Plaid, a fintech unicorn known for its APIs that connect consumer bank accounts to financial applications, announced today that it is buying Cognito. The price is around $250 million, paid in a blend of cash and stock TechCrunch understands, though we couldn’t suss out the exact mix of each.

The deal highlights where Plaid is heading in its post-Visa form. Recall that the company had previously intended to sell itself to the consumer credit giant before the deal ran into a regulatory wall; since then Plaid has raised capital and expanded its valuation by a factor of around four.

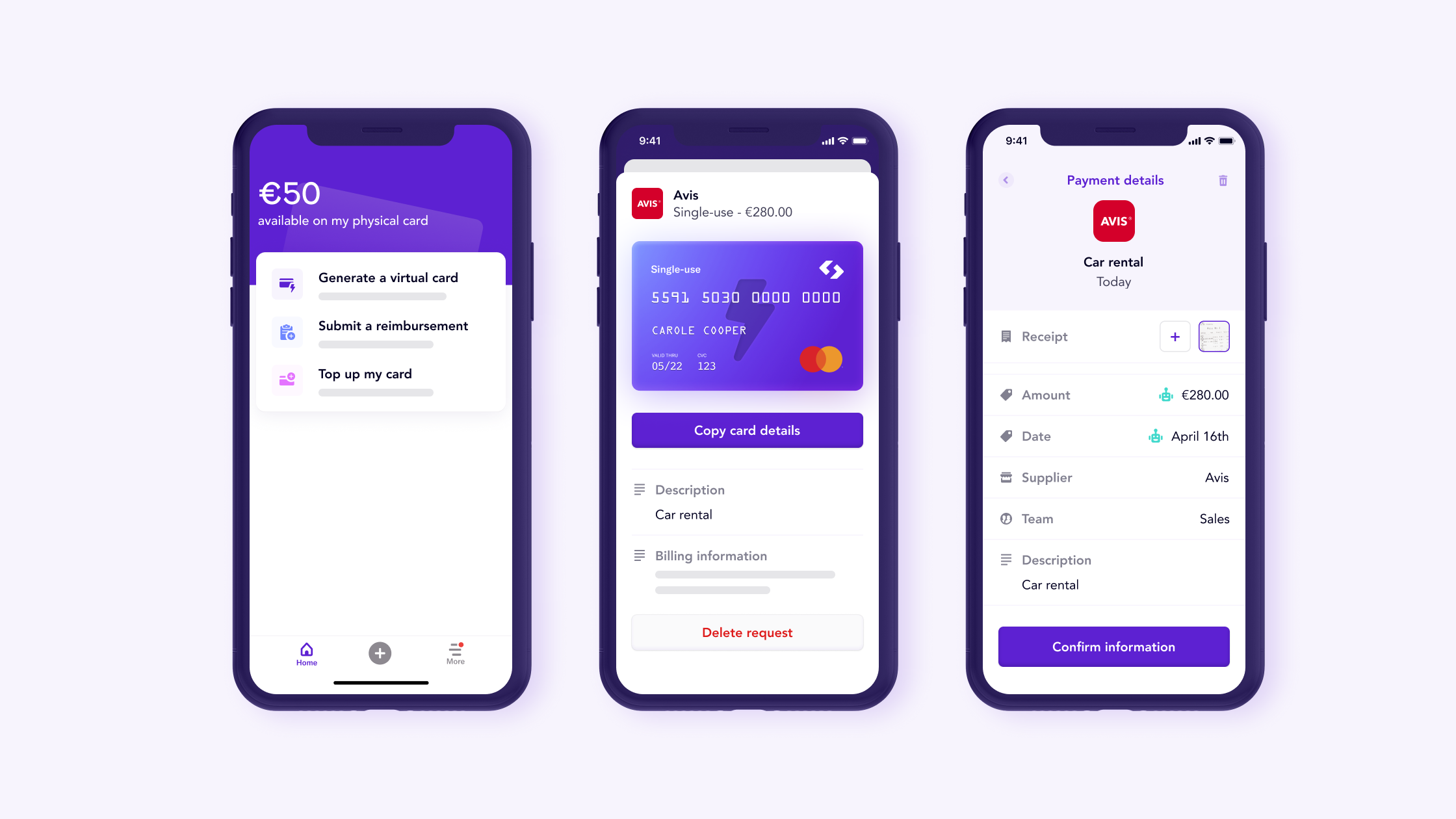

Cognito is an interesting buy for Plaid, offering verification services for the fintech world, which is distinct from what its acquirer is best known for. In practice, Cognito offers ID verification, along with help with thorny issues like know your customer (KYC) rules, and anti-money laundering requirements.

If you deal with money in motion, there’s work to do behind the scenes to ensure that your service is not facilitating nefarious activity, for example. (Unless, naturally, your company is named HSBC.) By buying Cognito — the acquiring entity is bringing aboard all of the smaller firm’s staff, including its three co-founders — Plaid is layering more services atop its core remit of consumer bank account connections via developer hooks.

Plaid’s API work puts it in between consumers, and a host of financial applications and services. That’s a lucrative, important, and I would add sticky place to be — all good things for a business. But why merely shuttle data back and forth, when it is possible to do more?

Recall that Plaid bought another startup called Flannel last year, in what Insider described as a push into the payments world; the company, flush with external cash and with equity worth north of $13 billion to use in deals, is adding to its roster of services that it can offer customers.

TechCrunch spoke with Plaid CEO Zach Perret and Cognito CEO Alain Meier (previously of Bloom) about the transaction. Meier said that the talks started off as a chat about a partnership that evolved into a sale; per Crunchbase data indicates that Cognito raised single-digit millions while independent, meaning that its exit price was likely attractive to its investors and staff.

