App downloads were stagnant in the fourth quarter, new analysis finds

The global app economy slowed for the first time last year, as consumer spending on apps dropped 2% to $167 billion, according to a recent annual report put out by data.ai. At the same time, downloads were up 11% year-over-year — a seemingly positive indication that app adoption was still taking place, driven in particular by emerging markets. But a deeper analysis of the fourth quarter points to more recently slowing download growth during a time of year that’s typically a boon for the app ecosystem. The holiday season tends to bring new phones and more free time for consumers to try new apps and games, which makes these new figures all the more surprising.

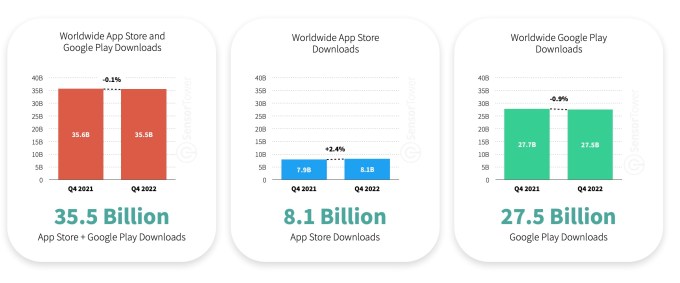

According to app intelligence firm Sensor Tower, mobile app adoption across the App Store and Google Play Store leveled off in Q4 2022, declining a slight 0.1% year-over-year to reach 35.5 billion new installs in the quarter.

Image Credits: Sensor Tower

Its analysis is on a per-user basis, meaning additional downloads of an app by the same person on different devices aren’t counted towards the total. It also doesn’t count app re-installs in order to show only new download growth. However, its figures are only estimates.

While the fourth-quarter trends weren’t enough to pull down the overall year-over-year download growth metrics, it seems, it’s another signal of a stagnating app economy — one, no doubt, still normalizing after outsized growth during Covid and one that remains impacted by the overall macroeconomic forces, which also play a key a role in app marketing spend.

But there’s another argument to be made here, as well, and that’s that the years of high-priced commissions on app sales and in-app purchases across the global app stores have finally begun to impact the innovation taking place in the wider app ecosystem. If companies have to share up to 30% of their revenues just to distribute their apps and games to a mobile audience, it’s more difficult for them to weather a storm like a down economy. And entrepreneurs may be less inclined to build for mobile, specifically, when other areas of the market are less restrictive. Look at the developments around crypto and Web3, for example — they couldn’t fully expand to mobile because of app store guidelines and the platforms’ need to profit from in-app purchases. With so much pressing down on app innovation, it’s not surprising to see downloads and spending suffer.

This trend isn’t only apparent in the metrics surrounding the stagnating app install rates and declining spending.

Another example of the ecosystem’s floundering is visible in Apple’s editorially selected top app of 2022. An accolade meant to reflect the opportunity to be had in building for mobile, the Cupertino company highlighted the Gen Z social networking app BeReal as its “App of the Year.” While arguably a breakout success with younger people, it’s also an app whose daily active users fell far behind its download figures and one that has no business model at present — the app doesn’t yet generate revenue. Its continued existence is being fueled by VC funding, not app stores’ ability to provide a platform where new ideas can easily monetize. And its developers are struggling to come up with what sort of subscription or in-app purchases they could convince their young users to pay for — the result of an app marketplace that sold consumers for years on the idea that mobile software should be free.

