Zoe, a startup founded by doctors and researchers out of London and Boston, made its name during the pandemic with a popular — dare we say viral? — self-reporting Covid-19 app. Embraced both by consumers and researchers, it provided early data into how Covid-19 spread and the symptoms associated with the initial infection and its lingering after-effects (Long Covid) — insights that were hard to come by virtually anywhere else.

Then as the virus moved from pandemic to endemic and attention shifted to other ways of tracking, Zoe also shifted, back to its original, pre-Covid mission: using self-reporting tech to track and build a nutrition study of the microbiome, and to provide personalized insights to individual users of its app based on their reporting of what and how they eat and the wider insights gained from the research.

That app is now is taking the next step in scaling its operations, as it looks to onboard 250,000 people off a waiting list it’s had going for over a year: it’s announcing £25 million in funding (around $30 million at today’s rates), an equity investment that CEO Jonathan Wolf said values Zoe at £250 million ($303 million).

U.S.-based venture firm Accomplice is leading the round, with previous backers Balderton Capital, Ahren, Daphni, and new backer L Catterton also participating.

The funding comes on the heels of a Series B of £48 million, which closed with a $20 million injection in May 2021 (a number that bumped up to $25 million after we published our story). Since then, it has onboarded some 50,000 active paying users, alongside the nearly 5 million people who have self-reported nutritional data free of charge. Wolf said that most of the last round in still in the bank; the latest funding is an opportunistic extension, made to shore up capital in the face of potentially stormy waters in the markets next year.

“We are seeing a big acceleration in customer demand so what we want to do is scale our business significantly to be able to meet that demand,” Wolf said. “Given the tough economic environment, we wanted to make sure we have the capital to do this. In fact, the vast majority of the $25 million raised in the last round is still in the company.”

And alongside the venture round, it’s also hoping to bring on more interest through a crowdfunding campaign. Taking into its wider community of interest that Zoe says numbers 2 million (this likely includes many who follow Zoe and have provided contact details by way of its previous Covid work, but it also has a podcast and related content) it will be running a campaign for investing via crowdfunding site Crowdcube. That will open on December 13 to that community and a day later to Crowdcube users, and then to the public at large, with investing starting at £10, “at the same share price as ZOE’s private investors.”

In addition to onboarding more users waiting to join, the plan also is for Zoe to expand beyond diet.

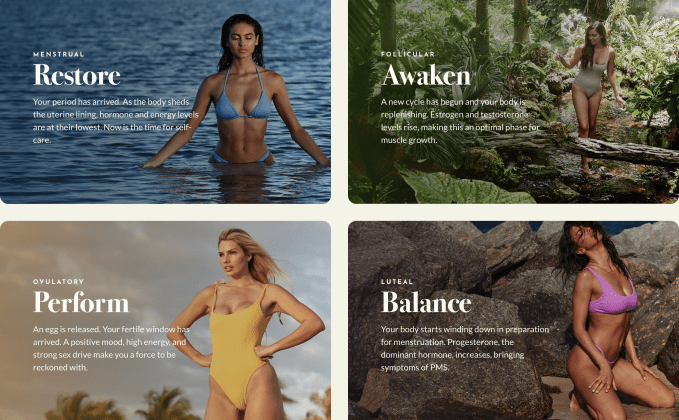

“We are looking to deepen our research into nutrition, the gut microbiome, sleep, mood, activity and other factors to improve long-term health,” said Wolf, who co-founded the startup with Professor Tim Spector of King’s College London and George Hadjigeorgiou. It plans also to expand research and studies in the ZOE Health Study; with a greater number and variety of health and lifestyle studies advocated by our contributors and scientists that will cover areas like menopause and more.

While it does not have plans to build any of its own hardware — it does send out glucose monitors and other physical products as part of its assessment (see below) but these are not made by Zoe — it will be making more integrations with hardware already out in the market, an approach that is essential for triangulating data and getting more complete pictures of each individual reporting in which is essentially a big data analytics exercise.

“I don’t see us dong anything in hardware. So many are already in this area and it’s exciting to take inputs from a variety of them. No single measure is more important or determines something. It will take a combination,” he said. “In the future we’re excited about integrations with Apple Watch and more.”

The reason for the slow movement in bringing those waiting off the list is because of the process involved in doing so — one reason for the funding injection to speed up how it scales.

The 50,000 active users it has have opted to pay £299.99 initially to get a test kit to run an initial analysis of their systems. The price is high, Wolf said, because it includes a gut microbiome test, a blood fat test, standardised test meals of muffins (!), real-time blood sugar sensor (CGM) if opted in to our science study; and then in return a gut health report and a personalised insights report.

Users are then given an option to take on memberships at different price points to continue the work and insights. These start at £59.99/month and go down to £24.99/month if you take out an annual subscription.

In a consumer world of health apps that include free, ad-supported options, it’s a big ask for users to step up and put in hundreds of dollars into a service to improve how they eat. Wolf said that Zoe had found that one of the lasting impacts of the pandemic was that there’s been a shift in how the general public regarded their health and the role that their activities played in it.

“I think the pandemic has had a profound impact on how people think about their health,” he said. “They noticed how what they do and how they eat and exercise impacted on a disease. That doesn’t mean everyone is healthier but now more see that it’s not something you wait to do until you’re sick. You have to take responsibility for it and add to it over time.”

Indeed, Covid-19 saw a boom in activity: people were walking, cycling and running more; some were buying more fitness equipment for their homes when their gyms or sports clubs closed; and generally more people were trying to do more not just to be healthy in case they too got hit by the virus, but because they were no longer coming into work every day and found themselves more sedentary by default. Of course, there’s been a big shift back to old pre-Covid ways, but there has also been a lingering shift, which is something that Zoe hopes to play into — not least because of its traction with users during the peak of the pandemic, when it had amassed more than 5 million users in the U.S. and U.K. for its symptom tracking app.

Zoe has naturally conducted a study on its users — 500 of them — and says that those actively following its program for 12 weeks or more said they felt “healtier” for eating following Zoe recommendations. “Their top improvements were; improved mood & alertness, better bowel habits, improved blood sugar & fat, less bloating and better sleep quality,” said Wolf. Some 85% said they had reduced constipation, reduced bloating, improved mood, and reduced diarrhoea, he said; and 70% said they had more energy and less bloating. It’s running a larger randomized study now to get more insights, which will be ready next year, he added.

Additional reporting Natasha Lomas

Zoe, which went viral with its Covid-reporting app, raises $30M to track nutrition and health by Ingrid Lunden originally published on TechCrunch