Square Peg Capital, one of Australia’s largest venture capital firms with current assets under management of about $3 billion USD, is digging deeper into Southeast Asia. The firm is currently raising $550 million in new funding, and if its recent investment history is anything to go by, a good chunk of that will be invested into Southeast Asian startups.

Tushar Roy, partner at Square Capital, told TechCrunch that Southeast Asia has been the firm’s fastest-growing geographical footprint (it is also known for investments in Israel). Half of the firm’s last $275 million fund, called Fund 3, was invested in Southeast Asia. Across all its funds, Square Peg has now invested a total of about $250 million in Southeast Asia. It now has 18 companies in its portfolio from the region.

The ones that have been made public are: Cialfo; Chope; DoctorAnywhere; FinAccel; Kaodim; Neuron; OnLoop; Pluang; PropertyGuru; StashAway; Timo; and Wego.

The $550 million in new funding, which Roy said is set to close by in the next quarter, will be spread across two funds. One is an early-stage venture fund that will invest in seed through Series B stage tech companies across Southeast Asia, Australia and Israel. The second, called Opportunities Fund 2, will be for later-stage follow-on investments in Square Peg’s best-performing companies from its earlier funds.

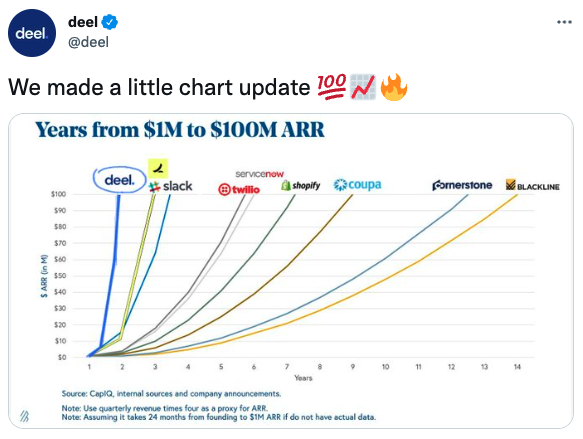

Over the firm’s history, it has deployed $900 million and has a net IRR of 37%.

Square Peg’s first investment in Southeast Asia was about eight years ago, in WeGo. Since then, its interest in the region has ramped up considerably, especially in the last two years.

“I joined Square Peg seven years ago and almost from day one, I focused on Southeast Asia region. Roy said. “The first five years were us going from the region being a bit of a curiosity to us, essentially looking more deeply at the region to now doubling down, and it’s a key driver of strategy for our firm.” In 2000, just as COVID was ramping up, he moved to Singapore to establish Square Peg’s office there.

The pandemic accelerated investment in the region because deals were being done over Zoom, opening it up to investors without traveling. “It’s really through the period of COVID 2020, 2021 that you saw a massive acceleration in some of the international funds’ interest in this region, as more international funds set up offices in the region,” Piruze Sabuncu, partner and another member of Square Peg’s Singapore office said.

COVID and remote work also opened up new workers to help companies scale up. For example, Indonesian companies started working with employees in Vietnam, Singapore or India. “This really brought in the right level of talent to get to the next stage as well,” said Sabuncu.

As for the first-quarter slowdown in funding, Roy said “I think in founders’ expectations on valuations are a bit more muted then they were at the end of last year,” but there is still a small number of companies “that everyone wants to invest in and so the valuations are holding up, it’s continuing to go up in those cases.”

Square Peg’s next funds will focus on software as a service, consumer internet, fintech, health, education and the future of work, as well as a growing focus on Web3 or crypto-enabled business models.

Roy said Square Peg is interested in working with the founders for 5 to 10 years or more years to help them build “iconic companies.”

“You might see many funds around that have 30, 40 to 50 investments. In our funds, it’s much more typical to have 15 to 20 and that’s across three geographies,” said Roy. “What that leads to is a much more concentrated portfolio, not in terms of just capital, but also in terms of relationships. We really invest a lot of energy on a smaller set of people.”