S@SThom.as

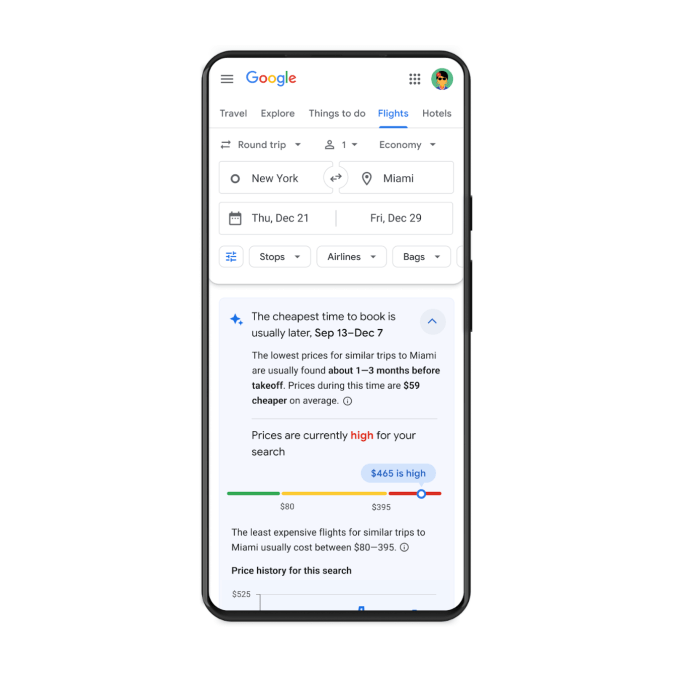

Google Flights today is releasing a new feature that will help travelers better determine the right time to book. Rolling out this week, the company is debuting new insights that will leverage historical trend data that lets consumers see when prices have typically been lowest to their chosen destination on their selected dates.

The addition aims to help consumers answer the question as to whether it’s better to book their flight now or wait for lower prices.

For example, Google explains, the new insights could tell users that the cheapest time to book their trip is currently two months prior to departure or that, typically, prices for their trip have generally declined closer to the date of departure. With this new understanding of whether or not they’re getting the best deal, consumers may chose to either book immediately or wait for a better price.

Image Credits: Google

The feature complements other insights Google Flights already offers, like the ability to see whether current prices for your search are low, typical, or high, compared to past averages.

In addition, users have the ability to turn on price tracking to receive notifications when flight prices fall significantly for their selected dates or flexible dates, depending on their preferences.

Some flights will also feature a price guarantee badge which means Google is confident the fare won’t get any lower before departure. If it does, Google will refund the difference via Google Play. This is part of a pilot program available for select itineraries in the U.S.

The new “cheapest time to book” insights and other flight savings features were announced today in a Google blog post that also included a look at 2023 flight booking trends, showing the latest data through July 2023.

Among the highlights, it found that for flights around Christmas, average prices have been lowest 71 days before departure, compared with 22 days before takeoff in the 2022 trends report. Plus, there’s no longer a “sweet spot” where prices dip before going back up for U.S. trips to Europe, it found. Prices tend to be lowest 72 days or more before departure, said Google.

Tesla has new, lower price options for shoppers who need less range. The automaker revived the “standard range” trim level on its two most expensive models, which cuts $10,000 from the price and around 80 miles from the EV range.

With this new option, the Model S is available with a starting price of $78,490 with a 320 mile range, while the Model X now starts at $88,490 with 269 miles of range. For the Model S, that’s down from $88,490 with 405 miles of range, and for the Model X, it’s down from $98,490 and 348 miles of range.

This trim option was previously discontinued in 2021 when Tesla started only selling the extended range and high performance Plaid kits.

According to the Model S and Model X product pages, the new Standard Range trim weighs the same amount as the extended range option. This likely means the vehicles sport the same battery pack and the range is limited by a software lock. Tesla might allow owners to unlock additional range after the purchase for the difference in price.

This is the latest in a series of worldwide price adjustments made by Tesla over the last 12 months leading to a decline in gross margins. The automaker cut the price of the Model Y and Model 3 several times over the past year. The higher-end Model S and Model X say price reductions, too. This latest move is different from previous adjustments in that it’s the first time Tesla cut the price and the range to offer vehicles at a lower price point.

Zeelo — a ‘smart buses’ platform providing bus operators, employers and schools with private bus and shuttle transport programs — has secured $14 million in a fresh Series A ‘Extension’ round of funding. The new investment was led by FlatzHoffmann (a European growth equity investor) and was joined by IREON Ventures (the CVC arm of Motor Oil Hellas), and an unnamed Boston-based family office.