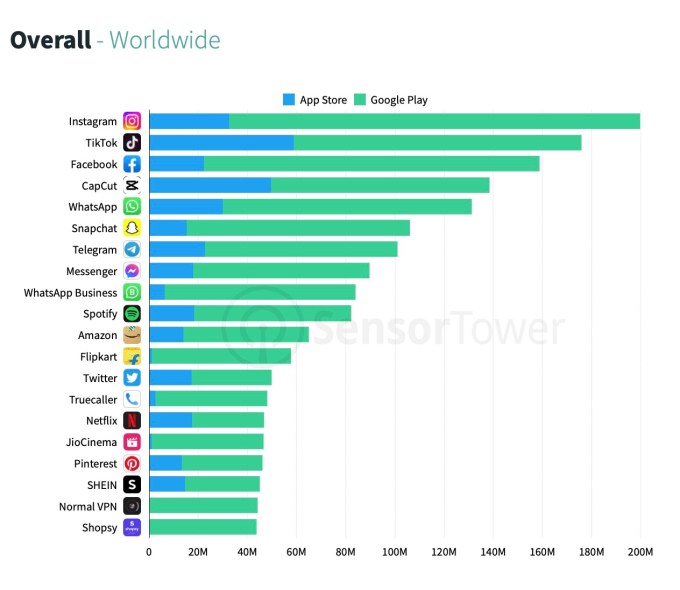

Then there are the apps that are at the top of Sensor Tower’s list of the most-downloads apps in Q4 2022 — they are the apps from tech giants like Meta and ByteDance, angling each other for the top spots. For years, it’s been rare to see any newcomers find a way onto this list, and that remains true in the fourth quarter.

Image Credits: Sensor Tower

Worldwide, Instagram edged out TikTok for the No. 1 spot, and Meta’s other apps found a place in the top 10 (Facebook at No. 3, WhatsApp at No. 5, Messenger at No. 8, and WhatsApp Business at No. 9.) ByteDance’s CapCut, an extension of TikTok’s workflow, is No. 4. Other top apps include the usual suspects, like Snapchat, Telegram, Spotify, Amazon, Flipkart, Twitter, and more big names.

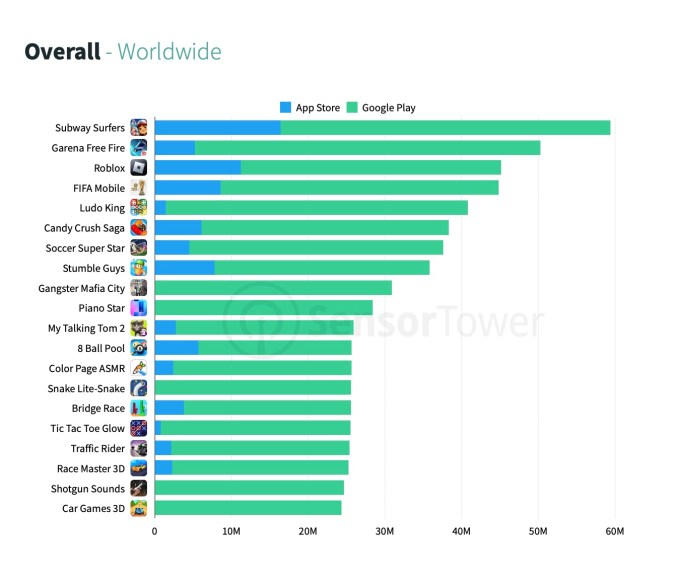

In games, Subway Surfers was No. 1, followed by Garena Free Fire, Stumble Guys, Roblox, FIFA Mobile, Ludo King and Candy Crush Saga. Subway Surfers had ended the year with nearly 292 million installs, up 48% from 2021. Newcomer Stumble Guys gained the No. 3 spot with over 184 million downloads, which is notable given it was only launched in 2021 while the other top five apps were released in 2017 or earlier — a bright spot in what was otherwise a quarter-over-quarter decline for mobile game installs.

On the App Store, game downloads declined 6.9%, on Google Play, they gained a small 0.6%.

Image Credits: Sensor Tower

Still, the games category continues to drive app installs. On the App Store, it’s responsible for almost three times as many installs as the No. 2 Category, Utilities, the report noted. But worryingly, the App Store’s games category dipped below 2 billion for the first since Q1 2019.

On Google Play, the games category was responsible for more installs (11.7 billion) than all categories on the App Store combined (8.1 billion), but the Play Store’s non-game categories were down 1.5% year-over-year, to 15.8 billion installs.

It’s too soon to say whether or not current trends represent a final cooling off of the app store gold rush, given how wider economic forces are clearly playing a role here in app adoption and spending. Plus, new app markets are coming online which means there will be more people downloading apps for the first time. But for the time being, the trend is a signal that there’s some saturation in top app markets and suggests that further innovation and growth may need to be kickstarted by forcing the app stores to engage in increased competition.

App downloads were stagnant in the fourth quarter, new analysis finds by Sarah Perez originally published on TechCrunch