Founded in 2014, Blossom Finance was first intended for Muslim entrepreneurs in the United States. The microfinancing platform connects investors with small businesses using mudarabah, a shariah-compliant profit-sharing agreement. But founder Matthew Joseph Martin soon realized that the startup, backed by investors like Boost VC and Tim Draper, was serving a relatively niche market in the States. So he started researching markets with large populations of Muslim people. Indonesia emerged as the best choice.

Southeast Asia is already home to a thriving fintech scene, where Grab, GoTo and Sea have built super apps that encompass financial services, and startups like Xendit, Akulaku and Dana (to name a few) have raised hundreds of millions of dollars for payments, banking services and other financial tools. Indonesia and Malaysia, in the heart of Southeast Asia, are among the countries with the largest Muslim populations in the world.

These factors are proving fertile ground for establishing and growing fintechs that focus exclusively on Islamic finance, offering products and services that follow shariah law. Among other things, this forbids accruing interest, speculation and financing non-halal products like pork, tobacco and alcohol.

According to the World Bank, Indonesia has the most Islamic fintech companies in the world – perhaps fitting, since it’s also the most populous Muslim-majority country in the world with about 231 million Muslims.

Some notable Islamic fintech companies include peer-to-peer lending platform and digital bank Hijra (formerly known as Alami), online bank Bank Aladin, LinkAja, which is backed by Telkomsel and Bank Mandri, the largest bank in Indonesia in terms of asset loans and deposits.

Gojek’s GoPay is also partnered with the Indonesia mosque council to allow users to make zakat, or obligatory alms giving, online.

Meanwhile in Malaysia, where 61.3% out of its 33.6 million inhabitants practice Islam, fintech companies that focus on Islamic finance include crowdfunding platform Ethis Ventures and investment platform Wahed, which is the only shariah-compliant robo-advisory platform in the country. Funding Societies, the SoftBank Vision Fund II-backed SME digital lending platform, recently launched a shariah-compliant financing product there, and now offers it as the default product to all its Malaysian customers.

Shariah law calls for a different approach to financial services, and conventional banks are also launching products for Muslim customers. Along with the growing number of Islamic fintech startups digitizing the process, Islamic-compliant services are becoming accessible to more people.

Profit sharing instead of debt

The seed of Blossom Finance was planted when Martin was running a project in the U.S. enabling people to buy Bitcoin. He ran into a receivables problem, and the usual way to finance cash receivables is to get line of credit or receivables financing from a bank. As a practicing Muslim, however, Martin couldn’t use conventional loans. But he also couldn’t find any other options in the U.S.

“Quite naively, I thought there are plenty of Muslims who own businesses, surely they face the same problem,” he said. “They must have a solution. So what is the solution?”

After learning more about the principles of Islamic finance, Martin launched Blossom Finance, a platform that connects investors with microbanks, which in turn disburse shariah-compliant financing to microbusinesses. Headquartered in Delaware, Blossom Finance hosts investors from primarily the United States and Europe, but all of the microbusinesses it serves are in Indonesia.

After initially soft-launching in the U.S., the Blossom Finance team realized that the market there for Islamic finance was very small, said Martin. They started looking for a bigger market, and landed on Indonesia because of the financial inclusion challenges facing micro and small businesses.

Other reasons Blossom Finance chose Indonesia over other countries with large Muslim populations included its relative political stability, Martin said. It also has a strong baseline infrastructure for operating businesses with primarily foreign capital.

“There’s already been over the past two decades prior to us arriving tons of amazing work,” Martin said. “A lot of the groundwork was already there and we were able to come in and operate as a connector where there are inefficiencies, and a lack of capital. We were able to bridge that lack of capital using a technology solution. All that underlying infrastructure for the last mile of serving the microbusinesses was already there and we were able to tap into it.”

Investors on Blossom Finance’s platform pool their money into funds, or cooperatives, which are then managed by microbanks. The microbanks disburse the financing to microbusinesses to purchase inventory and other things they need. All losses and profits are shared pro rata, Martin explained. If an investor’s capital is 1% of a fund, they can expect to receive 1% of its profits, or absorb losses at the same rate.

What makes Blossom Finance’s microfinance platform shariah-compliant is its use of murabaha contracts instead of traditional interest-charging loans. For example, when a microbusiness, like a corner store, needs to buy inventory like beverages or snacks, they go to one of the cooperatives for financing. Martin explains that the basis of the financing is not the capital, but the commodity that needs to be purchased. The cooperative purchases it at wholesale prices and provides it to the business at a markup instead of charging interest. They then share the profit with investors. Martin said cooperatives can often connect microbusinesses with wholesalers that they didn’t previously know, and also benefit from economies of scale, which also helps microbusinesses.

