S@SThom.as

Brinc, the Hong Kong-based accelerator backed by investors like Animoca Brands, is launching a new program for fledgling climate tech startups. The three-month program is tailored for founders who are focused on carbon dioxide removal (CDR). They will receive fundraising support, guidance on how to scale up and introductions to Brinc’s network of follow-on investors, mentors and corporates.

Janina Motter, Brinc’s Climate Tech Program manager, told TechCrunch that the accelerator has focused on climate tech for several years through its food tech vertical. “From those successes, we recognized sector specificity is key to maximize value for founders,” she said. “This is why we plan to have several different climate tech programs over time, with this new program focused on carbon removal, utilization and storage.” She added that Brinc has seen underinvestment in carbon removal relative to its climate impact.

The inaugural cohort includes four startups. Motter said “the strongest applicants understand how their approach fits into the competitive landscape and have compelling answers about ‘why them? why now?’ for the company to grow. Furthermore, for CDR in particular, it’s critical that startups have some initial understanding of how their technology fits into broader context (ecological risk, co-benefits, local communities, etc) and are willing to develop a robust framework which will help them scale responsibly.”

From the United Kingdom, Airhive is creating geochemical direct air capture (DAC) to scale carbon removal. Its DAC system is modular and based on a fluidized nano-structured sorbent.

Based in the United States, CarbonBridge captures fermentation CO2, or CO2 generated by fermenting plant matter to make beer, wine and other products, before it enters the atmosphere, and produces eco-friendly methanol through a microbial conversion process. The startup says this is a cost-effective alternative to mainstream methanol made from fossil fuels.

Hong Kong’s Formwork IO wants to reduce carbon emissions in architecture and other parts of the built environment. It does so by creating carbon-negative concrete through the use of waste carbon dioxide and materials as binders. Formwork IO is focused on the Asian market, where it says more than 70% of cement is produced.

Poas Bioenergy, based in Costa Rica, turns agricultural waste, including coffee and pineapple residue, into biochar and syngas, making waste management more efficient and giving farms a source of clean energy.

The Climate Tech Program is supported by organizations like Artesian, Carbon Business Council, CO2CRC, Direct Air Capture Coalition, PML Applications and others.

Brinc launches new program for climate tech startups by Catherine Shu originally published on TechCrunch

WhatsApp is used by more than two billion around the world, and is an important tool for many small businesses. But as they scale up, even WhatsApp for Business might not be able to keep up with their needs. That’s where WATI (WhatsApp Team Inbox) steps in. Built on WhatsApp for Business’ API, WATI has customer sales and engagement tools created for the messaging app. Today the Hong Kong and Malaysia-headquartered startup announced it has raised $23 billion in Series B funding to scale its team and product.

The round was led by Tiger Global with participation from returning investors Sequoia Capital India & Southeast Asia, and new investors DST Global Partners and Shopify (marking the e-commerce platform’s first venture investment in a startup operating in the Southeast Asia region). WATI’s last round of funding was an $8.3 million Series A announced 10 months ago, and its new round brings its total raised to more than $35 million since 2020.

WATI founders Bianco Ho and Ken Yeung began working together in 2016, building Clare.AI, an omnichannel AI digital assistant for large Asia enterprises. In 2020, they launched WATI to give SMBs a self-service, low-code product on the WhatsApp for Business API. The startup currently has more than 6,000 customers in 75 countries, including SMBs in spaces like house cleaning, schools, education centers, edtech, fintech, medical facilities, D2C brands and Shopify stores.

Ho told TechCrunch that while she and Yeung were working on Clare.AI, “our assumption was that only larger enterprises had the resources to deploy a successful digital assistant with artificial intelligence.” After a few years of working with their clients, however, the two realized many were looking for a simpler solution, so WATI was created. Part of the reason for its launch was the digital acceleration caused by the pandemic, as many businesses rushed to get online.

WATI founders Ken Yeung and Bianca Ho

In many emerging markets, and mature markets like Europe, WhatsApp is the preferred communication channel between customers and businesses. WATI helps non-technical businesses scale their customer support, customer engagement and acquisition through its CRM.

