French startup Swile has raised a $200 million Series D funding round led by SoftBank International Group. With this funding round, the startup has now reached unicorn status, meaning that Swile has a valuation of $1 billion or more. Swile provides a payment card for employee benefits, such as meal vouchers, gift cards and sustainable mobility vouchers.

Michel Combes, SoftBank International Group’s President (pictured left), is joining Swile’s board. Some of the startup’s existing investors are participating once again, such as Eurazeo, Index Ventures and Bpifrance. Headline is also investing in Swile for the first time.

This is a significant round for the company as it keeps raising bigger rounds year after year. Swile raised a Series A round of $17.4 million (€15 million) in 2018, a Series B round of $34.7 million (€30 million) in 2019 and a Series C round of $81 million (€70 million) in 2020.

Swile started as a payment card to hold your meal vouchers. In France, companies have to contribute to lunch when it’s in the middle of a work day. Some companies offer a cafeteria with cheap meals, others hand out meal vouchers that you can spend in restaurants and bakeries.

But the experience is a bit confusing when you’re paying for lunch. Employees often ask whether a restaurant accepts meal vouchers. And if you want to spend more than your daily budget, you have to use two cards.

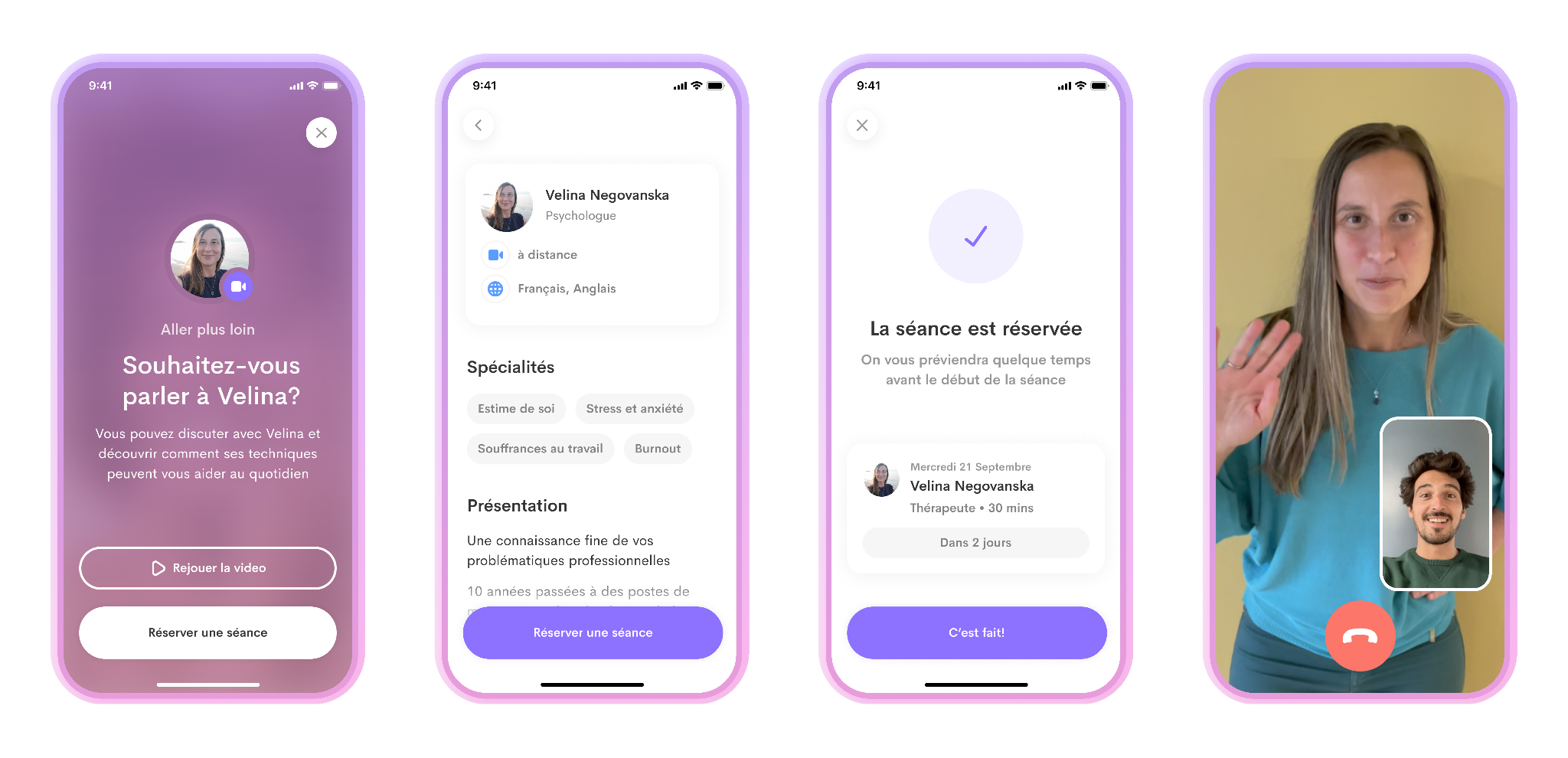

With Swile, employees can optionally add their personal debit card to the Swile app. When you spend more than your daily limit, Swile automatically charges your personal card. It’s a better experience for the end user.