For Plaid the deal makes sense from a number of angles. First, the issue of verifying users for fintech applications is, per Meier, an “extremely complex problem.” That means that Plaid can get past building all of what Cognito has thus far with its checkbook. And with Plaid customers asking for ways to more quickly onboard users per Perret, Plaid knew that it had customer demand for what the smaller company had built; buying Cognito means that Plaid can instantly layer on another service to its already growing customer base.

From that perspective, the deal is something akin to Microsoft acquiring an enterprise software company, knowing that it can sell its product via existing channels and customer relationships. By selling to Plaid, Cognito can likely scale its in-market footprint far more quickly than it could have by itself. Plaid, the company shared with TechCrunch via email, has around 5,500 customers today, a rich vein for Cognito to mine now under the larger company’s aegis.

TechCrunch asked Perret about where Plaid is heading from a product perspective. Our hunch, given the Cognito deal, was that it intends to build an ever-wider cadre of services that customers of its core product can add as they will to their existing contracts. As Cognito will be priced as an add-on, our thesis felt directionally correct.

The CEO noted that Plaid had launched a product called “Signal” recently, aimed at helping reduce fraud as an example of what the company has been working on in recent quarters. Plaid has also built a consumer portal where end-users can check their various connection points.

That’s illustrative. Plaid’s work to build more services atop its core product — which feels very similar to the product work that Stripe has done on top and adjacent to its payments nucleus — doesn’t appear to be merely a push to better support business customers. It has a consumer play in the mix as well. I would add at this juncture that the company remains, in our view, a firmly B2B company today.

Still, you can imagine what could be coming in the future. If consumers use Plaid as the de facto way to connect to the larger web of fintech and finservices products, and the company provides a central hub, or source of truth, it could build relationships with myriad individuals. That would give it sway on both ends of the fintech-user relationship, a powerful place to sit.

Here’s hoping that Plaid dreams big and uses its relationships on both sides of the app-user coin to do lots. Like, say, reinvent credit scoring. That would be a net-good for individuals everywhere.

Regardless, the Cognito deal is not the final acquisition that we anticipate from Plaid before its eventual public offering. More when we have it.