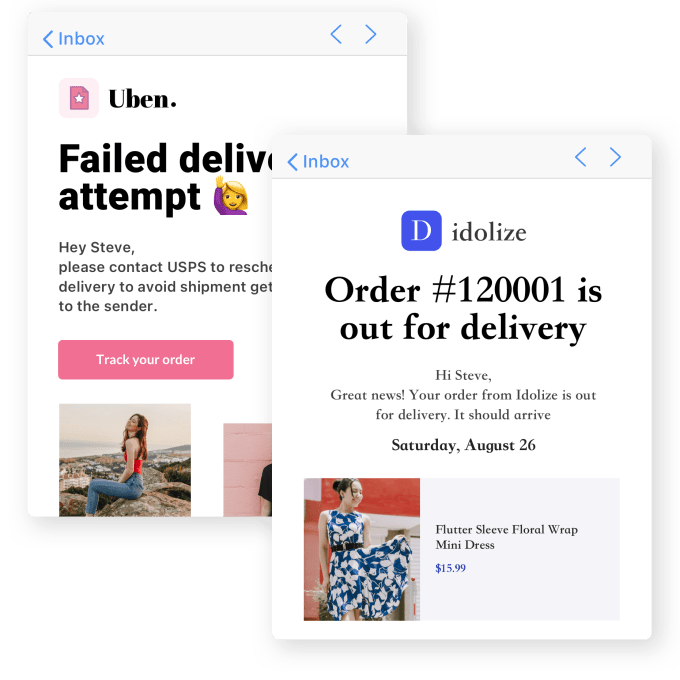

WATI’s customer engagement software is built on WhatsApp for Business’ API and lets clients send personalized notifications. The platform includes a collaborative team inbox used by multiple agents, and features like smart routing, canned responses, data tagging and analytics. Interactions can be automated through low-code workflows and chatbots, and connected to e-commerce platforms and CRMs. WATI also has integrations with platforms like Zoho, Shopify and Google Sheets.

An example of how WATI is used is a large e-commerce company that relies on its to manage campaigns like Prime Day. The company usually gets 60 to 100 messages a day from customers through WATI’s team inbox, the majority of which come from its website’s WhatsApp chat, and sends about 30,000 messages every day when campaigns are active.

Another example is an edtech client that has used WATI for almost two years. They rely on about 50 templates a month for lead generation, nurturing, payment reminders and class updates, and send 20,000 to 30,000 messages a day. WATI also helps them get high-quality organic leads through a WhatsApp widget on their website.

Ho said WATI’s closest competitor is the native WhatsApp for Business app, which most SMBs start off using, but WATI is a suitable fit for them as their businesses scale.

Funding will be used on hiring and investing in WATI’s product stack for low-code automation. The company also has go-to-market plans for emerging markets, like Latin America and Southeast Asia

WATI, a CRM tool built for WhatsApp, raises $23M led by Tiger Global by Catherine Shu originally published on TechCrunch

Ordinary Folk, a Singapore-based telehealth startup dedicated to men and women’s health issues, has raised $5 million in pre-seed funding from Monk’s Hill Ventures. The funding will be used for hiring and expand into Hong Kong while scaling in Singapore.

Founded in 2020 by Sean Low, the startup has two main platforms: Noah is for men’s sexual health, mental wellness, hair care and weight management, while Zoey focuses on sexual wellness, fertility, mental health and wellbeing.

Low says he started Ordinary Folk to ease the pain points of an in-person clinical visit, while also making it easier to seek care for stigmatized conditions like erectile dysfunction.

“Men’s and women’s health conditions are intimate problems that affect all of us at some point of our lives, whether directly or through your partner,” he told TechCrunch. “And before we started Noah and Zoey, there weren’t any good solutions in Singapore and Hong Kong.”

The company chose Hong Kong as its next market to expand into because there are many similarities between Singapore and Hong Kong, Low added. For example, both are densely-populated and fast-paced, with healthcare systems that have the same issues, he said.

“While there are nuances, Singaporeans and Hong Kongers also identify similarly on issues such as high healthcare costs, fear of illegitimate medication, inconvenience of visiting a doctor and the stigma attached to men’s and women’s health conditions,” he explained.

Ordinary Folk says that since its launch, its revenue has grown by over 130% and it has had over a million unique visitors. It differentiates from other telemedicine startups by building a full healthcare stack, Low said, including healthcare and logistics for medication in non-description packaging.

This also means Ordinary Folk was able to create a health assessment patients take before scheduling an appointment, allowing doctors to make more detailed diagnoses.

“In the case of sexual health, having to answer intimate questions can be tough and what more to a stranger whom you’ve never met,” said Low. The health assessment was developed in partnerships with doctors and health experts. Ordinary Folk’s network of providers include physicians, psychologists, therapists and other specialists.

In a prepared statement, Peng T. Ong, the co-founder and managing partner of Monk’s Hill Ventures, said, “Millions of people across Asia find it difficult to access proper treatment and care for health conditions that have tremendous taboo attached. Through Noah and Zoey, Ordinary Folk is uniquely positioned to bring in value through the consumer journey of healthcare services, creating an ecosystem where patients have access to medical experts and products, and a wide range of treatment options.

Singapore-based Deskimo, the on-demand app that lets people find co-working spaces and pay by the minute, announced today it has raised a $3 million seed round. It is also soft launching in Jakarta, bringing its total markets to three, along with Singapore and Hong Kong. Participants in the round included Y Combinator (Deskimo was part of its summer 2021 cohort), Global Founders Capital, Pioneer Fund, Seed X, Starling Ventures and TSVC.

