Even as cloud infrastructure market growth slows, Microsoft continues to gain on Amazon

It was a rough quarter for the cloud infrastructure market as companies looked for ways to cut back on spending in an uncertain economy. When you combine that with the strong dollar and a weak Chinese market, the market slowed to 21% growth, a precipitous drop from the 36% growth we had seen the year prior.

While we aren’t seeing the gaudy growth of years past, Synergy Research still found the market exceeded $61 billion for the quarter with the 12 month trailing revenues of over $212 billion, a hefty sum by any measure, even with the slowdown.

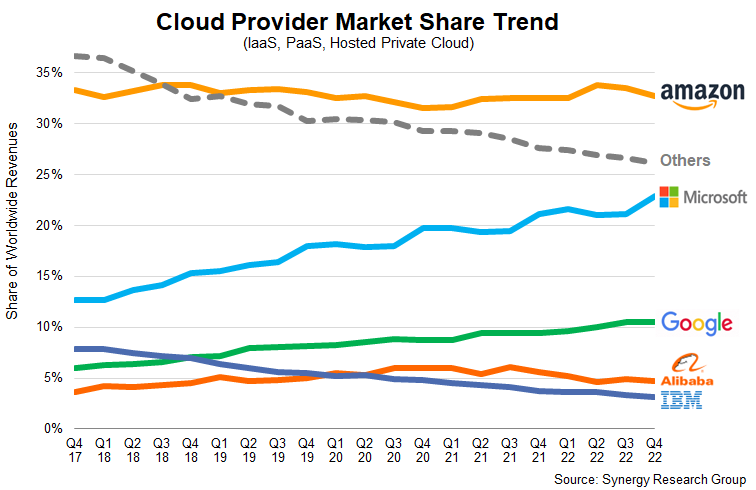

Also of note was that while each of The Big Three saw growth slow in Q4 2022 from the previous quarter, Microsoft still managed to gain market share ground on Amazon. Microsoft increased its share from 23%, up from 21% the prior quarter, while Amazon fell from 34% to 33% and Google remained steady at 11%. The Big Three cloud providers accounted for 66% of worldwide cloud revenue.

That comes out to approximately $20 billion for Amazon, $14 billion for Microsoft and $7 billion for Google. Per usual, this is looking at IaaS, PaaS and hosted private cloud services. It doesn’t include SaaS, which is measured separately.

Image Credits: Synergy Research

Amazon cloud revenue grew a modest 20% over the prior year, and the company acknowledged in the earnings call that growth dropped even further to the mid-teens in the first month of the year. Meanwhile Microsoft reported cloud growth of 22%, down from 24% the prior quarter and Google Cloud revenue grew 32%, down from the 38% growth the previous quarter.

Amazon was first to market and has had a long head start, but it seems as the market slows after years of steady growth, it’s giving its chief competitor, Microsoft, a bit of an opening to gain on them. It could be partly due at least to the fact that Amazon’s market maturity is finally catching up to it, and Microsoft is able to gain some advantage in spite of spending slowing overall.

John Dinsdale, chief analyst at Synergy says there were three key reasons for this quarter’s drop-off, which he believes are short-term issues, and he remains optimistic for the future. “There are three main factors. The strengthened US dollar diminishes the apparent growth rate of many non-US markets; the large Chinese market remains constrained by pandemic issues and local policies; and the worsened economy has caused some enterprises to more closely review spending on cloud services. These factors should be primarily short term in nature and Synergy forecasts that growth rates will remain strong over the next few years,” he said in a statement.

It will be interesting to watch the market in 2023 and see how the macro economic environment affects revenue, and if the slower growth we’ve been seeing continues to work in favor of Amazon’s competitors by enabling them to gain more ground.

Even as cloud infrastructure market growth slows, Microsoft continues to gain on Amazon by Ron Miller originally published on TechCrunch