An Indonesian warung, or small store selling snacks, drinks and daily use items (Gratsias Adhi Hermawan/Getty)

Cooperatives don’t set prices, and instead mudarabah agreements are based on current market prices, which microbusinesses agree to. To make sure microbusinesses get fair agreements from microbanks, cost of funding for microbusinesses is one of the things Blossom Finance takes into consideration when deciding whether to work with a cooperative/microbank.

“Let’s say you’re the bank and I want to buy chickens. You agree to buy me 100 chickens. Let’s say it costs $1,000. We will agree that your profit will be 20%, so I have to pay you $1,200 over the course of, say, 12 months. So you as the financier have that 20% profit,” Martin said.

The advantage of working with cooperatives instead of commercial banks is that they provide more flexible payment terms and financing tenure, which is helpful if a business runs into financial difficulty, Martin added.

Martin said there is discussion among Islamic scholars about whether or not profit-sharing is inherently better than debt. But, he asks, “if equity and debt are equal, why is it that the Prophet Muhammed prayed for protection from debt? I think we all inherently know the answer to that question, because debt can trap the poor in a cycle of poverty that they cannot escape. Equity, on the other hand, involves the concept of risk participation. Investors hopefully have a better upside, and the reason they get that better upside is because they’re participating equally with the entrepreneur in terms of risk.”

Fostering financial inclusion

A 2022 report by research firm DinarStandard and fintech Ellipses estimates that the market size of Islamic fintech in the Organisation of Islamic Coorporation (OIC) countries was $79 billion in 2021, making up 0.83% of global fintech transaction volume. While Islamic fintech’s market size is still small, it is expected to reach $179 billion at a 17.9% CAGR by 2026, outpacing traditional fintech’s 13.5% CAGR growth over the same period.

DinarStandard and Ellipses also found that there are 375 Islamic fintech companies around the world. Most are in the P2P financing space, and Indonesia is one of the top markets in transaction volume.

Islamic fintech startups in Malaysia and Indonesia have the support of government policies. For example, Indonesia’s National Islamic Finance Committee is focused on developing Islamic finance and the country’s Islamic economy.

And in Malaysia, Bank Negara’s Investments Accounts Platform is the first Islamic P2P initiative established by a central bank, while the government-owned Malaysia Digital Economy Corporation connects investors with halal business owners. In 2019, the Malaysian government also issued its Shared Prosperity Vision 2030, a 10-year framework for restructuring its economy that includes building an Islamic fintech hub as a key part of its strategy.

The World Bank has said that the growth of Islamic fintech can foster financial inclusion by giving unbanked people access to financial services.

For example, one group of people it can reach are those who avoid bank accounts because their terms are not shariah-compliant, and want usury-free financial transactions based on risk-sharing. Islamic fintech can also help resolve issues that unbanked people face, like lack of money, lack of proper documentation and being located far away from conventional Islamic banks.

Golden Gate Ventures partner Justin Hall, an investor in Hijra and Funding Societies, believes that Islamic fintech makes Islamic financial services accessible to more people.

“Islamic banks are extraordinarily conservative, not only with how they operate, but the cost of financing, who they can lend to, etc.,” he said. “Having companies that differentiate from that and provide a nice consumer experience on the digital banking side, but within the framework of an Islamic bank, there’s an opportunity there.”

The World Bank also says the Islamic microfinancing, or short-term financing with terms of less than 12 months, can play an important role in alleviating poverty in OIC countries since they work with customers who are often underserved by traditional banks.

One example of a fintech company creating shariah-compliant products for underserved customers is Funding Societies, which is headquartered in Singapore with operations in Indonesia, Malaysia and Thailand.

Kien Poon Chai, the country manager of Funding Societies Malaysia, said its shariah-compliant financing product was launched in 2022 to serve relatively new micro- and small businesses, which are usually overlooked by banks when seeking working capital.

Chai said the impetus for launching shariah-compliant financing products was because Malaysia has a large Muslim population and the company was seeing demand from lenders and SMEs looking for financing products in line with their faith.

Funding Societies underwrites its shariah-compliant financing product in the same way as its conventional financing counterparts, but there are several nuances it has to pay close attention to. For example, financing cannot be used for non-halal businesses, including ones that sell alcohol, pork, tobacco or massage houses.

Financial offers also have to be backed by underlying assets, so for every disbursement Funding Societies makes through its shariah-compliant product, it has to purchase underlying commodities through exchanges.