The startup was founded earlier this year by Raphael Cohen, Rocket Internet’s former head of Asia, and Christian Mischler, who co-founded Foodpanda, HotelQuickly and GuestReady. Instead of offering its app directly to consumers, Deskimo works with companies that have a hybrid workplace model. The app is offered as a benefit to employees, who usually work from home but might want to get away to concentrate or take calls (Mischler said Deskimo’s average users spend 3 hours at a desk, but some stay the whole day). It partners with coworking spaces, including WeWork, The Hive, Executive Centre and Garage Society, giving them additional streams of revenue.

Mischler told TechCrunch in an email that the startup expanded into Jakarta because it is targeting cities with heavy traffic congestion and where real-estate infrastructure is usually less developed than in cities like Hong Kong or Singapore. “Indonesia is the largest market in Southeast Asia and Jakarta is one of the first markets where Singaporean companies expand into, hence many of our existing corporate clients were requesting the ability to use Deskimo there, which is why we’ve prioritized Deskimo in Jakarta ahead of other metropolitan areas in Southeast Asia.”

In Jakarta, Deskimo has contracted with more than 40 workspaces so far for its soft launch, with plans to add about 10 to 20 more locations by the end of this year. In all its cities, it looks for spaces outside of central business districts so users can find desks close to their homes. For example, in Hong Kong and Singapore, about one-third of Deskimo’s spaces are located in residential areas. In Jakarta, spaces are spread more evenly across the city, Mischler said, with about 60% of its partner workspaces located outside of CBDs.

“As COVID-related restrictions continue to ease, we expect spaces to become more busy, which is why we’ll continue to add options to the app to ensure availability in proximity to all Deskimo users,” he added.

Over the past three months since its launch, Deskimo has also added several new services in response to user demand, including the ability to book centrally-located meeting rooms. It is also trialling fixed-fee subscriptions in addition to its current pay-as-you-go model. Other features Deskimo is working on include the ability for main account holders to bring a guest, prepaid credits for companies in addition to end-of-month bills and a rate cap for users who want to spend the entire day at a space.

FunNow is a booking app for spontaneous people. For example, you can reserve a manicure or restaurant seat and head right over. As people start to spend more time outside their homes, FunNow is prepping itself for expansion into more countries. The Taipei-based company announced today it has closed a Series B of $15 million.

The round was co-lead by Perfect Hexagon Commodity & Investment Bank and Ascendo Ventures, with participation from the corporate venture arms of PChome, KKday and Wistron. It also included returning investors CDIB Capital, Darwin Ventures, Accuvest, Sanput Travel Group and CSV Venture Fund, which is jointly managed buy NEC Capital Solutions and Venture Labo Investment.

Co-founder and chief executive officer TK Chen told TechCrunch that FunNow originally planned to start raising its Series B in 2020 before COVID hit. Despite dealing with the pandemic’s impact in all of its markets, including Hong Kong and Malaysia, the company began to see business improve during the second quarter of this year. Its Series B brings FunNow’s total funding, including its 2018 Series A, to about $22.5 million, and will be used to expand the number of categories in its app, adding night clubs, karaoke bars and catering, for example, and enter new countries, including Thailand, Singapore and Japan.

During the pandemic, FunNow faced different challenges in each of its markets. For example, cases in Kuala Lumpur were low for most of this year before an outbreak that started in May. In Taiwan, FunNow’s biggest market, life was relatively normal until an uptick in cases triggered a lockdown from May to August, causing its revenue to decline sharply, but now its returned to about 80% of its pre-pandemic performance.

During the outbreaks, FunNow’s team adapted the app’s services. For example, in Malaysia, it talked to food and beverage merchants and discovered that customers prefer to pick up food instead of waiting for deliveries, so it added takeaway bookings. “Within two months, our return for takeaway was almost the same as dine-in revenue,” said co-founder and chief global strategist CC Chang.

The app already had multi-channel reservation tools, so it began adapting the types of hotel reservations offered, adding daytime options, with stays of 4, 6 or 12 hour increments. For example, people who wanted to dine somewhere, but not in a restaurant, could book a room for a few hours and order room service. Some users, tired of WFH, booked hotel rooms to work.

FunNow founders TK Chen, CC Chang, Pei-Yi Sun and Szu-Chi Lee

“We kept innovating, developing the app, developing more functions and also acquired a great team in Southeast Asia, Singapore and Kuala Lumpur, and also in Hong Kong,” said Chen. “We wanted to raise money now so we can expand market share as soon as possible, once the pandemic is under control.”

He added that COVID has changed consumer habits. For example, people now use online bookings more since walk-ins are discouraged in many places, and they prefer the convenience of FunNow over a phone call. People also started taking advantage of times when the COVID situation is relatively under control to do things like get salon services.