And this product alone has been quite successful. Just four years after launch, Swile has captured a 13% market share on meal vouchers in France. It competes with well-established companies, such as Edenred, UpDéjeuner, Sodexo’s Pass Restaurant and Apetiz. Swile generates revenue on interchange fees.

In addition to small and medium companies, the startup has managed to convince bigger clients, such as supermarket chain Carrefour and its 65,000 employees in France. Other clients include Doctolib, Spotify and Airbnb in France.

“Our bet with Swile — as we disclosed it 18 months ago — is that we want to go beyond lunch and manage employee benefits with the Swile card. It should help you manage all your employee benefits,” Swile founder and CEO Loïc Soubeyrand told me.

For instance, employee representatives usually offer gift cards for the end of the year. Instead of handing out paper checks, the employee representative bodies can top up the Swile card with those gift cards. After that, the employee can use the same card for lunch and for Christmas presents. Swile has acquired Sweevana for that part of the business.

Similarly, Swile will soon let you pay for ride-sharing, public transport subscriptions or bike rides between your home and your office. In France, this is a nascent market as companies will have to contribute to sustainable mobility spendings starting on January 1st.

“This is what’s great with unification. You don’t need five different cards to manage five different benefits,” Soubeyrand said. And companies don’t need five solutions with five different suppliers either.

