It’s been several years since Barcelona-based Typeform tapped investors to grow usage of its “conversational data collection platform”, as it bills the customizable form/survey/quiz builder software it sells. Actually it’s around 4.5 years since its $35M Series B — the result of “sustainable growth while prioritizing efficiency”, as it tells it.

But growth in the no-code/low-code tools space appears to have spurred the (relative) veteran form builder to feel the need to step on the gas — as it’s now announcing close of a $135M Series C.

The round is led by family controlled investment firm Sofina, with participation from existing Typeform investors including General Atlantic, Index Ventures, Point Nine Capital and Connect Ventures, plus new investors Top Tier Capital Partners, GP Bullhound, Teamworthy Ventures and Trium Venture Partners.

Typeform is also disclosing its post-money valuation after this financing round is $935M. And it says that in 2021 it reached $70M ARR — as well as disclosing that it has more than tripled its annualized recurring revenue since 2018. But now sees room to grow further as more businesses look to digital tools to grow their own sales.

“We’re at an inflection point where brands need to offer digital interactions that lead to real connections with customers,” says CEO Joaquim (aka ‘Kim’) Lecha. “There is a massive opportunity for Typeform to provide a differentiated experience, and raising this round will help us accelerate our growth even further. While we’re not prioritizing profitability as we scale, we’ll continue to focus on keeping a healthy runway and predictable ROI.”

Commenting in a statement on the growth opportunity Sofina is also spying here, principal Benjamin Sabatier added: “The accelerated consumer shift to digital channels and increasing importance of digital native brands are driving the need to build closer online engagement with customers. Typeform’s conversational solutions generate higher response rates and provide richer insights to improve consumers’ experiences. Sofina is proud to support Typeform’s vision and dynamic team as it continues to build incredibly versatile solutions that serve a wide-range of use cases.”

The Series C brings Typeform’s total investment to more than $187M since its founding a decade ago, in 2012 — before the explosion of no/low code tools we’ve seen coming to market in recent years, touting a whole range of services that claim to make it easier for non-techie professionals to build and deploy their own custom digital experiences and workflows, from website ‘lander’ chat bots to auto-rendering design elements as code and plenty more besides.

So on the one hand you could say Typeform was ahead of the no-code curve. But, on the other, there’s now very evidently a lot more competition in the marketing tech space it’s chasing than there used to be — all the way back when Typeform’s founders came up with the idea of deconstructing and beautifying online forms with a little designer (white) space to drive engagement.

And that, in turn, implies greater investment is needed to meet rising demand and fend off competitive threats.

Lecha says the new funding will be put towards more product dev, increasing accessibility and additional integrations. It will also be expanding its 450-strong remote working team globally as it seeks to swell the 500M+ “interactions” its products currently generate each year.

Typeform has already expanded out from its first focus on ‘design-led’ forms — offering adjacent products like Typeform Chat, a no-code chatbot builder.

Online form building itself is a fairly commoditized function with plenty of competition, including from long time players like Jotform and GoCanvas, through to companies of a similar age as Typeform (like Cognito Forms), right up to tech giants like Google and Microsoft. Plus there is no shortage of chat bot builder tools these days, either. Hence Typeform’s keenness to position its business as a “conversational” data collection platform; tl;dr its USP is not the data capture itself — it’s how it’s being gathered that counts.

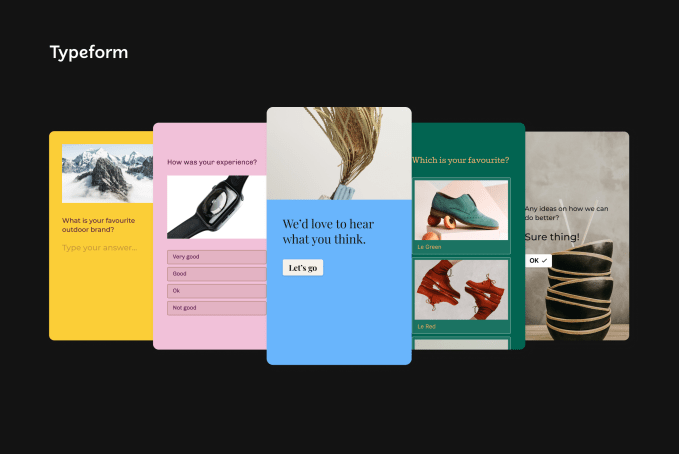

And on that front the pitch is Typeform’s design-led, personalized approach makes (what could otherwise be clinical) digital interactions “feel like a personal conversation”, as Lecha puts it — by providing its users with a customizable digital canvas and tools to showcase their brand through the medium of slicker audience engagement during outreach.