FunNow is facing more competition, however, as startups that used to focus on international travel switched to “staycations.” For example, both SoftBank-backed Klook and PickTime now also offering local bookings for many categories that overlap with FunNow. Chen said he anticipates that “the competition between us will ultimately get bigger and bigger.”

One of the ways FunNow differentiates is its emphasis on “daily life” activities—for example, food, hair cuts, manicures or massages, instead of packages centered around destinations, like theme parks, tourist spots or other cities.

“We are really focused on instant booking,” said Chang. “It’s important to our users because it’s more convenient. You don’t have to make a phone call and we have 10 different categories that are based on daily life, so if you are used to FunNow to do your hair, your nails, make salon appointments, order bouquets or cakes for parties, you won’t easily switch to other platforms.”

FunNow’s Series B included the corporate venture arms of e-commerce platform PChome, tour and activity booking app KKday and electronics manufacturer Wistron. Chen said their investment means that FunNow will be able to work with all three companies to “accelerate the growth of a lifestyle ecosystem.”

For example, PChome, one of the most popular shopping apps in Taiwan, might feature FunNow activities during promotions. People browsing on PChome for Mother’s Day gifts could see FunNow bookings for restaurants in the app.

Before the pandemic, KKday offered international travel bookings, but is now focused on staycations, or local activities. By working together, Chen said the two companies plan to become more formidable rivals to Klook. “We can’t give a lot of details right now, but the basic idea is to combine resources. For example, they have a lot of activities and we have dinners and massages. If we come together, we can combine our suppliers and get more traffic and orders to merchants.”

FunNow will seek other similar partnerships to drive low-cost traffic. Known for being one of Apple’s manufacturing contractors, Wistron’s role in FunNow’s booking ecosystem seems less obvious, but Chen explains its “not a pure strategy partner. Wistron has spent a lot of time focused on digitizing Taiwan’s market, and created a corporate fund to invest in startups, and we will get a lot of support from them.”

In a statement, Ascendo Ventures managing director Aaron Shih said, “FunNow’s performance during the COVID-19 pandemic shows that the company’s operating conditions are optimistic and have huge potential for overseas expansion.”

Based in Hong Kong, Finverse’s ambitious goal is to enable open banking throughout the Asia-Pacific region. The startup recently came out of stealth mode with $1.8 million in seed funding, and is now live in four markets (Hong Kong, the Philippines, Singapore and Vietnam) with connections to 30 banks. Founder and chief executive officer Stephane Lesaffre told TechCrunch that Finverse plans to launch in one new market per quarter, with the goal of covering about 75% of consumer and SMEs banks in each place.

Participants in Finverse’s seed round included Febe Ventures, Golden Gate Ventures, SixThirty, Venturra and angel investors.

Finverse is among a crop of fintechs developing APIs that allow easier sharing of financial data. The most prominent examples include Plaid in the United States and Tink and Truelayer in Europe (Finverse’s seed funding included angel investment from Truelayer employees).

Before starting Finverse in 2020, Lesaffre was senior product manager of financial data integrations at NerdWallet, working with account aggregation APIs like Plaid and legacy player Yodlee.

Plaid won the U.S. market because it was reliable and developer-friendly, Lesaffre said. It did not offer as much data coverage as Yodlee, but “what it did do is a very narrowly-focused set of data very well, and very easy to build. My ultimate learning from NerdWallet is that bad data is really worse than no data.”

Finverse wants to do the same thing for the Asia-Pacific region by building dependable APIs and data integrations. “At the core, we are a basically a consent-based data pipe where a consumer allows Finverse to connect to their account and share it with another fintech or financial institution,” said Lesaffre.

This can include information about accounts, balances, transaction histories and bank statements. Accessing this data gives financial institutions a sense of the consumer’s assets and liabilities, and can be used to perform things like income estimates, credit checks and gauge ability to repay.

Lesaffre said that Finverse’s early adopters are mostly fintech startups, including a mix of SME lending providers and buy now, pay later services.

Finverse’s APIs can be used for a wide range of use cases, but most of its current potential clients are focused on consumer or SME lending. Many of them want to transition from a heavily manual process that requires applicants to upload documents, to a digitized credit decision that can take as little as one minute.

Finverse is currently focused on banked consumers, or people who have traditional bank accounts and credit histories, but over time it also plans to add digital wallets, neobanks and other less traditional institutions. Future use cases include financial tracking as more people in Asia start using e-wallets, investment apps and online bank accounts.

“If you are a smaller digital bank, you know that a lot of your customers will have another primary account at a larger bank, so a lot of smaller banks are quite keen to be able to get a full perspective on their consumers,” said Lesaffre. “One way to do that is to let consumers track all their accounts in one place.”

Another use case for Finverse’s APIs is cross-border payments verification, compliance and KYC.