Fee disclosures and charges also have to be shariah-compliant. There cannot be uncertainty in financing products, so all fees and charges must be clearly defined and outlined. For example, penalizing people for early repayment with prepayment fees is forbidden.

Peer-to-peer lending without interest

Another Islamic startup focused on financial inclusion is P2P lending platform and neobank Hijra. Founded in 2018, Hijra has raised $30 million in equity from investors like Quona Capital, Golden Gate Ventures and EV Growth. It first started as an aggregator of traditional Islamic banks serving SMEs, but co-founder and CEO Dima Djani told TechCrunch that after about 9 months, the team realized that the Islamic banking industry in Indonesia couldn’t keep up with the growth of fintech.

As a result, Hijra got licensed by Indonesia’s Financial Services Authority (OJK) in 2019 to operate as a digital lending platform. Then retail lenders began asking for more comprehensive financial services, so Hijra, then known as Alami (which is still the name of its P2P lending platform) acquired a small Islamic bank last year and launched a new digital bank with savings accounts and money transfers.

The main reason Djani wanted to launch an Islamic finance platform is because Indonesia has one of the largest Muslim populations in the world, but the penetration of Islamic finance was still very low, at about 6% to 7% of total banking assets, compared to about 30% penetration in Malaysia. Djani attributes this to low consumer awareness of Islamic finance, but says a new wave of religious teachers, who gain followers on social media, has given rise to a strong halal economy over the last 10 years and also spurred interest among millennial and Gen Z Muslims in adopting services that are tailored to their faith.

In Indonesia, the guidelines for Islamic finance are determined by three authorities, said researcher Fahmi Ali Hadaefi. These are the Financial Services Authority (OJK), which regulates and supervises the financial services sector, Bank Indonesia, which oversees banks, and the Majelis Ulama Indonesia (National Sharia Board-MUI), or the country’s leading Islamic scholars body.

The MUI has published at least two fatwas on fintech. The first, issued in 2017, is about Islamic perspectives on practices related to e-money. The second one, issued a year later with the Financial Services Authority, covers Islamic fundamentals for P2P lending.

Since Muslims are prohibited from interest-bearing transactions, Hijra’s team wanted to provide an alternative for users in need of working capital financing. Like Blossom Finance, it uses a profit-sharing model to avoid interest.

The way it handles P2P loans between lenders and farmers is one example. When a fish farmer needs to buy feed, they don’t take out a loan with interest from a lender. Instead, their lender buys fish feed and sells it at a profit to the farmer, with markups based on current market rates. Instead of paying for the feed immediately, farmers pay it off after harvesting fish in about three to four months.

Islamic finance is meant to create a transparent and fair financial service for everyone,” said Djani. “For example, we view interest or usury as an unfair instrument on its mechanics. In addition, we also view that speculation and gambling as unfair, as they do not commensurate the effort and return evenly.”

Harvesting fish on Ganga Island, North Sulawesi, Indonesia (Giordano Cipriani/Getty)

Hijra’s digital banking app, which it was able to launch after acquiring the small Islamic bank in Jakarta, doesn’t give any yield to depositors at the moment, but it also doesn’t charge them any fees. In the future, Hijra is planning to launch more sharia-compliant financial solutions, like rent-to-own, payments and community-driven savings for groups of people who have a common goal, like saving money for a trip to Mecca.

Building a halal payment gateway

Another example of a company founded to get more Muslims participating in digital financial services is PayHalal, which was created to provide a shariah-compliant online payment gateway.

Co-founder Pat Salam Thevarajah told TechCrunch that he and fellow PayHalal co-founders realized in 2016 that if they wanted to get more people in the Muslim community to adopt online payments, they would have to build their entire tech stack from the ground up, instead of going to a white-label provider like Ayden. Thevarajah said that 55% of the Malaysian population is unbanked primarily because they fear riba, or interest.

“We built it because of the pure necessity to create end-to-end compliance into the transaction. That’s how PayHalal came about. The primary objective is to keep payment free from riba and gharar, or speculation, so that Muslims are able to perform electronic payments in person or e-commerce without any form of non-compliance.”

One of PayHalal’s goals is to create a network like Visa or Mastercard that stays true to Islamic finance principles. One key difference is the lack of interest.

Conventional payment gateways treat money as a commodity, which means it can be sold at a price higher than face value or lent out with interest. PayHalal does not treat money as a commodity, instead only using it to purchase goods and services, and makes profit on the trading of goods or services. PayHalal makes sure its services are shariah-compliant with the help of two team members, scholar Dr. Daud Bakar and co-founder Indrawathi Selvarajah, who was a corporate lawyer before she became a shariah fintech specialist.