Image Credits: Swile

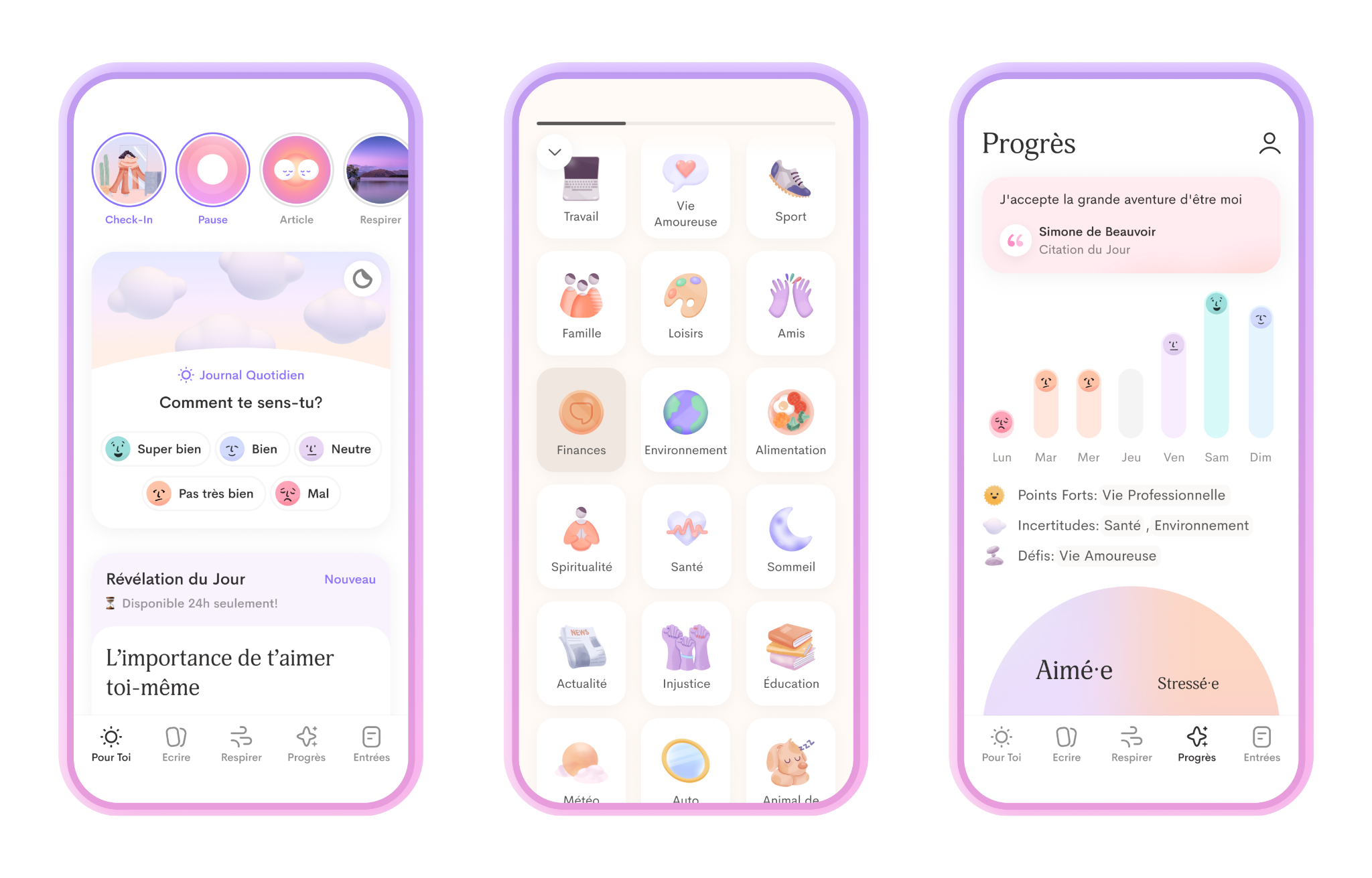

From a super card to a super app

Beyond the Swile card and its transactional revenue, the startup wants to build an app to improve internal communications, run anonymous surveys and gather feedback from employees. This could open up some revenue opportunities with a software-as-a-service approach and monthly subscriptions.

The company has been testing its app in beta for the last 12 months and it should be available to Swile clients soon. Swile has acquired Briq for its expertise on that area.