The follow-on premise is data collection done well can forge stronger connections and gather better intel that helps convert potential customers — so data capture itself becomes a selling opportunity to be leant into not a box to be checked. (And to back that up Lecha gives the example of a lead generation survey Typeform distributed to its own users which he says found that leads collected using its tools “have a qualification rate higher than 95%”.)

“With Typeform, customers interact with a brand through a suite of interfaces that are fun and interactive, yet have the feel of a personal, one-to-one conversation,” he adds.

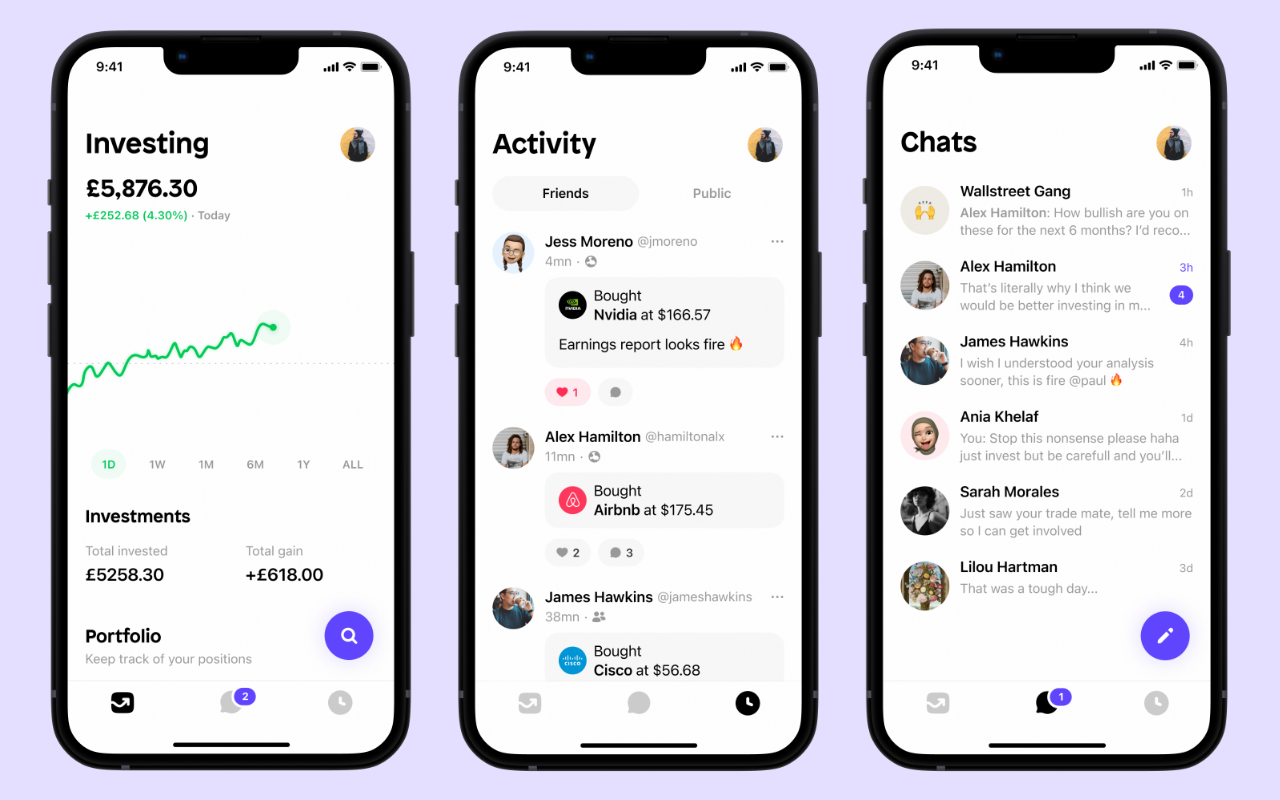

Typeform’s design-led approach to marketing outreach (Image credits: Typeform)

The pitch looks to be paying off: Typeform has some 125,000+ paying customers for its products at this stage.

It does also offer a free plan — giving it a pool of users to upsell paid plans which offer tiered rates based on usage, as well as stepping up to supporting white labelling and bolting on additional functionality (such as analytics and priority support).

“We’re using this funding to support our focus on becoming the essential platform for the marketing tech stack,” Lecha tells TechCrunch. “The gold standard for digital interactions that feel like real conversations. We want to enhance the ways we solve for the mission-critical workflows that allow our customers to truly engage with their audiences and grow their businesses.

“To do that, we want to continue adding more features while reinforcing ease-of-use of our products, provide more ways to share and embed typeforms, and add new customization tools that allow for even stronger, bespoke expression of our customers’ brands.

