Vira Health, a U.K. startup that offers personalized digital therapeutics for women going through menopause, has closed a second round of funding — taking $12 million from lead investor Octopus Ventures, along with participation from U.S.-based VC firm Optum Ventures, as it gears up to hop over the pond.

Existing investors in the April 2020-founded business also joined in the latest round of financing. Vira’s £1.5 million seed — announced last summer — included backing from LocalGlobe, MMC Ventures, Amino Collective and other angels. (The startup is reluctant to label this “second raise” using standard fundraising terminology but, when pressed, pegs it as equivalent to a Series A.)

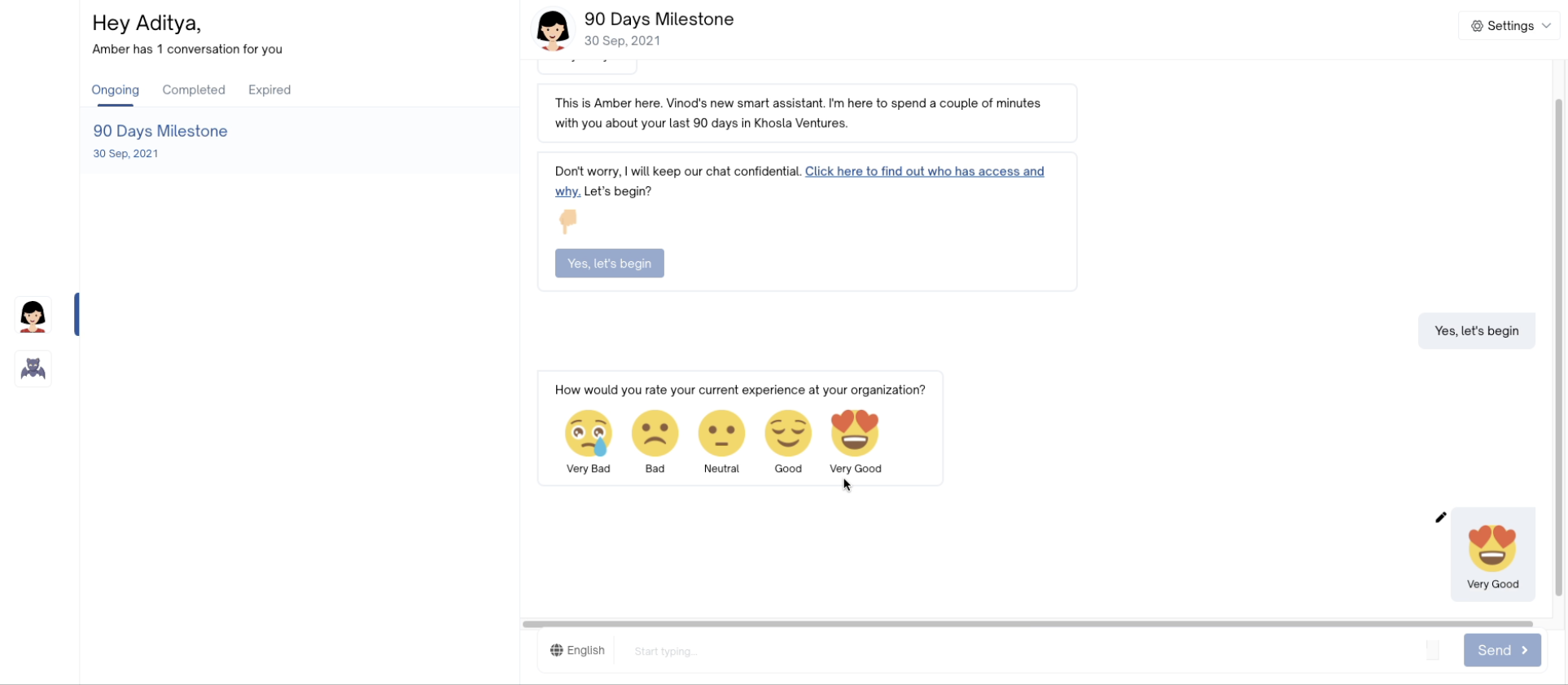

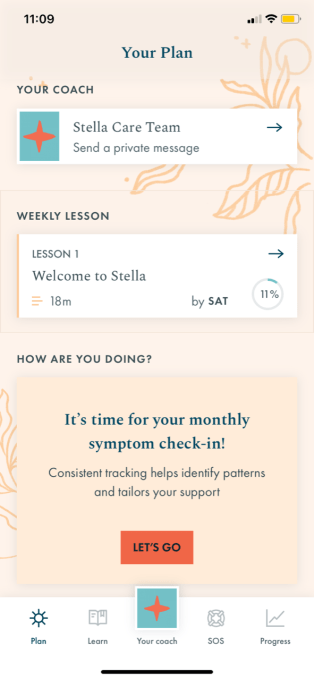

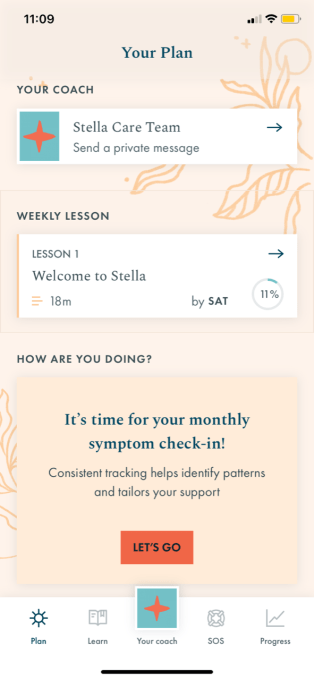

Vira’s app — Stella — which launched in the U.K. last August, delivers information and targeted support for women who are experiencing menopausal symptoms, supporting them to make lifestyle and behavior changes aimed at tackling whatever blend of physical and/or psychosocial issues they’re experiencing.

This means the app may be serving up exercise programs alongside diet advice or a course of cognitive behavioral therapy (CBT) to combat insomnia or mood-related issues, or indeed another combination of customized support programs.

It also takes a community approach to further expand the support, with opportunities for users to be brought together for Q&As/Zoom chats around discussion topics so they can quiz experts and/or share related experiences with each other.

This sort of digital therapeutics formula looks very familiar now — given the decade-plus we’ve seen a variety of established therapeutics being digitized to scale and reach more people in need of targeted support via their mobile device, whether for problems with sleep, mindfulness and mental health, diet, addiction, sex, musculoskeletal conditions and even aging, to name a few.

Menopause has had relatively less love than some other areas where digital therapeutics startups have been busy for years. Although there is a growing number of players in this space too now — such as the likes of Elektra Health, Gennev, Peppy and Lisa Health.

Over what has generally been a boom decade for digital health, we’ve also seen the rise of femtech as a distinct category — and raised awareness has increased the volume of funding to female-led startups that are tackling issues which exclusively affect women. So it follows that the attention-value calculus is continuing to shift. Hence now a U.K. startup that’s addressing an issue which “only” affects a subset of woman (middle-aged females) can close a double digit second round just a couple of years after being founded.