Other open banking startups focused on Southeast Asia include Brankas and Finantier. Lesaffre said Finverse’s approach is different because it is targeting the entire Asia-Pacific region, instead of focusing on specific markets. Its new funding will be used to grow its engineering and business development teams.

XanPool, a payment infrastructure provider that facilitates faster crypto and fiat settlements, announced today it has raised a $27 million Series A led by Valar Ventures. The round included participation from CMT Digital, Wise founder and chairman Taavet Hinrikus and existing investors Gumi Gryptos and Antler.

The funding brings XanPool’s total raised since it was founded in 2019 to over $32 million. Founder and chief executive officer Jeffrey Liu told TechCrunch that Series A will be used to consolidate XanPool’s presence across APAC, where it is used in 12 countries, with the goal of growing its user base from 500,000 now to 10 million by the end of 2022. Its users include consumers and businesses that want an alternative to traditional payment processors.

XanPool’s software enables a non-custodial crypto-to-crypto (C2C) network that is made up of liquidity providers, including crypto funds, money service operators and traditional-export businesses, who have idle capital sitting in their crypto wallets, e-wallets or bank accounts.

“XanPool never touches this money, we simply make the software which allows the individual or business to automate their buying and selling, and in return earn a fee,” Liu said.

The liquidity providers’ capital is used to settle cross-currency and cryptocurrency transactions and, in return, they earn fees of up to 2% a month. XanPool says its C2C network now has over $200 million of liquidity.

Liu added that the peer-to-peer architecture reduces counterparty risks because its C2C transactions don’t involve an intermediary and transactions are completed without credit or late settlements.

Based in Hong Kong, XanPool has more than 400 business partners. These include South Korean financial ‘super app’ Toss; Vietnamese fintech ViettelPay; Singapore’s electronic fund transfer service PayNow; Indonesian e-wallet GoPay; PayID, the fast payments infrastructure developed by Australian banks; and the Hong Kong Monetary Authority’s Faster Payment Service. They give their customers access to XanPool through their apps, and XanPool performs its own KYC on users.

XanPool founders Jeffrey Liu and Artem Ibragimov

Liu said XanPool’s user experience is different from traditional custody platforms because they just need to provide their crypto wallet address, send fiat to local liquidity peers on its C2C network and then receive cryptocurrency directly into their wallets.

Most traditional custody platforms, on the other hand, require users to send them fiat currency before conducting fiat-crypto exchanges and then wait for exchanges to approval withdrawals.

XanPool plans to continue offering its infrastructure to third-party exchanges, wallets and decentralized applications instead of launching its own app. Liu said XanPool’s goal is to become similar to the SWIFT Network, also enabling settlements without holding its own liquidity, but compatible with cryptocurrency, fast payment services and e-wallets.

FoundersHK was created to strengthen Hong Kong’s startup community, which has weathered more than two years of political turmoil, along with the COVID-19 pandemic. Today the non-profit, which started as an events and mentoring network, held the first demo day of FoundersHK Accelerate, its equity-free accelerator program, which was created to help prepare Hong Kong startups to raise funding and scale globally.

Eleven startups (a full list is below) representing diverse sectors—pet care, fintech, insurance and education, to name a few—pitched an audience of about 500 mentors and investors. They were chosen from a pool of 150 applicants by FoundersHK’s creators, including Alfred Chuang, co-founder of BEA Systems, which was acquired by Oracle for $8.5 billion in 2008, Edith Yeung, former 500 Startups general partner and Phil Chen, founder of HTC Vive. All three are also partners in Hong Kong-based venture firm Race Capital.

One of FounderHK’s goals is to restore hope to Hong Kong’s startup ecosystem. When asked what that means to her, Yeung said, “In 2019, I landed at the airport in Hong Kong, where thousands of young people were protesting. I was overcome with sadness and even took a photo so I wouldn’t forget how I felt about the turmoil there. As a person born and raised in Hong Kong, I couldn’t just stand by and do nothing. I realized mobilizing entrepreneurship and helping founders build their startups was the best way to contribute and help, so FounderHK was born to do just that.”

One of its goals is to help Hong Kong startups secure more funding. “A lot of active investors in Hong Kong don’t invest in local Hong Kong companies. The part that is very ironic is that all unicorns in Hong Kong raised money from overseas,” Yeung said.

FoundersHK connects startups with mentors, many of whom are from Hong Kong, and work at major venture firms and tech companies like Facebook, Microsoft, LinkedIn, Apple and Grab. It held its first event in 2019, before the pandemic hit, and has since continued hosting educational events online.

One reason why FoundersHK is equity-free is because it wants to focus first on creating a culture change. “Hong Kong is a very money-driven place, so when you say that none of this will be money-driven, people are shocked,” said Chuang. “One of the things we really want to fix first is the networking issue, because people learn from other people, but they are not connected and it’s very hard to learn.”

