Meet Finary, a new French startup that wants to change how you manage your savings, investments, mortgage, real estate assets and cryptocurrencies. The company lets you aggregate all your accounts across various banks and financial institutions so that you can track your wealth comprehensively over time.

After attending Y Combinator, the startup has just closed a $2.7 million (€2.2 million) seed round led by Speedinvest with Kima Ventures and angel investors, such as Raphaël Vullierme also participating.

If you know people who have a ton of money, chances are they tend to be at least 40 or 50 years old — you don’t become rich overnight after all. And they tend to manage their investment portfolio through a wealth management service with tailor-made services.

“There’s very little tech in wealth management. Advisors are also incentivized to sell you some financial products in particular,” co-founder and CEO Mounir Laggoune told me. In that situation, the company in charge of the financial product is generating revenue for the advisor — not the client.

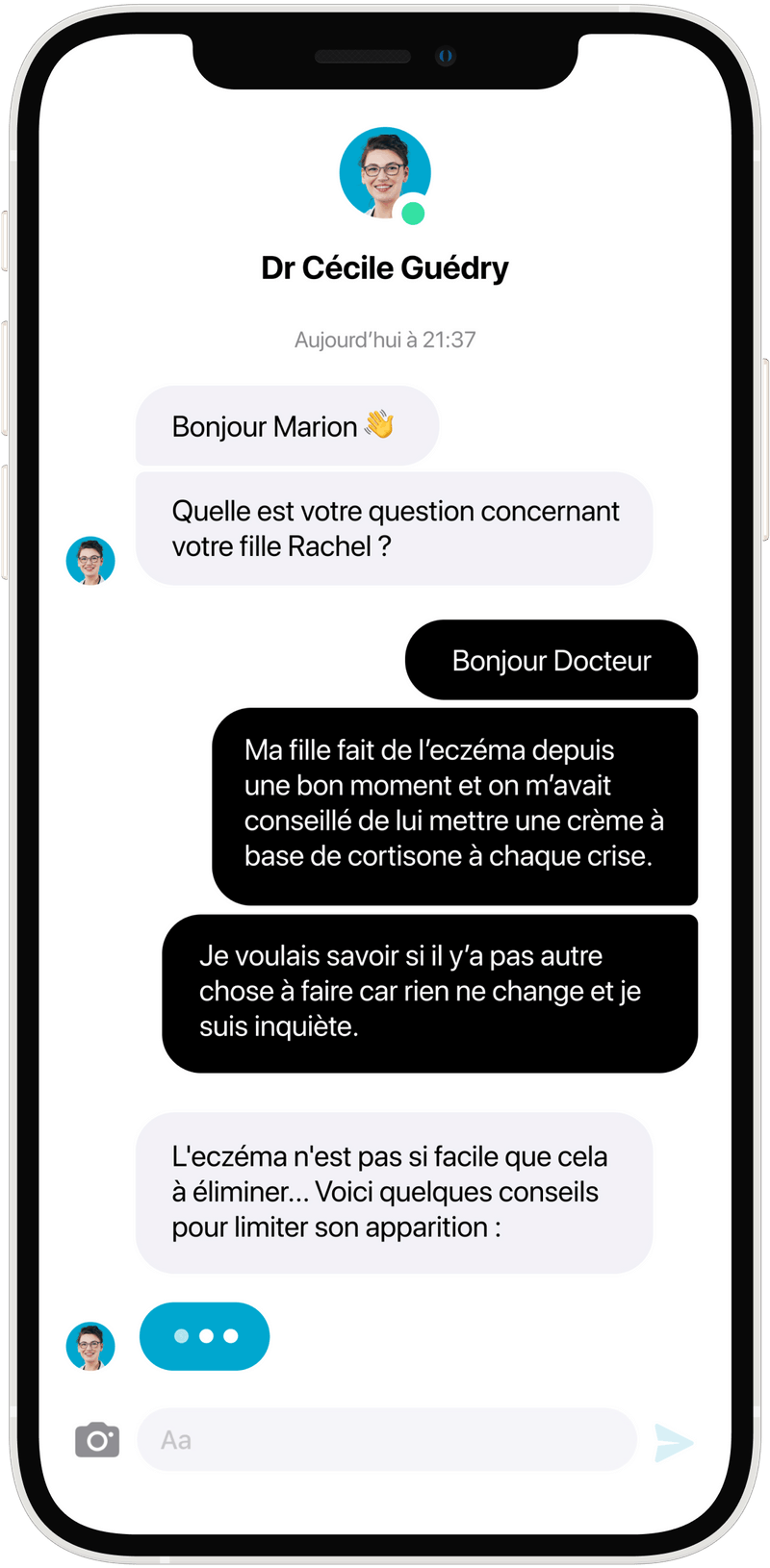

At the same time, a new generation of investors is starting to accumulate a lot of wealth. And yet, they don’t have the right tools to allocate it properly. Younger people want to see information directly. They want a way to track information in real-time, or near real-time. And they want to be able to take some actions based on that data.

Finary wants to build that service based on those principles. It starts with an API-based aggregator. When you create a Finary account, you can connect it with all your other accounts — bank accounts, brokerage accounts, mortgage and real estate, gold, cryptocurrencies, etc.

The startup leverages various open banking APIs to be as exhaustive as possible. For instance, “you can connect a Robinhood account and a Crédit Mutuel de Bretagne account,” Laggoune said. Behind the scenes, Finary uses Plaid and Budget Insight, runs its own bitcoin and Ethereum nodes to track wallet addresses, estimates the value of your home through public data and a proprietary algorithm.

After that, you can see how much money you have, how it is divided between your investment pools, the current value of your gold and cryptocurrency assets and more.

“Our long-term vision is that we want to build a virtual wealth manager for Europe,” Laggoune said.

That’s why Finary recently launched its premium subscription called Finary+. With a premium account, you can see how much you’re paying in fees and track your performance — more features will get added over time.

A few months after launching its platform, Finary already tracks €2 billion in assets across thousands of users. With today’s funding round, the startup will roll out its service to more countries and more financial institutions in France, Europe and the U.S. The company is also working on mobile apps.

This is an interesting take on wealth management as Finary doesn’t try to reinvent the wheel. Legacy players want you to use a single bank for all your financial needs. But you end up paying a lot of fees and you have to use old and clunky interfaces.

Finary isn’t yet another wealth management service. It’s a holistic service that lets you use multiple banks and services while remaining on top of your assets.

Image Credits: Finary