Not that raising Vira’s latest tranche of funding was a cake-walk, says co-founder and CEO Andrea Berchowitz.

“We were speaking to one investor in the U.S. — who I’m sure would be not thrilled if I said who it was — and she said she’d seen 30 menopause startups and had not done an investment yet,” she recounts, saying one of the hurdles for that particularly reluctant (unnamed) investor was a question mark over whether women in the U.S. are actively seeking this sort of care, being as the conversation around menopause over the pond is not as advanced as it is in the U.K. (where Berchowitz emphasizes the topic gets a lot of mainstream media coverage).

“Fundraising is so hard,” she adds. “I think it’s really important to keep saying that — sometimes you can almost forget how hard it was when the money hits the bank account but it’s really hard.

“We know it’s hard for women to raise money… every data points shows that. Let’s not pretend it’s not. And then when you’re raising for a product that no one in the room has experience with — because they’re either young or male — the fact is we need someone to basically be over 45, probably over 50 — there’s not a tonne of that and then to be female so yes we have to do a lot more education.

“However I think it’s an interesting litmus test because… people who are unwilling to learn about new things probably aren’t right for us as investors. And so our approach was to really target funds that had either invested in women’s health before or digital therapies before. So we knew we could have a conversation with them about what we were building.”

Commenting on Vira’s funding in a statement, Kamran Adle, health investor at Octopus Ventures, said: “Menopause is an enormous yet underserved and underfunded market. One billion women, or approximately 12% of the global population, are expected to experience menopause by 2025, and we’re excited to work with the Vira Health team.”

“We are pleased to invest in Vira Health,” added Julia Hawkins, general partner at LocalGlobe and Latitude, in another supporting statement. “There is a strong interest in menopause care right now and this is a phenomenal team committed to building what women want and need.”

Image Credits: Vira Health

Berchowitz says the second raise will go on building out the app’s care pathway — including launching a telehealth component so that users will be able to book a virtual consultation with a physician and get prescribed pharmaceuticals (such as hormone treatment) if appropriate, rather than needing to step away and go see their regulator doctor.