Right now, when an instrument comes from a conventional financial institution, PayHalal feeds it into its AI-based non-shariah compliance screening tool. The tool then suggests treatment based on the amount of non-compliance factor, and PayHalal says that it takes the fee it earns on the transaction, writes it off and contributes it to social work, like feeding poor people or building mosques, as part of a process called purification.

Thevarajah said the process is auditable because Islamic financial institutions have internal shariah compliance departments, which in turn undergo regular audits by external shariah supervisory boards. The process of identifying non-compliant transactions, writing off profits and donating fees is documented and reviewed by internal and external auditors for accuracy.

Some examples of shariah non-compliant transactions include ones that involve the sale of forbidden items like alcohol, tobacco and pork. Transactions that involve riba or gharar are also considered non-compliant, and these can include interest charged on late payments or uncertain terms used in sales contracts.

“There is no guarantee that we can keep riba away, unless it’s a closed-loop Islamic transaction,” said Thevarajah. “If it becomes an open-loop transaction, we are then required to do purification.”

Cases of non-compliant transactions it tries to avoid include the exchange of goods for consumption that aren’t made with halal ingredients. Another is in cases of salaam contracts, where a buyer pays immediately for something that will be delivered at a later date. When that kind of transaction is handled by PayHalal, it mitigates chargebacks by making sure customers get their goods at the agreed upon time.

“Transparency is fundamental with Islamic transactions,” Thevarajah said.

One of PayHalal’s goals is to build a super app with different shariah-compliant financial services, like insurance products and saving accounts for pilgrimages to Mecca. It recently took a step toward expanding its product portfolio by launching a shariah-compliant buy now, pay later service with Atome. The BNPL program is interest-free and has no annual and servicing fees. It is currently onboarding merchants who offer halal and shariah-compliant services and products.

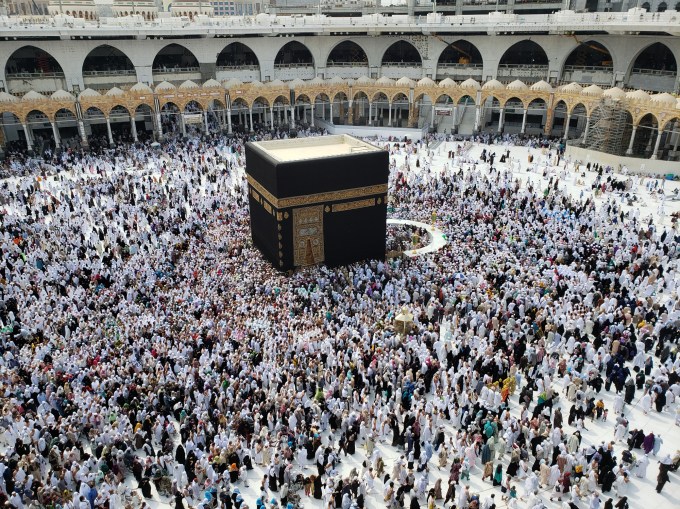

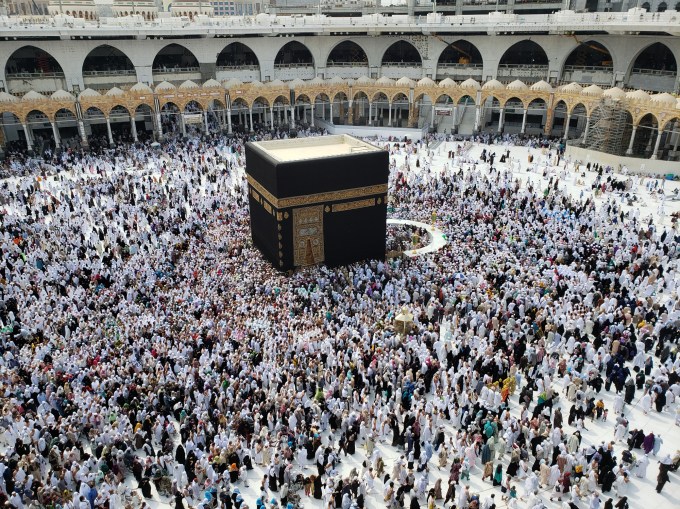

Mecca during the Hajj pilgrimage (Reptile8488/Getty)

Thevarajah explains that if a customer defaults beyond the three-month term of the loan, PayHalal can’t charge interest. Instead, it has to underwrite the entire transaction. “Our contract with the merchant would be active participation where we buy the product and we resell it to the consumer for the consideration of a fee,” he said, adding “The contract changes the entire structure of how an Islamic buy now, pay later operates.”