Even though Hong Kong founders might be reluctant to talk about their challenges at first, they are eager for the opportunity, he added. “After the first person has shared what their biggest problem is, everyone else shares, because they now know they all have common problems. That brings a lot of teams together and that’s a culture changing thing.”

Chuang says that hundreds of startups have gone through FoundersHK’s mentorship program. One reason it started its accelerator program was because many teams wanted more support before approaching investors. Bonnie Cheng, a former venture partner at 500 Startups, was recruited to run FoundersHK Accelerate. The program includes weekly check-ins with FounderHK’s leaders, and a mentorship network that includes people from Sequoia Capital, Goldman Sachs, Alibaba, Monks Hill and Matrix Partners.

“We’re finding a lot of Hong Kongers from everywhere who want to help support the community and check out these companies,” said Yeung.

The past few weeks were spent prepping startups for demo day, and making sure they don’t sell themselves short in pitches, another culture change FoundersHK wants to encourage. “Fundraising is a really big part of this accelerator, really the main thing is to teach them what they need to do, what attractions do they have and how to do pitch it,” Chuang said. “A lot of our work is connecting them with investors to pitch.”

Part of FoundersHK’s work is helping startups find partners in the right markets. Since Hong Kong is a small market, most startups begin thinking about international expansion from the start, including Southeast Asia, the United States and mainland China.

More than 100 investors from those markets attended FoundersHK Accelerate’s demo day.

“To get 100 investors from around the globe in front of a bunch of Hong Kong startups, that’s never happened before,” said Chuang. “This is a first and we’re hoping this will lead into future programs. Bonnie is a mastermind and our goal is to spiral these kind of events and do more and more.”

People from FoundersHK Accelerate’s leadership team and first batch of founders

Meet FoundersHK’s first batch:

Sleekflow is a B2B sales platform created specifically for social commerce companies. Most social commerce sellers rely on WhatsApp and other messaging apps to talk to customers and close sales. Since they don’t have a centralized hub, that means social commerce sellers need to do a lot of busywork, while missing out on valuable data that can boost conversion rates. Sleekflow is a SaaS selling platform for businesses that enables them to build customer flow automation (for example, sending offers if a shopping cart has been abandoned) and analytics to keep track of sales performance. It integrates with messaging apps, social media networks and CRM software like Salesforce. Sleekflow, which works primarily with mid-market and enterprise companies, plans to expand internationally by working with channel partners.

DimOrder is a “super app for restaurant management” that says it is now used by 5% of restaurants in Hong Kong. Co-founder Ben Wong comes from a family of restaurant owners and said he wanted to create a solution to reduce the amount of labor spent on operations, while increasing profit margins. DimOrder’s frontend includes ordering, delivery with integrated logistics providers throughout Hong Kong and marketing tools. On the back end, it can handle inventory purchasing, payment and analytics. DimOrder plans to add central kitchen and school lunch box ordering for 108 schools in Hong Kong next year to its frontend, along with working capital loans, inventory management and an HR system to its back end. It will expand to Southeast Asia next year.

Spaceship is a logistics platform focused on the fragmented cross-border courier, express and parcel services market. With more than 100,000 customers so far, Spaceship lets sellers compare providers, declare shipment content, chose time slots for shipments, make payments and track packages end-to-end. It also offers consumer services like logistics booking and relocation and moving services, and will launch other verticals, including a marketplace and travel planning. Spaceship plans to expand into Taiwan before entering other markets like Singapore, Thailand and Japan.

FindRecruiter is a bounty recruiting platform to help businesses find talent much more quickly than traditional recruiting methods. Co-founder Lawton Lai was a recruiter for a decade before launching the startup, and said it typically takes about 52 days to fill an opening. FindRecruiter can reduce that to about 17 days by working with more than 500 on-demand recruiters across six Asian countries who specialize in particular fields. The platform broadcasts job openings and matches employers with recruiters based on their sector, expertise and needs. FindRecruiter says its recruiters can earn 25% more in commissions and save 30 hours on cold-calling every month. Its clients include startup unicorns and bluechip companies.

PowerArena is a deep-learning analytics platform to help monitor manufacturing operations. It currently focuses on the electronics and automotive sectors, with clients like Wistron and Jabil. Even on manufacturing floors with many automated machines, more than 72% of the work is still done by people, says PowerArena’s founders. To use PowerArena, manufacturers install 1080p cameras and connect them to the platform for real-time analytics. For example, if there is a sudden slowdown in production, PowerArena can hone in on the cause, like maintenance being performed in one part of the factory.

WadaBento helps restaurants expand their operations and increase profit margins with automated vending machines in well-trafficked areas. It has sold 140,000 bento boxes in Hong Kong so far. Restaurants that want to expand usually have two costly options—opening new locations or delivery apps. WadaBento takes lunch boxes prepared by restaurants and puts them into their patented vending machines. Food is kept above 65 degrees during delivery and while they are in the machines, and hygiene is monitored through IoT devices. WadaBento has received patents in Japan, U.S. and China and recently signed a deal with Hong Kong’s largest fast food chain. It also recently shipped a machine to Japan, its first overseas market. It plans to deploy more than 200 machines by the first half of 2022.