It is also gearing up for a U.S. launch of the app — which it’s penciling in for the second half of this year, according to Berchowitz.

Menopause is a multifaceted challenge to tackle. It can trigger years of disruptive symptoms for women — ranging from mood changes, sleep disruption and brain fog, through changes to menstruation (i.e. before periods eventually stop), low libido and painful sex, hot flushes and night sweats, and other physical shifts such as weight gain and incontinence — which means Vira’s app is necessarily designed to tackle a spectrum of issues women may suffer as they go through this life change.

To ensure the app is targeting relevant support, it personalizes the package of therapeutics based on what the user tells it they’re most concerned about.

“The way it works is a woman comes on the app and she tells us what symptoms are bothering her the most,” explains Berchowitz. “That was based on the fact that menopause is going to be an entirely different experience for everyone — no two women have the same symptoms and the same health background and the same preferences and the same way they want to be talked to and all that.

“So we say you tell us what’s bothering you the most — and if that’s sleep and incontinence then we’re going to help you with that. If it’s weight gain and feelings of low mood or anxiety then we’re going to help you with that. And then we take those symptoms and we design a 12-week program to help get relief for those symptoms.”

“Each program is based on the best available science for that given symptom,” she adds. “So if that’s sleep it’s built on cognitive behavioral therapy and sleep scheduling. If those are pelvic floor issues — so incontinence or painful sex — that’s built on pelvic floor activation.”

The science behind these app-based interventions draws on current best practice per symptom, according to Berchowitz, although she confirms the app itself is not currently a regulated medical device (rather it’s offered as an information service).

That said, as the product evolves — notably as Stella expands from dishing out purely information-based support into becoming a telehealth platform which may be involved in issuing prescriptions for pharmaceuticals or being able to provide a service like fitting a Mirena coil — the nature of the interventions are set to change. And Berchowitz further confirms its regulated status may therefore end up changing too, suggesting an application for regulatory clearance could be a future step for the business.

(And, again, that sort of trajectory isn’t new: We’ve seen other femtech startups evolve from building a pure consumer service to launching a regulated medical product. See, for example, period app Clue getting FDA clearance for a digital contraceptive.)

As noted above, Vira is by no means the first to digitize existing therapeutic approaches like CBT either, so — as regards the meat of a digital support service — it’s far from starting from scratch here.

Rather it can draw on plenty of existing success in the digital health category — gleaning inspiration and ideas from the growing body of implementations of digital therapeutics, pioneered by the likes of Sleepio, to name one of the early startups in the space (which recently raised a $75 million Series C from SoftBank’s Vision Fund).

This (now) rich field of digital therapeutic startups has provided passive support to Vira on the fundraising front, per Berchowitz.

“Our investors in this round are Octopus which has in its stable Quit Genius and Sleepio, among others, which are two digital therapies that did kind of go U.K. to U.S. — so I think there’s a lot to learn there,” she notes, adding of Optum: “They’re in Kaia Health, they’re in Equip which is a digital therapy for eating disorders.

“And that allowed us to have a really great conversation, like, you know how Kaia works, how it’s been sold, what their challenges and opportunities are — so using that frame let’s chat about menopause. And how it fits into that frame.”

“We weren’t convincing people that the digital delivery of lifestyle and behavior change was a totally new idea,” she continues. “We were saying maybe you don’t know but a lot of the things that you need to do to manage symptoms at menopause are lifestyle and behavior change — there’s specific exercises, there’s change to diet or it’s cognitive behavioral therapy — and these are all things that have been proven for digital delivery in other ways so what we’re doing is [what investors refer to as] a ‘horizontal roll-up’. So it’s unreasonable that a woman is going to have Sleepio and NHS Squeezy for pelvic floor plus an Elvie Trainer plus, plus, plus, and do that all!

“So the explosion of digital therapies allowed us to just say — yeah, that’s us. You’ve heard of that, you believe in that, this is how that applies to our area.”

“Optum is [also] very U.S.-health focused so I think we’ve tried to surround ourselves with as much of that experience as we can while continuing to build here in the U.K. because we do just get that feedback loop faster because menopause is on the [public/media] agenda,” she adds, fleshing out the strategy for the second raise — and noting that Octopus’ “stated interest in taboo topics” also made it “easier to go to them”.

What about product efficacy? Some of the new funding is being pegged for clinical trials of its approach. And Berchowitz also flags a feasibility study they undertook from December to February — which suggested 75% of women who completed their Stella treatment plans experienced improved symptoms. (Plus she notes they are polling users on an ongoing weekly basis to get a less formal “well being score”.)