Thevarajah added that transactions are structured as deferred payment sales, which means PayHalal, acting as the seller, buys the product for a supplier and then sells it to a customer at a profit margin. The customer than pays off the total price of the product in installments over a predetermined period of time. The transaction is asset-based, which means that it is secured against the product being sold, not the buyer’s creditworthiness.

Still early days

The rise of Islamic fintech in markets like Indonesia and Malaysia is tied to the growth of Islamic finance in Southeast Asia. According to a S&P report published last year, Southeast Asia’s $290 billion Islamic banking market is expected to continue growing at a CAGR of about 8%. In Malaysia, Islamic banks will make up 45% of the overall commercial banking loan book by the end of 2025, and in Indonesia, Islamic finance’s market share is expected to grow to 10% by the end of 2026, at a faster rate than conventional banks.

But Islamic fintech still makes up a very small percentage of the total market. As stated earlier, DinarStandard and Ellipses estimate that the market size of Islamic fintech in was OIC countries was $79 billion in 2021, or just 0.83% of global fintech transaction volume. But that’s not stopping Hijra from making international expansion plans—the team already has an eye on Malaysia, Turkey and Saudi Arabia.

Golden Gate’s Justin Hall, also an investor in Hijra and Funding Societies, believes Indonesia is uniquely positioned to be a starting ground for Islamic banks to expand to other markets around the world.

“Indonesia is the only country today that has a confluence of operators that understand Islamic banking, as well as serial entrepreneurs, institutional LPs that are willing to capitalize companies that are doing that, and a very, very large domestic market. It’s very rare to find a model unique to Southeast Asia that can go global and I actually don’t know of any but Islamic fintech.”

As Muslim fintechs create a more inclusive market landscape for Muslim users, they are also working on their own inclusivity issues, such as getting more women into the field of financial technology businesses.

Djani said the rate of women working in Muslim fintech is still comparatively low, though some have promoted women to leadership roles, including Hijra’s chief financial officer Febriny Rimenta.

One of the co-founders of PayHalal, Selvarajah, is a woman and Thevarajah said Muslim fintech startups can take several steps to get more women into the space, including building a gender-inclusive workplace based on Islamic values, providing flexible working arrangements, mentorship and promoting transparency to build trust with women employees.

He added that Muslim fintech startups can design products, including savings and investment platforms, to increase women’s financial empowerment.

Martin said the cooperatives Blossom Finance works with typically have a high representation of women, with one that is staffed completely by women.

Barriers exist in other aspects of the space, too. On the fundraising front, Martin said one of the main obstacles he faced in the U.S. was educating investors.

“First you have to explain what does Islam say and why is this even a problem, and then you explain your situation. So that was a challenge. However, I would say for VCs who were able to connect the dots and understand it was a genuine problem—there were some that did say, ok, maybe this is too niche and they passed—but for those who were able to take the time to understand the problem, we didn’t face any barriers.

Perhaps surprisingly, the most pushback he got was from other Muslims.

“Where we did face barriers was within Muslims living as a minority in America. They pushed back against: ‘why are you calling this Muslim? Why are you focused on Islam?’” he said. “Very interestingly, the venture capital investors [who did back us] were like, this makes sense. This is an important niche. I think that goes back to being a minority and post-9/11, and being defensive. There is that resistance versus going to a Muslim-majority [market], where it’s like “well of course you’re doing Muslim finance, why wouldn’t you?”

For Islamic fintechs, finding investors can also mean doing their own due diligence.

PayHalal, which has received $4.5 million in seed funding from Asad Capital, Q Cap, Effective Shields and Crescent Capital, is now in the process of raising a $5 million Series A round at a valuation of $33.5 million. Thevarajah said part of fundraising means assessing potential investors to ensure both they and their fund management is done in alignment with shariah principles.

“Investor interest in the Islamic fintech sector for PayHalal was very high due to its potential in a fast-growing Muslim population worldwide,” Thevarajah said. “While some investors viewed it as a captive market due to the religious beliefs of the Muslim community regarding halal food and transactions, we still had to ensure that potential investors fell within the fit and proper category for Islamic financial services.”

Founders in countries with large Muslim populations say they also had to educate investors, but that is changing. The $30 million Hijra has raised in equity so far is almost all from non-Muslim countries. Djani said several of its investors already had a strong interest in Islamic financial services because it is a growing niche that is able to provide differentiation for fintech players.

“We will need to do education on what we are offering, but dramatically less so over the past few years as Islamic finance has become more mainstream and widely accepted in Muslim-majority countries, like Indonesia,” he said.

Muslims come into the frame in Southeast Asia’s fintech boom by Catherine Shu originally published on TechCrunch