Retykle wants to reduce fashion waste by making it easier to resell maternity and children’s wear. Co-founder Sarah Garner, who spent 10 years working at luxury fashion companies including LVMH, said kids on average outgrow 1,700 of clothing by the time they’re 18, but only about 5% of children’s clothing reaches the secondary market. Retykle’s goal is to keep as many items in circulation as possible. Retykle carries items for babies to mid-teens. All items are sold on consignment: sellers send clothing to Retykle, which then inspects each piece before listing it on the site. When an item sells, users get an email alert and cash or credit transfers. The company plans to launch in Singapore next month and in Australia in 2022.

Preface Coding is a tech education platform that provides scalable but customizable coding classes. Students can make on-demand bookings with teachers, and either meet with them virtually or at an offline location. The platform helps train teachers and most classes are 1:1. It serves a wide range of students, including kids aged 3 to 15, university students (especially Asian overseas students in the U.S. and Australia) and senior professionals in the financial, management and consulting industries. It’s also made partnerships with universities and banks, and plans to scale globally.

ZumVet is a pet care startup that offers video vet consultations, house visits and pharmacy deliveries, including medication and home-based diagnostic tests. Co-founder Athena Lee said ZumVet was created to help pet owners who don’t have a regular vet or live in areas where there aren’t a lot of veterinarian clinics. Vets perform consultations, create treatment plans and offer support remotely, or make house calls. Zumvet works with a network of independent vets and offers subscription plans to make pet care more affordable.

Big Bang Academy was created to address increasing demand for STEAM education and wants to make learning as “compelling as a movie, fun as a theme park and educational as a classroom” for kids. Its accredited curriculum includes videos and personalized lesson plans for each student. It also encourages a hands-on approach with experiment kits that are delivered to kids’ homes. The platform currently has 200 interactive sessions and a 70% course completion rate, a high number for an edtech platform. It business models include B2B, partnering with educational organizations, and B2C subscription models, and about 80% of its customer base is recurring. Big Bang Academy plans to diversify its content and create learning toys, too.

YAS Microinsurance is an insurtech startup with policies that can be activated in as little as five seconds, including coverage for running, biking or hiking accidents. It also recently signed its first partnership with Kowloon Motor Bus, one of the largest public bus companies in Hong Kong, to cover its passengers, including loss or theft or accidental medical expenses. YAS Microinsurance launched four months ago and says it now has $800,000 in committed revenue. About 6,300 policies were activated over the past couple of months, and it currently activates about 600 new policies per week.

RISE, one of Asia’s largest tech conferences, is returning to Hong Kong in March 2022 as an in-person event, and will be held there for at least five years, announced organizer Web Summit today. Last year, Web Summit said RISE would move to Kuala Lumpur, but its return to Hong Kong means the conference will no longer be held in Malaysia’s capital, though a spokesperson told TechCrunch that it is plans to host other events there in the future.

RISE will take place at the AsiaWorld-Expo from March 14 to 17, 2022.

In November 2019, while large pro-democracy demonstrations were taking place, Web Summit announced it was postponing RISE to 2021. Then in December 2020, it said that the 2021 event would not be held, and RISE would instead resume in Kuala Lumpur in 2022.

In an emailed statement, a RISE spokesperson told TechCrunch, “The political situation in Hong Kong did not impact our decision to consider Kuala Lumpur as a host city. Rise 2022 was originally meant to take place in Kuala Lumpur. However, this is no longer feasible. We would like to thank the MDEC, who invited us to host RISE in their wonderful city,” adding “RISE has already had five successful years in Hong Kong since its launch in 2015. Our long-standing relationship with the city made it a natural decision to stay.”

In Web Summit’s announcement, co-founder and chief executive officer Paddy Cosgrove said, “We are extremely grateful for the support the city of Hong Kong has given RISE over the last five years, and we couldn’t be more excited to return in-person in 2022.”

The announcement included a statement from Hong Kong’s secretary for commerce and economic development, Edward Yau, who said, “I’m very excited that RISE, the world-renowned tech event, has chosen to return to Hong Kong and stay here in the coming five years.”

Part of Y Combinator’s current batch, Deskimo wants to make finding coworking spaces easier. Its on-demand booking app is currently available in Singapore and Hong Kong, with plans to enter more markets after Demo Day. Its founders are former Rocket Internet executives who say that their main competition aren’t spaces like WeWork or other hot desk booking apps. Instead, its Starbucks, since Deskimo caters to people who usually work from home, but occasionally need a place nearby where they can get away from distractions or take meetings. Deskimo partners with employers and charges them by the minutes their workers spend at space, instead of a monthly or yearly fee.