Zeelo now plans to accelerate sales and US operations on the East and West coasts, as well as work on its tech platform.

A company spokesperson clarified that this round is an equity-based extension rather than a Series B or growth equity round because – based on its growth in the US – the company plans to attract US lead investors for it’s next stage of funding.

Up until this point Zeelo has ‘been through the wringer’ somewhat, after having to abruptly reverse out of an acquisition by mass transit group Swvl, which itself had fallen fowl of the massive devaluations in SPACs. The lauded $100 million buyout was only announced three months prior to that.

Last year, Swvl, an Egyptian-born startup that provides shared transportation services for intercity and intracity trips, layed-off 50% of its remaining headcount. The 99% stock tumble it took after a SPAC merger might have had something to do with it.

That said, while Swvl agreed to terminate the acquisition of Zeelo, it had already committed to a $5 million convertible promissory note for Zeelo, which the latter managed to retain.

Prior to all that, Zeelo had raised $19.6 million from investors such as ETF Partners, InMotion Ventures and angels. The full funding outline to date is: At pre-Seed the company raised $1.6 million, then a Seed of $6 million. Its Series A part 1 was $12 million, then the above Series A extension of $14 million. That makes it’s total Series A $19.6 million, with the total funds raised standing at $33.6 million.

Outside of the UK, Zeelo now has a second headquarters in Boston, Massachusetts, and co-founders Sam Ryan and Barney Williams have fully relocated to the US. It now has contracts with Fidelity, and some, unnamed, large enterprise clients.

After a tumultuous 2022, Sam Ryan, Co-Founder and CEO at Zeelo told me the company was “thrilled” when it managed to get the Series A extension, especially in the current market: “But the underlying growth of business even through last year has been really strong.”

I asked him what has been fueling the business? In short, it’s down to both the lack of public transport options in the US and the cost of living crisis: “Our business… works very well in places where there’s limited public transit, where people are car dependent. A lot of our customers are in manufacturing, distribution and warehouses where a lot of workers can’t afford cars. It’s a big issue outside of London, but it’s pretty much an issue everywhere outside of Manhattan.”

He said there was a “big increase in demand when fuel prices increased, because employees were becoming noisier about the cost of their car.”

He added that although there is spotty competition there is a large and ready market in the US for this model: “On a deal by deal basis we rarely bump into anybody. There is some competition but given the size of the market, the whole thing is wide open.”

Christopher Hoffmann, Partner at FlatzHoffmann added in a statement: “Zeelo is a unique and proven mobility player headquartered in Europe with a strong expansion push to the US. It combines a strong transit-tech platform with a clear sustainability mission.”

We love mergers and acquisitions here at TechCrunch. We even kind of like reverse mergers. But this latest development in the robotics industry sure has us excited!

Delivery robots maker Serve Robotics is going public via a reverse merger with a blank-check company, and it raised $30 million just before the deal. That could be great for the company, but we’re more interested in the visibility this deal grants us into the economics of building, deploying and running a fleet of delivery robots.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

On one hand, using people to move goods around cities is expensive and can contribute to congestion and pollution. On the other, when has anything about robotics been cheap?

Using tech instead of flesh and blood usually results in savings — you only need to look around yourself to realize the benefits of the industrial revolution and the Internet. But robotics can prove tricky even for smaller sidewalk-level devices, despite recent advances.

Using tech instead of flesh and blood usually results in savings — you only need to look around yourself to realize the benefits of the industrial revolution and the Internet. But robotics can prove tricky even for smaller sidewalk-level devices, despite recent advances.

So, how good is Serve’s business? We do not know. What we can tell from the numbers, however, is that it’s still early days for companies deploying hundreds or even thousands of robots to bring you food and groceries.

Serve’s numbers

When a company files to go public, we usually sigh with excitement because we get to pore over its last few years’ financial results to understand the business’ health and valuation prospects. Serve doesn’t fit that model well.

The company recorded no revenue in 2021 and managed a mere six figures of topline in 2022, so we are not dealing with your traditional tech shop on its way to the public markets. Serve has a good reason for working to go public, though: As my colleague Kirsten wrote, following the SVB crisis, the company found itself on uncertain financial ground, which led its co-founder and CEO Ali Kashani to take a closer look at the company’s approach to raising capital, and he decided Serve needed a broader scope of investors.