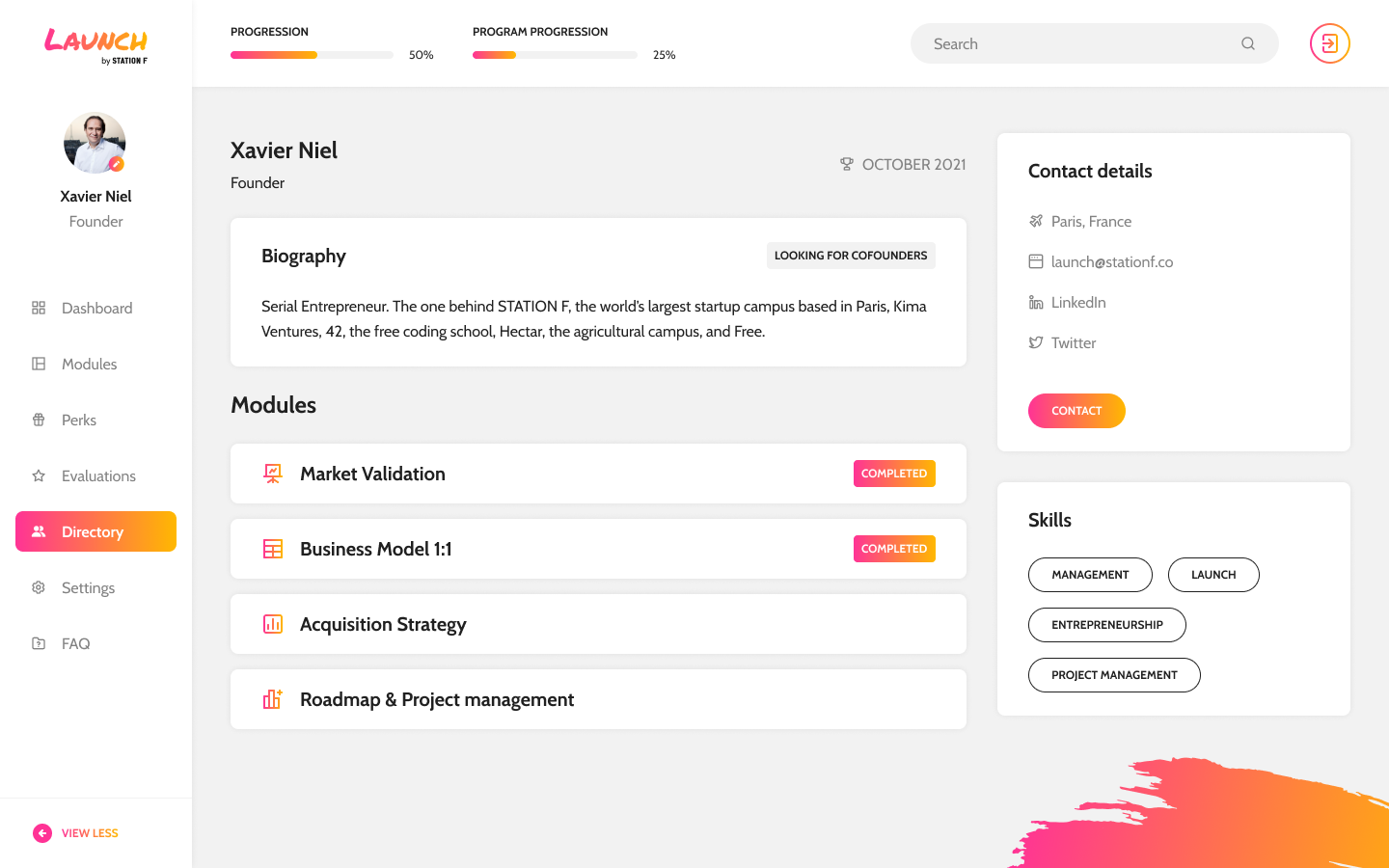

So what does Revyze feel like? When you open the app, you get a TikTok-like feed of videos. These videos fill the entire screen and you can skip to the next video with a simple swiping gesture. There’s a three-minute limit on video length.

On the second tab, you can explore the video library more granularly. You can select a topic, such as math or literature, and even select a chapter in the syllabus. Revyze started with French high school students in their final year and is progressively expanding to other grades.

And because we are talking about educational content, Revyze is paying close attention to the videos that are uploaded to the app. When a user submits a video, it isn’t instantly live on the platform.

“Videos are validated by us and by the community,” Perrot said. “We want to make sure that it’s high-quality content, that it’s accurate and that it isn’t off-topic. Eventually, there will be a peer moderation system and after that we will add a bit of machine learning.”

What do you get when you post on Revyze? A warm fuzzy feeling. In more technical term, you amass reward points just like on Stack Overflow. These reward points are called EDU. You get 20 points when you post a video, and you get one point when someone thanks you for the video.

Some teens post videos because explaining a concept is the best way to know for sure that they understand it perfectly well. Others want to climb the leaderboard.

In the long-term, if web3 is more than just a fad, Revyze could also turn EDU into a currency to reward the community for their contributions. But that’s not the next item on the roadmap.

Up next, Revyze is going to expand to more countries and more educational systems. There are also a ton of opportunities when it comes to personalizing the app for each user.

Revyze plans to algorithmically sort videos so that they are relevant to your level and your way of learning — an algorithm with a focus on learning outcomes instead of watch time. This way, users should waste less time skipping videos to they find relevant content.

“We aren’t a social network,” Sciberras said. “Our goal is that you should spend as little time as possible in the app to learn as much as possible.”

Image Credits: Revyze

Revyze is building the TikTok of educational videos by Romain Dillet originally published on TechCrunch