Image Credits: Vira Health

“Having both measurements is really important because on the one hand the point of this is are we helping you find relief from your symptoms,” she suggests. “But the thing about menopause is it is this sort bio-psycho-social huge thing and women are more than their symptoms and so it is possible that your symptoms are out of control but you might be feeling a bit better because in fact there’s loads of other stuff going on in your life and you’re kind of on a path to managing it — and so we also just try to trust our users and if they say they’re feeling better that’s great. And if they say they’re not feeling better then we need to do something.”

So while she says the startup is not in a position to quantify exactly how much of the benefit users report from engaging with its app-based programs is — or could be — linked to a placebo effect, ultimately if women are finding the targeted support helps them to navigate a challenging period of life change does it really matter how or why it’s working for them?

“Sometimes what’s happening in menopause is your oestrogen is fluctuating all the time and so even if you are on hormone replacement therapy and doing your pelvic floor activation it could still be incredibly tough,” Berchowitz adds. “There is no silver bullet that just fixes it all for every woman and so I think placebo is one way of saying it — but I also think there is something about awareness and information that does remove some of the fear and the unknown.”

Placebo question aside, one thing at least looks relatively clear: An oft-reported lack of support for women raising menopausal concerns via traditional healthcare services is creating a sizeable opportunity for startups to step in, unbundle the use-case and offer specialized care to middle aged women for a fee. (Including, evidently, in the U.K. where healthcare is available free-at-the-point-of-use.)

“Not everyone gets high quality menopause care from their GP [doctor] — we hear that time and again,” says Berchowitz, expanding on the rational for bolting on a telehealth component. “We’re not trying to be a GP service, we are trying to be a specialized service for women seeking out care at menopause.”

Vira isn’t disclosing how many users its app has at this stage but Berchowitz is upfront that they expect the U.S. to be a relatively challenging market to grow the business — given how discussion around menopause is less developed there than in the U.K.

The U.S. also of course has a very different healthcare model. And she further notes that there can be a lot of variation states-by-state — adding that Vira will thus be spending time adapting and localizing content to ensure that the language and tone used strike an appropriately familiar note.

Vira’s business model for Stella is two-fold: Direct to consumer paid subscriptions and a B2B2C approach which targets employers to fund the service, making it available as a free benefit to their staff. And Berchowitz confirms it plans to use broadly the same approach in the U.S.

“The model will be similar in the U.S. because I think the workplace angle for us is the priority — we have lots of conversations with workplaces that are really making a shift in how they think about benefits. And the focus on women, especially senior women, is increasing — not enough but it is increasing. And so the conversation of ‘if you provide better support for women at menopause you can keep them longer, you can support them to make that next promotion, which also means you have more role models.’

“It’s much louder in this country than it is in the U.S. — but it has started in the U.S. So I think the workplace benefits is one we’re going to stick with.”

The workplace focus is also where it all started for Berchowitz.

Winding back to the beginning of Vira’s journey, she says the idea for the business began with a personal urge to do something to address the lack of women in senior leadership positions — having seen little progress on this very visible problem over a long career at McKinsey and also working for the Bill & Melinda Gates Foundation.

“I’d been in senior positions and the lack of women at the top was something that was talked about a lot and just didn’t change in that whole time I was there and so I knew I wanted to do something that helped women jump over that last promotion or help them in the workplace,” she tells TechCrunch. “I wasn’t totally sure what the issue I was going to tackle was but I knew it was something about getting women into senior positions.”

The idea crystalized into tackling menopause as she explored the topic, hearing stories about women abandoning their careers or struggling to cope with professional demands as they experienced years of what can be deeply disruptive changes.

Meeting the right co-founder was also key to launching Stella, per Berchowitz. Her co-founder, Dr. Rebecca Love, is a chronic disease epidemiologist and an expert in behavior change — bringing the dedicated medical expertise needed to credibly underpin a recasting of lifestyle change-based therapeutics in digital form.

“I was really lucky to meet Rebecca,” recalls Berchowitz. “At that point she was looking at obesity and diabetes and we hit it off as friends — and the kind of entry point for her is that menopause is this amazing entry point into later life health for women where the things that need to happen to manage symptoms around exercise or nutrition or pelvic floor activation or strength training. That sort of lifestyle and behavior change affects immediate symptoms — so it gives relief in the short term — but also really changes the long term health trajectory for a woman.

“So we kind of met over this idea that menopause could be a really interesting and untapped way to really change the lives of women over time — and so Vira Health was born.”