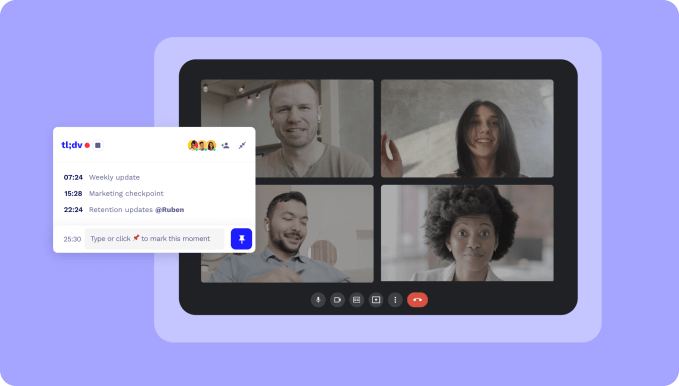

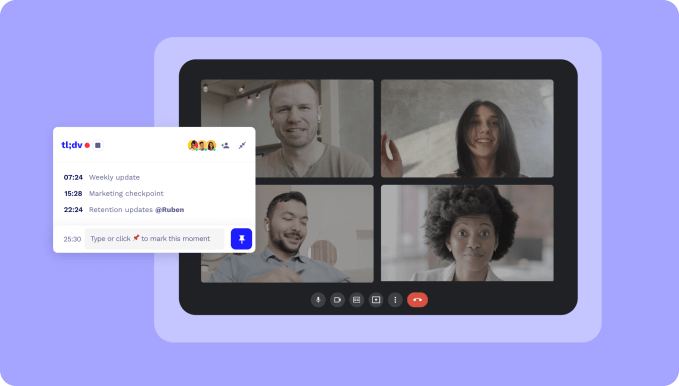

If the pandemic-triggered proliferation of online meetings is killing your team productivity and sapping the attention of overloaded info workers, German startup tl;dv might have just the tool: It’s built an extension for videoconferencing platforms, like Zoom and Google Meet, which bolts on a suite of capabilities that attendees can use to record, transcribe and timestamp key moments to quickly and easily (re)surface important info after the meeting has ended.

Idea being that, collectively, the suite of tools can help professionals keep on top of the flow of info coming at them and their co-workers without everyone needing to attend every meeting in real-time. (Hence the name, tl;dv — which is internet slang for ‘too long; didn’t view‘.)

While major videoconferencing platforms can offer basic stuff like a record function, the winter 2020-founded startup reckons there’s a gap for bolting on a suite of extras that can enhance third party live meeting platforms, while neatly integrating with other popular office productivity tools like Slack and Notion, and with CRMs like Hubspot and Pipedrive.

Going beyond pure, info-structuring convenience, it also features clipping tools which let users turn killer meeting soundbites into video snippets which could be used for various broader purposes, like internal training or external marketing, depending on the content.

The platform launched in summer 2021 and it now has around 300 paying customers — the majority of which are start-ups and SMEs.

The vast majority (~95%) aren’t yet paying as it’s taking a freemium approach, meaning it’s offering certain features (like transcription) cost-free; but — overall — “thousands” of professional users are happily tapping into its freebie time-saver tools.

While productivity software is a hotly contested space, tl;dv has managed to convince a bunch of investors it’s onto something: Today it’s announcing a €4.3 million seed raise, led by Madrid-based K Fund, with participation from existing investors Seedcamp, Mustard Seed Maze, and another.vc. Also joining the round are Shilling.vc, plus a number of other European founders and business angels, such as Oscar Pierre, co-founder and CEO of on-demand delivery platform Glovo.

“All over the world, knowledge workers are spending at least fourteen hours a week in meetings. Most of the time, they’re just passively listening with their microphone on mute. tl;dv helps people quickly catch up on meetings instead of attending every call live,” tl;dv co-founder and CEO Raphael Allstadt tells TechCrunch.

“We measure success based on how often a user watches a recorded tl;dv instead of attending the live call. When a user frequently watches tl;dv highlights and clips — quickly navigating to key moments before exiting the recording — we see this as a sign they’ve gained the context they needed, and can start focusing on the work that really matters.”

Commenting on tl;dv’s seed raised in a statement, K Fund’s Jaime Novoa added: “For a long time at K Fund, we’d been recording some of our internal meetings so that they could be consumed at a later time by those not able to attend. This exploded with the pandemic and hybrid forms of work. tl;dv brings this to another level and we’re obviously heavy users at the firm. It’s not only about the pure aspect of recording calls but also about the way it integrates with other productivity tools such as Calendar, Notion, Google Docs, etc so that it becomes an essential part of the way we work.”