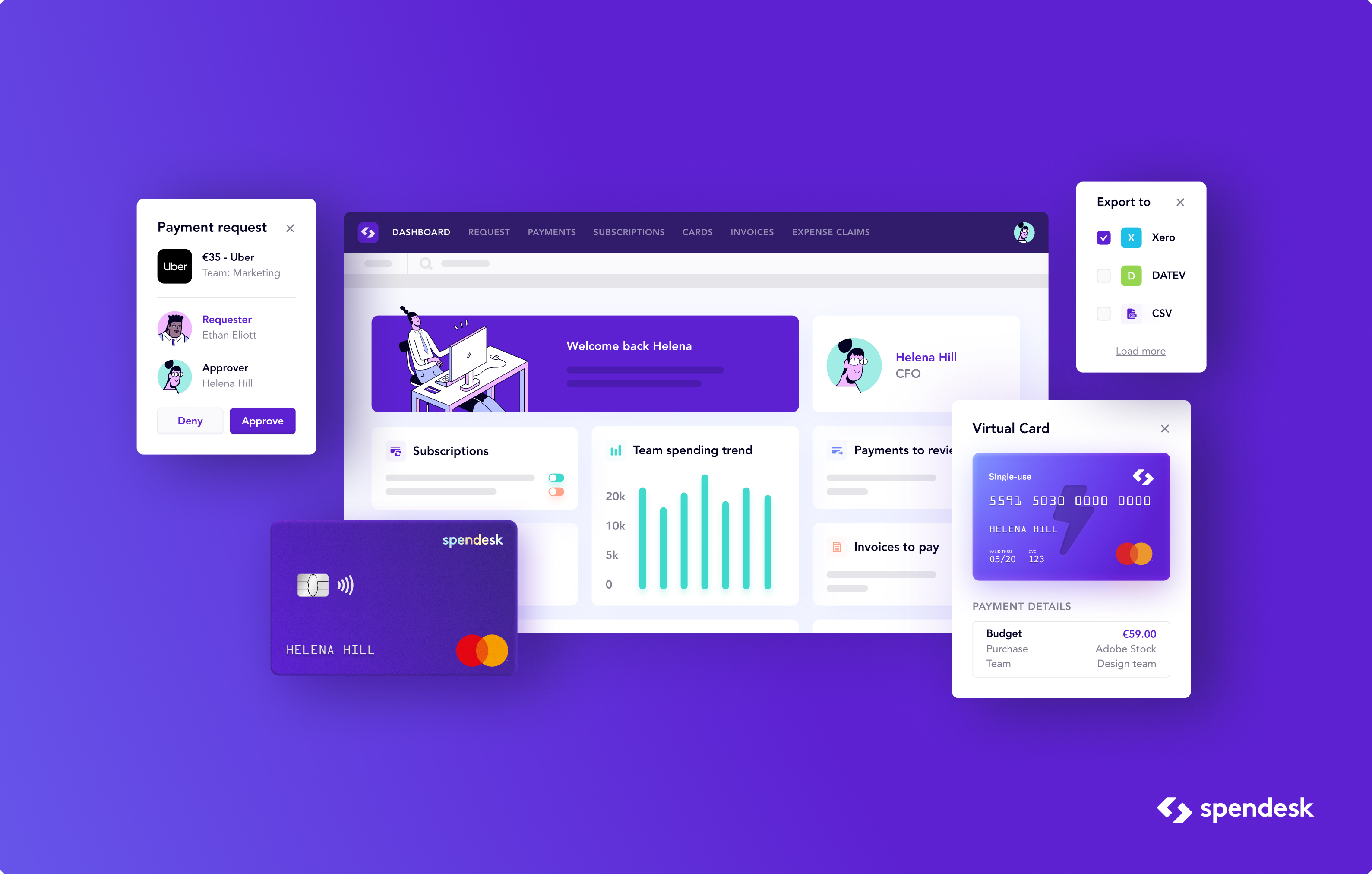

In the future, small companies could also imagine managing their corporate spending from Swile. You don’t necessarily need a full-fledged, separate solution to manage expenses when you’re just getting started.

Up next, Swile also has ambitious international goals. Brazil is by far the biggest market when it comes to employee benefits. With the acquisition of Vee Benefícios, Swile now has 120 employees in São Paulo and it wants to turn Brazil into its main market.

By 2022, Swile wants to hire 500 employees — the company will double in size. There will be more international expansions as well. Mexico looks like another promising market for instance. Even if those international bets take time to pay off, Swile is still just getting started in its home market. It still has a tiny market share and a lot of room for growth.

Image Credits: Swile