Deskimo was launched in February by Raphael Cohen, Rocket Internet’s former head of Asia, and Christian Mischler, who co-founded Foodpanda and served as its global chief operating officer. After Rocket Internet, the two started HotelQuickly, an on-demand booking app they sold in 2017.

The pandemic has quickly changed attitudes toward remote work, with a McKinsey survey finding that 62% of respondents said they only wanted to return to the office a few days a week, or not at all. As a result, many companies, especially startups, will continue offering flexible arrangements.

Mischler and Cohen already have experience watching peoples’ behavior shift after Foodpanda was launched. “Back in 2012, people were saying that food ordering is not going to work online, people just order on the home or in person,” Cohen said. “What we learned from on-demand restaurant delivery, the shared market-based model, is very similar in that case to setting up with workspace partners.”

Deskimo now has about 40 properties in Singapore and 25 in Hong Kong, and wants to expand in both residential and business districts, since many remote workers prefer to find a space close to their homes. It works with several different types of property owners and is approaching each group step-by-step. The first are office spaces that are already set up for coworking and see Deskimo as an additional distribution channel. The second are hotels that are converting some of their space into coworking areas. Finally, Deskimo plans to partner with spaces like social clubs and event venues that usually sit empty during weekdays.

On the client side, Deskimo contracts with companies, who then offer the app to their employees. Each person gets a monthly budget on Deskimo, and their employers are only billed for the time they spend at a space. The Deskimo app generates a QR code that workers use to gain access to one of its spaces, and they also scan it when checking out to record how long they were there. Pricing ranges from about $2 to $4 USD per minute, with desks in central business districts typically costing more. Aggregated invoices are sent to clients each month and revenue is then shared with coworking space owners.

“Many companies realize they can save a lot of costs by having people work from home so they can reduce their office space, and instead of adding more fixed costs, they just add variable costs,” said Mischler. “They provide their employees with the ability to go to an office, but if they don’t want to because they have a great home to work from, employees are also more than welcome to work from home.”

In Deskimo’s current markets, other on-demand coworking space apps include Switch, Flydesk, WorkBuddy and Booqed. But Mischler says its main competitors are large F&B chains like Starbucks, since they are easy to find. He adds that Deskimo is more efficient for workers, who are guaranteed a table and don’t need to worry about finding outlets or the quality of Wi-Fi. Besides expanding into more markets, Deskimo also wants to add other services on top of coworking to give it a competitive edge.

“Once we have the company relationships and their employees use Deskimo for their bookings, there’s a lot of different things we can build on top of it, whether it’s employee engagement or workforce management, not just workplace management,” says Mischer. “But we’re focused on the transactional model right now because that’s the biggest pain point.”

AfterShip launched in 2012 to help online sellers track packages across different carriers, but since then it has built a suite of data analytics tools covering almost every step of the shopping experience, from email marketing to customer retention. The Hong Kong-headquartered startup announced today it has raised a $66 million Series B led by Tiger Global, with participation from Hillhouse Capital’s GL Ventures.

AfterShip’s last round of funding was a $1 million Series A in 2014. Co-founder Andrew Chan told TechCrunch that the company has been profitable since its launch and grew mainly through word-of-mouth referrals and partnerships, like a Shopify integration, that boosted its profile. But the company recently added a sales team and will use its latest capital on international hiring for sales and customer support. It also plans to launch new products and expand further in the United States, where about 70% of AfterShip’s customers are located.

The company’s software enables sellers to track shipments made through more than 740 carriers and handles more than 6 billion shipments each year. AfterShip’s partners with about10,000 companies, including some of the biggest names in e-commerce: Shopify (where it is used by 50,000 merchants), Magento, Squarespace, Amazon, eBay, Etsy, Groupon, Rakuten, Wish and retail brands like Dyson and Inditex.

AfterShip’s core product is its shipment tracking platform, but it also makes apps for shoppers, including self-service returns and package tracking, and sales and marketing tools for merchants that let them get more use out of data from shipments. Chan explained that package tracking is also a user engagement tool for sellers that lets them show more product recommendations and promotions to shoppers. AfterShip’s tools enables merchants to create their own branded tracking pages and notifications. Other features allow them to track the performance of different carriers, create email marketing campaigns and increase customer retention.

Its CRM capabilities help AfterShip differentiate from other shipment tracking aggregator providers.

“When we think of our vision, we look at what Salesforce is doing, but is there an e-commerce Salesforce that can cover more topics for sales people to use,” Chan said.

In press statement, Pangfei Wang, global partner at Tiger Global, said, “AfterShip leads the charge in making the shipping process more transparent and reliable for consumers and companies alike. As growth in e-commerce spirals ever upward, we are excited to partner with AfterShip and its leadership team as they continue to advance technology in this critical and expanding industry.”