Asked how defensible it is to bolt productivity features onto third party meeting platforms, given these players could just clone popular features and bake it into native functionality, undermining tl;dv’s standalone utility, Allstadt argues that’s not a concern as it can offer something they won’t: A convenience-focused layer that works across different videoconferencing platforms, wherever office pros might be chattering virtually.

“The reality is that most of us are using more than one video call platform for work,” he argues, predicting: “The live conferencing market will continue to fragment.”

“Slack is increasingly used for internal meetings — Discord, too. Some of our users have security requirements that mean they can only use Google Meet internally, however their clients insist on using Zoom,” he goes on. “Our goal is to help busy professionals bundle insights from any live conferencing provider to any async platform where they collaborate. We will become a partner to Zoom and not a competitor.”

So how does tl;dv work? Users manually trigger timestamps and/or add notes to flag key moments — so, interestingly (and unlike some rivals) — it’s not (currently) trying to automate the generation of meeting minutes, e.g. by using AI to parse transcriptions and ID key moments. Although it does not rule out adding that functionality at a later date.

Asked about this, Allstadt says some early users recounted having a poor experience with automated note-taking tools — hence he says they decided to focus on creating an interface/workflow that makes it super simple for actual humans to do the note-taking work in the first instance.

“We are not a tool for automatic note-taking,” he tells TechCrunch. “What is interesting is that a lot of our users have tested tools that offer some form of automated note-taking but feel the technology is not yet adequate. It’s important to be able to rely on meeting minutes, which is why tl;dv focuses on simplifying the note-taking of users (instead of attempting to take notes for users). We’re keeping a close eye on the advancements of automated note-taking software. When we feel this technology is good enough for our users, we’ll be integrating it!”

Explaining how tl;dv works currently, he adds: “During the meeting, tl;dv users can timestamp important moments with the click of a button or by writing short notes. This function also allows them to tag specific colleagues. The recording and transcript are instantly available after the meeting and automatically shared with all participants. tl;dv notifies the organizer whenever a meeting has been accessed to show them which content is especially useful or interesting for others. The organizer can also create short snippets and share these specific clips with teams, investors, stakeholders, or managers who weren’t in the call.”

Image credits: tl;dv

To make video clips from recorded meeting content, tl;dv users scan the transcript for important parts, select the relevant bit of text and hit a button to get the platform to turn that slice of the meeting into a shareable video snippet. So, er, let the meme-ification of colleagues commence!

Another convenience-focused feature tl;dv offers is baked in translations for meeting transcripts which Allstadt says are immediate available in more than twenty languages currently (“in the spirit of cross-continent collaboration!”).

More features are incoming. “We will soon release a powerful search function that allows users to search for any word and instantly locate all the conversations recorded with tl;dv in which that word was spoken,” he notes, adding that deeper integrations with asynchronous platforms like Hubspot, Salesforce and GSuite are also in the works.

The seed funding will also be put towards expanding utility with a feature that lets users group meetings in folders to simplify sharing and storing, per Allstadt, among other forthcoming extras.

Discussing the competitive landscape for meeting productivity tools, he points to Gong as “interesting” — acknowledging that the well-financed revenue intelligence startup was an early entrant in the space and “paved the way in some sense”, as he puts it.

But he argues that Gong’s focus on sales teams creates an opportunity for the small European upstart to offer something “far more cross-functional” — further suggesting: “Especially considering how customer-oriented businesses are increasingly sharing sales insights across their organization. In other words, we want to normalize the adoption of tl;dv across entire companies — not just sales.”

Another early mover he namechecks is Otter — which had a first focus on transcription but has since been expanding its feature set to include productivity-focused features like automated meeting summaries, so there’s more than a little functionality overlap there. Although Allstadt plays that angle down. “We believe the value lies in the video, which helps enrich communication with emotive, vocal, and visual cues,” he argues, suggesting tl;dv’s video snippeting features will be able to give it an edge with teams who may already be subscribed to Otter’s rival offering.

One key thing to note about tl;dv’s platform is that meeting recordings are not currently stored end-to-end (E2E) encrypted — per Allstadt, it’s storing customer data on Amazon Web Services facilities and encrypting all communication to and from the AWS with 256-bit encryption at present — although he says that adding that extra layer of robust security is on its short term roadmap.

A lack of E2E encryption caused reputational headaches for Zoom during the pandemic — when it emerged that its security was not as robust as it had claimed. The platform later promised to focusing on fixing these security and privacy concerns and went on to roll out E2E encryption, including for non-paying users.