“Our approach and technology leads to insights that are exceptionally valuable, so we want to put more power into the hands of our customers to take action on those insights by bolstering our data visualizations, analytics and optimization tools. We also know that our customers need to use Typeform in conjunction with many other tools — we integrate with apps across the tech stack, and will continue to develop even more integrations with technology partners.”

Discussing the competitive landscape in the “conversational experience space” — aka, personalized marketing outreach that feels more friendly, approachable and reactive than a static form — he also argues there’s plenty of cross-over that allows for rivals to work together on integrations.

“The conversational experience space is fascinating, in that competitors can also have complementary products and even integrate with solutions that might also be considered competitors. Companies like Qualtrics, Intercom, Hubspot, etc are some examples of companies that offer tools that compete with Typeform in some ways but we also have worked with many of them to build integrations,” he suggests.

“Our focus is on building the best possible solution for our customers, and in many cases that means meeting them where they and their stakeholders are and finding ways to work well with all the solutions in their tech stack — we do whatever we can to help businesses grow and engage their audiences.”

So while tech giants like Google and Microsoft do offer their own form-builder tools (among their wider suite of enterprise tools), Typeform is happy to integrate — letting its users “import, analyze and augment their data and processes” across tools like Google Forms, Office 365, Excel Online, Google Analytics and Google Tag Manager, per Lecha.

“Compared to other options, we offer a unique combination of both the best interaction experience and the ability for businesses to create highly customized interactions across multiple types of interactions, whether it be forms, chats or video,” he further argues.

Typeform is using some AI/machine learning to increase product personalization — such as via its VideoAsk product, which it launched following its last funding raise, to let customers to create videos that combine chatbot automation “and the personal touch of video” — enabling “asynchronous video conversations” that blend the efficiency of automation with a more human/”face-to-face” feel.

“VideoAsk uses the AI model GTP-3 to understand what is being said in video response, then provide the best response based on conditional logic,” notes Lecha, adding: “Our AI also fuels seamless speech-to-text transcription for conversations in English, German, Dutch, French, Portuguese, Spanish, Catalan, Italian, Swedish, Russian, and Turkish.”

Usage of Typeform’s product spans a variety of industries and services — including ecommerce, professional services and software, and academia.

While under the primary customer use-case of growing a business/engaging an audience (other use cases include recruitment, customer feedback, employee outreach etc), Typeform can manifest as “interactive forms, video and chat to do mission-critical jobs like collecting leads, qualifying customers, and engaging them for a long-term relationship”, per Lecha, who notes the software is also used for conducting research, providing personalized customer service, and collecting feedback.

“Interaction is at the core of every job our customers do,” he adds.

“We also know that when Typeform is embedded across mission-critical work flows, leveraged by multiple core functions and deployed across a variety of use cases, we help our customers discover new opportunities, create and execute plans based on actionable insights, and grow their audience — this is why we’re investing in building out our already powerful integration options.”

Typeform CEO Kim Lecha (left) and co-founder David Okuniev (Image credits: Typeform)

While the majority of Typeform’s customers are making use of its free plan, so aren’t currently generating any revenue for it, Lecha says that more than two-thirds of paying customers started as free users.

He also touts a high rate of organic growth, saying around 80% of new customers sign up — “because they or someone they know has had a great experience with Typeform’s tools in the past” — underlining the pulling power of freemium.

“We definitely see that the flywheel powered by our products continues to inspire loyalty once a user sees all the ways they can use Typeform to interact with their audiences throughout the funnel — that’s why so many users who start with our free version end up becoming paid customers, unlocking more and more value,” he suggests.

The US remains Typeform’s largest market (both for users and revenues), followed by Europe.

While Typeform is not yet profitable, Lecha described the business as “well positioned to prioritize profitability when the time is right” — again as a result of continued attention to operational efficiency.

“For now we’re focused on scaling our business and provide the gold standard of online interactions,” he adds.

Asked what Typeform’s investment roadmap looks like from here on in — and whether an IPO is something it’s actively considering — Lecha sidesteps the question, saying only: “Our strategy is always driven by our focus on our customer — we’re confident in our plan to grow efficiently and effectively meet the increasing demand for our solutions. As we continue on our journey to create a world of more personal business relationships, we’ll certainly consider whatever options help us achieve our vision.”

The IPO market is another downward signal, with the upcoming calendar of public-market debuts looking essentially barren. Mobileye, yes, will go out, but that’s Intel spinning out a previously public company, so it hardly counts — though we will be watching.

The IPO market is another downward signal, with the upcoming calendar of public-market debuts looking essentially barren. Mobileye, yes, will go out, but that’s Intel spinning out a previously public company, so it hardly counts — though we will be watching.